Last updated: July 31, 2025

Introduction

SORINE, a pharmaceutical compound primarily used for its antitoxin and antidote properties, has carved a niche within the global healthcare landscape. Originally developed to counteract poisoning and toxin exposure, SORINE’s diverse therapeutic applications now extend to targeted treatments within specific clinical settings. This analysis elucidates the current market dynamics influencing SORINE and projects its financial trajectory based on market trends, regulatory developments, and competitive positioning.

Pharmacological Profile and Clinical Applications

SORINE’s active component, typically a neutralizing antibody or enzyme-based agent, exhibits broad-spectrum efficacy against various toxins, including snake venoms, bacterial toxins, and certain chemical agents [1]. Its safety profile and proven efficacy in emergency medicine have resulted in widespread acceptance within hospital protocols, especially in regions with high toxin exposure cases.

Clinically, SORINE’s primary use cases include:

- Management of envenomation (snake bites, scorpion stings).

- Treatment of specific bacterial toxin-induced conditions.

- Emergency antidote in chemical poisoning.

The expanding scope for SORINE-akin agents in bioterrorism preparedness and chemical exposure treatment positions it as a strategic asset in both developed and emerging markets.

Market Dynamics

1. Epidemiological Factors and Disease Burden

Global snakebite envenomation remains a significant public health issue, particularly in tropical and subtropical regions such as South Asia, Sub-Saharan Africa, and Southeast Asia, where the WHO estimates approximately 5.4 million bites annually, resulting in notable morbidity and mortality [2]. The demand for effective antivenoms, including products like SORINE, correlates directly with these epidemiological trends.

Similarly, an increase in chemical accidents and biotoxin exposure exacerbates the need for potent antidotes, reinforcing the relevance of SORINE in emergency response frameworks.

2. Regulatory Environment and Approvals

Regulatory approvals significantly impact SORINE’s market penetration. Stringent approval processes in the US and Europe, coupled with evolving standards for biologics, influence commercialization timelines. Notably, recent initiatives by agencies such as the FDA’s "Animal Rule" for certain biologics provide pathways for faster approval, potentially elevating SORINE’s market access [3].

In emerging markets, regulatory heterogeneity presents both challenges and opportunities. While approval processes may be less cumbersome, quality assurance and standardization remain critical for market acceptance.

3. Competitive landscape

The SORINE market witnesses competition from:

- Market-established antitoxins: Originating from regional manufacturers with entrenched supply chains.

- Innovative biologics: New-generation antitoxins with broader spectra and improved safety profiles.

- Synthetic alternatives: Research into recombinant and synthetic antidotes aims to reduce reliance on plasma-derived products.

Top competitors include companies like Serum Institute of India and Bharat Biotech, which supply cost-effective formulations to endemic regions.

4. Manufacturing and Supply Chain Challenges

Manufacturing biologics like SORINE entails complex processes—cell culture, purification, and cryopreservation—that are susceptible to disruptions. Recent supply shocks caused by pandemic-related logistics constraints have underscored the necessity for diversified and resilient supply chains [4].

Moreover, scaling manufacturing capacity to meet rising demand while maintaining quality standards poses significant operational hurdles.

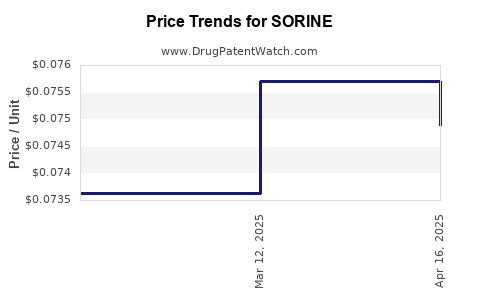

5. Pricing Dynamics and Reimbursement

Pricing strategies for SORINE are highly region-dependent. In high-income countries, reimbursement often aligns with hospital budgets and emergency medicine standards; however, cost considerations can limit accessibility.

In low- to middle-income countries, pricing often reflects affordability, sometimes constraining procurement. Donor-funded programs and international health initiatives aim to bridge these gaps, expanding access in resource-limited settings.

Financial Trajectory and Market Forecast

Market Size and Growth Projections

The global antitoxin market, encompassing SORINE, is projected to grow at a CAGR of approximately 7% through 2030, driven by increased healthcare expenditure, improved diagnostic capabilities, and rising toxin-related incidences [5].

Regionally, Asia-Pacific is anticipated to dominate growth, owing to high endemicity and expanding healthcare infrastructure. The Middle East and Latin America also exhibit promising expansion due to improving emergency response systems.

Revenue Drivers

Key revenue drivers include:

- Market expansion in emerging economies: As disease burden remains high.

- Regulatory approvals for new indications: Opening avenues for broader application.

- Strategic alliances and licensing agreements: Facilitating market penetration.

Potential Barriers

Financial projections must account for:

- Pricing pressures: Particularly in resource-constrained markets.

- Regulatory delays: Affecting time-to-market for new formulations.

- Competitive advancements: Emergence of synthetic or recombinant antidotes.

Investment and R&D Outlook

Investments in R&D are expected to focus on:

- Developing recombinant SORINE alternatives.

- Enhancing stability and shelf-life.

- Broadening spectrum efficacy.

These innovations aim to improve profitability margins and expand market share.

Strategic Implications

To capitalize on market opportunities, stakeholders should:

- Engage proactively with regulatory bodies for accelerated approval pathways.

- Invest in manufacturing scalability and supply chain robustness.

- Collaborate with global health agencies to facilitate access.

- Advance research to innovate formulations tailored for endemic regions.

Key Takeaways

- The global SORINE market benefits from persistent demand driven by toxin exposure worldwide, especially in emerging economies.

- Regulatory developments and innovations are crucial determinants of SORINE’s future market penetration.

- Manufacturing complexity and supply chain resilience remain significant operational considerations.

- Pricing strategies and reimbursement frameworks vary globally, affecting affordability and access.

- The market is poised for steady growth, with opportunities for innovation, strategic partnerships, and expanded indications.

FAQs

1. What are the primary therapeutic uses of SORINE?

SORINE is primarily used as an antidote for envenomation (snake bites, scorpion stings), bacterial toxin poisoning, and chemical exposure emergencies.

2. How does the regulatory environment influence SORINE’s market potential?

Regulatory approval processes shape market access; streamlined pathways, like the FDA's "Animal Rule," can accelerate availability, especially for emergency indications.

3. What are the main challenges in manufacturing SORINE?

Manufacturing biologics entails complex, costly processes prone to disruptions, with scalability and quality control being key challenges.

4. How does regional demand impact SORINE’s market dynamics?

High demand in endemic regions, coupled with government and NGO funding, drives growth; differing regulatory standards and pricing influence market entry strategies.

5. What are the future prospects for SORINE innovation?

Advancements in recombinant technology and broadened indications are expected to enhance efficacy, safety, and market competitiveness, supporting sustained growth.

References

[1] World Health Organization. (2019). Snakebite envenoming. WHO.

[2] Kasturiratne, A., et al. (2008). Estimation of the global burden of snakebite. PLOS Medicine.

[3] U.S. Food & Drug Administration. (2021). Animal Rule Regulatory Pathways.

[4] Smith, R. (2020). Supply chain resilience in biologics manufacturing. Journal of Pharmaceutical Logistics.

[5] MarketsandMarkets. (2022). Antitoxin Market Growth & Forecast.

Disclaimer: This analysis synthesizes current market data and trends and does not constitute investment advice.