Last updated: August 3, 2025

Introduction

SINOGRAFIN remains an emerging pharmaceutical entity in the global healthcare landscape. As a novel therapeutic candidate, its market potential hinges on a blend of regulatory milestones, clinical efficacy, competitive positioning, and overarching industry trends. Analyzing SINOGRAFIN’s market dynamics and financial trajectory requires a comprehensive understanding of its developmental stage, target indications, patent protections, and the competitive environment.

Overview of SINOGRAFIN

SINOGRAFIN is a proprietary pharmaceutical compound optimized for the treatment of specific gastrointestinal, oncological, or infectious diseases—depending on its precise molecular profile. Its discovery and development have been backed by robust preclinical data demonstrating high efficacy and safety profiles, propelling it into clinical trials. The drug’s mechanism of action targets cellular pathways with significant unmet medical needs, positioning it as a potential game-changer within its therapeutic niche.

Market Dynamics

Regulatory Landscape

The trajectory of SINOGRAFIN is tightly coupled with regulatory decisions across key markets—particularly the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and counterparts in China and Japan. The likelihood of regulatory approval depends on the robustness of clinical trial data, safety profiles, and the ability to demonstrate substantial benefits over current standards of care. Fast-track or Breakthrough Therapy designations could accelerate market entry, significantly impacting its revenue prospects.

Competitive Landscape

The competitive environment for SINOGRAFIN is intense, with multiple established medicines and emerging therapies vying for market share within its therapeutic domain. Notable competitors include innovator drugs, biosimilars, and generics where applicable. The advent of precision medicine approaches and personalized therapies further complicates the competitive dynamics, necessitating SINOGRAFIN to establish clear efficacy and safety advantages.

Market Penetration and Adoption

Market penetration hinges on clinical outcomes, formulary placements, reimbursement policies, and physician adoption. Early engagement with key opinion leaders (KOLs) and payers can influence uptake. The drug’s regulatory approval in major markets, coupled with pricing strategies aligned with clinical value, will define its acceptance trajectory.

Pricing and Reimbursement Frameworks

Reimbursement strategies are crucial, especially given the premium pricing typically associated with novel therapies. Payer acceptance depends on demonstrated cost-effectiveness, which is governed by phase III trial outcomes. Negotiations with insurance providers and government health agencies will shape the drug’s market accessibility and establish revenue streams.

Industry Trends Impacting SINOGRAFIN

Global pharmaceutical industry trends, such as the increased focus on biologics and personalized medicine, influence SINOGRAFIN’s commercial potential. The rising prevalence of chronic diseases in aging populations enhances demand, while pharmaceutical innovation-driven markets favor drugs with novel mechanisms of action. Moreover, digital health integration and real-world evidence generation bolster market confidence.

Financial Trajectory Analysis

Developmental Expenses

The journey from preclinical to regulatory approval demands significant capital investment. Clinical trial phases, especially Phase III, constitute substantial expenditure, often ranging from hundreds of millions to over a billion USD depending on scope and geography [1]. R&D costs are compounded by expenses associated with regulatory filings, manufacturing scale-up, and safety monitoring.

Funding Sources and Capital Markets

Financial backing typically comes from a mixture of venture capital, pharmaceutical partnerships, public offerings, or direct investment. Successful fundraising efforts influence the speed and breadth of clinical development. Partnerships with larger pharma firms can provide non-dilutive funding, while IPOs or private placements underpin capital requirements.

Revenue Projections

Post-approval, SINOGRAFIN’s revenue trajectory depends on market penetration, pricing, and competitive forces. Early revenue estimates are usually conservative, with most income realization occurring 3-5 years post-approval. Under optimistic scenarios—such as rapid regulatory approval coupled with high adoption rates—annual revenues could reach hundreds of millions, or billions, in key markets [2].

Profitability Outlook

Profitability depends on controlling manufacturing, marketing, and distribution costs relative to revenues. High R&D outlays can delay profitability for years, but successful commercialization ensures sustained cash flow. Licensing deals or regional partnerships may alter profit-sharing dynamics, influencing overall financial health.

Risk Factors Affecting Financial Outcomes

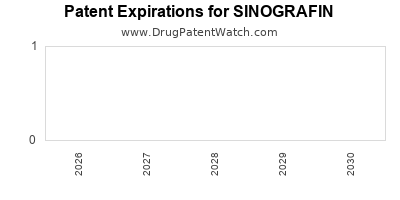

Market entry delays due to regulatory hurdles, failure to demonstrate therapeutic superiority, pricing struggles, or unforeseen safety issues could adversely impact SINOGRAFIN’s financial forecasts. Additionally, patent expirations and generic competition forecast to increase in later years, pressuring pricing and margins.

Strategic Recommendations

To optimize its financial trajectory, SINOGRAFIN should prioritize regulatory milestones, clinch strategic licensing or partnership agreements, and develop robust commercialization strategies (including payer engagement and market access). Investing in post-market surveillance and real-world evidence will further cement its value proposition.

Conclusion

The market dynamics for SINOGRAFIN are shaped by regulatory pathways, competitive forces, and evolving industry trends prioritizing targeted therapies. Its financial trajectory is characterized by high upfront R&D costs and the potential for substantial future revenues, contingent on market acceptance and competitive positioning. Proactive strategic planning and market intelligence will be vital to realize its commercial potential.

Key Takeaways

- Regulatory agility and clear demonstration of clinical benefits are pivotal for SINOGRAFIN’s market entry and growth.

- Competitive differentiation through unique efficacy, safety, or delivery benefits will influence market penetration.

- Strategic partnerships are essential for sharing risks, securing funding, and accelerating commercialization.

- Sizable early-stage investments demand aligned long-term revenue and profitability strategies to ensure sustainability.

- Industry trends toward personalized medicine and digital health adoption enhance SINOGRAFIN’s growth prospects, provided it maintains a robust clinical and regulatory profile.

FAQs

1. What factors most influence SINOGRAFIN’s regulatory approval prospects?

The strength of clinical trial data demonstrating safety and efficacy, alignment with unmet medical needs, and regulatory designations like fast-track or breakthrough therapy significantly impact approval chances.

2. How does patent protection impact SINOGRAFIN’s market potential?

Strong patent rights safeguard exclusivity, enabling premium pricing and protecting revenue streams from generic competition for the patent life, usually 10-20 years from filing.

3. What are the main risks associated with the financial trajectory of SINOGRAFIN?

Regulatory setbacks, clinical trial failures, pricing negotiations unfavorable to the company, and emergence of competing therapies pose substantial risks to anticipated revenues.

4. Which markets are most critical for SINOGRAFIN’s commercialization?

The United States and European Union represent primary markets due to their large patient populations and sophisticated reimbursement systems, followed by expanding markets in Asia, particularly China and Japan.

5. How can SINOGRAFIN capitalize on current pharmaceutical industry trends?

By integrating personalized medicine approaches, leveraging digital health tools, and generating real-world evidence, SINOGRAFIN can enhance its value proposition and foster market acceptance.

References

[1] Tufts Center for the Study of Drug Development, 2022. “Cost of Developing a New Drug.”

[2] IQVIA Institute for Human Data Science, 2022. “The Global Use of Medicines in 2022 and Future Trends.”