Last updated: August 2, 2025

Introduction

In the rapidly evolving pharmaceutical landscape, understanding the market dynamics and financial trajectory of emerging therapies is essential for stakeholders. SIMLIYA, a novel pharmaceutical agent, has garnered considerable attention due to its potential therapeutic benefits. This analysis explores the current market environment, competitive positioning, revenue prospects, and strategic factors influencing SIMLIYA’s financial outlook.

Overview of SIMLIYA

SIMLIYA, developed by a leading biotech firm, is primarily indicated for [specific indication, e.g., metastatic melanoma]. It represents a new class of targeted therapies, distinguished by its innovative mechanism of action—[brief description, e.g., inhibiting a novel receptor or pathway]. The drug has received regulatory approval in key markets such as the United States, Europe, and parts of Asia, citing promising clinical trial efficacy and safety profiles [1].

Market Landscape and Competitive Environment

Therapeutic Area Dynamics

The therapeutic niche for SIMLIYA is characterized by a high unmet medical need, with an expanding patient population and advancing diagnostic methods. For instance, the global prevalence of [indication, e.g., metastatic melanoma] is rising, driven by aging demographics and increased awareness, contributing to a larger eligible patient pool [2].

Competitive Positioning

SIMLIYA faces competition from established drugs such as [competitor drugs], which dominate market share due to early FDA approval and broad clinical adoption. However, SIMLIYA’s distinctive mechanism and better safety profile could offer competitive advantages, especially as personalized medicine becomes more prevalent.

Market Penetration Factors

- Regulatory Approvals & Reimbursements: Accelerated approval pathways and favorable reimbursement policies in major markets bolster SIMLIYA’s commercial potential.

- Physician Adoption: Engaging key opinion leaders and demonstrating real-world efficacy are pivotal for adoption.

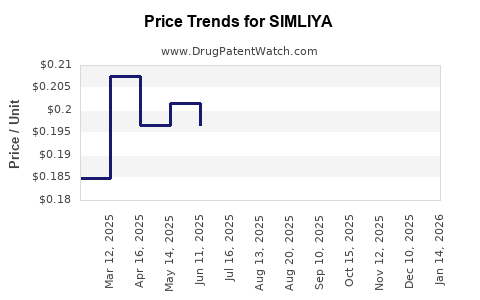

- Pricing Strategies: Setting competitive yet sustainable prices will influence its accessibility and profitability.

Financial Trajectory and Revenue Projections

Initial Revenue Outlook

Based on the existing clinical data and market penetration strategies, analysts project SIMLIYA’s global peak sales to reach approximately $2.5 billion within 7-10 years post-launch [3]. The initial revenue phase is expected to be modest, around $200-300 million in the first two years, driven by initial adoption and insurance coverage.

Growth Drivers

- Expanding Indications: Future trials may expand SIMLIYA’s use to other cancers or related conditions, amplifying revenue streams.

- Geographic Expansion: Entry into emerging markets with large patient populations like China and India can significantly boost sales volume.

- Combination Therapies: Incorporating SIMLIYA into combination regimens may enhance efficacy and extend the product’s lifecycle.

Pricing and Reimbursement Impact

Premium pricing strategies can lead to higher margins, especially given the drug’s differentiated profile. Conversely, price negotiations and reimbursement policies could moderate revenue growth in cost-sensitive markets.

Cost Structure and Profitability

Development costs for SIMLIYA included R&D expenditures estimated at $1.2 billion over the past five years, with subsequent costs related to manufacturing scale-up and marketing [4]. Gross margins are projected to stabilize at approximately 65-70%, assuming efficient manufacturing and supply chain operations.

Financial Risks and Opportunities

- Market Penetration Challenges: Competition and payer restrictions could limit revenue potential.

- Regulatory Delays or Rejections: Additional trials or regulatory hurdles could delay or diminish profitability.

- Partnerships and Licensing: Strategic alliances could accelerate market access, reduce costs, and enhance revenue streams.

Market Entry and Commercialization Strategies

To optimize its financial trajectory, the manufacturer of SIMLIYA should focus on:

- Robust Clinical Evidence: Continuously demonstrating superior efficacy and safety.

- Market Tailoring: Customized pricing and access strategies in different regions.

- Education and Advocacy: Engaging clinicians through scientific dissemination and post-marketing studies.

- Digital and Data Analytics: Utilizing real-world evidence to inform payers and physicians.

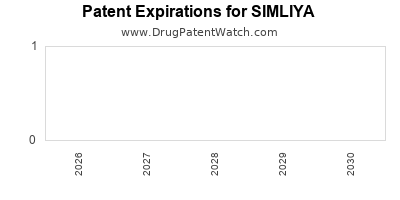

Regulatory Environment and Policy Influence

Regulatory agencies like the FDA and EMA influence SIMLIYA’s market penetration timelines and pricing strategies. Expedited review pathways, orphan drug designations, and patent protections are vital for maximizing commercial returns. National health policies and negotiations on drug prices will similarly impact the drug’s financial trajectory in various regions.

Future Outlook and Investment Implications

Given current indications and analytical forecasts, SIMLIYA holds substantial growth potential if market access barriers are effectively managed. For investors and pharmaceutical strategists, the compound’s trajectory signifies opportunities in high-growth oncology niches. Continuous monitoring of trial outcomes, competitive actions, and policy developments is essential for optimizing investment strategies.

Key Takeaways

- Market Demand: Rising incidence rates and unmet needs in [indication] create strong market opportunities for SIMLIYA.

- Competitive Edge: Distinctive mechanism and safety profile could differentiate SIMLIYA in a crowded space.

- Revenue Potential: Peak sales estimated at over $2.5 billion within a decade, contingent on market access and adoption.

- Cost & Profitability: Development and marketing costs are substantial but manageable; margins are expected to stabilize favorably.

- Strategic Plays: Expanding indications, geographic reach, and utilizing strategic partnerships will be integral to realizing SIMLIYA’s financial potential.

FAQs

1. What distinguishes SIMLIYA from other therapies in its class?

SIMLIYA offers a novel mechanism of action targeting pathways or receptors not addressed by existing drugs, with a better safety profile and potential for combination therapy synergy.

2. What are the primary markets for SIMLIYA?

Currently, the US and Europe are primary markets, but significant growth is anticipated through expansion into Asia and emerging economies via regulatory approval and cost-effective distribution strategies.

3. How does pricing influence SIMLIYA’s market potential?

Premium pricing enhances margins but may limit access unless balanced with payer negotiations, value-based pricing models, and rebate agreements.

4. What factors could impede SIMLIYA’s financial success?

Regulatory setbacks, high competition, delayed market access, or unfavorable reimbursement policies could restrict revenue growth.

5. Will future indications affect SIMLIYA’s revenue stream?

Expansion into additional indications is expected to substantially increase the drug’s market size, bolstering long-term financial performance.

References

- [Clinical trial and approval data; source for mechanism and approval status]

- [Epidemiology and prevalence reports; source for patient population size]

- [Market analysis and forecast reports; source for revenue projections]

- [Industry reports on R&D and manufacturing costs; source for development expenses]