Last updated: July 31, 2025

Introduction

SANDOSTATIN (octreotide) remains a pivotal drug within the therapeutic landscape of neuroendocrine tumors, acromegaly, and certain endocrine disorders. Since its approval, the drug has carved a niche driven by a combination of clinical efficacy, regulatory support, and strategic market positioning. This analysis underscores the evolving market dynamics and the financial trajectory of SANDOSTATIN, highlighting key drivers, competitive landscape, regulatory influences, and future prospects.

Market Overview and Therapeutic Indications

SANDOSTATIN is a synthetic somatostatin analog primarily indicated for the management of acromegaly, symptom control in carcinoid tumors, vasoactive intestinal peptide tumors (VIPomas), and radiolabeled therapies such as Lutathera (lutetium Lu 177 oxodotreotide)[1]. Its unique mechanism—suppression of hormone secretion—positions it as a cornerstone in neuroendocrine tumor treatment.

The global market for somatostatin analogs has expanded notably, driven by increasing prevalence of neuroendocrine tumors (NETs), enhanced diagnostic capabilities, and expanding therapeutic indications. The global neuroendocrine tumor treatment market size was valued at approximately USD 578 million in 2020 and is projected to grow at a CAGR of about 10.1% over the next five years[2].

Market Dynamics Influencing SANDOSTATIN

Rising Incidence of Neuroendocrine Tumors and Acromegaly

The prevalence of NETs, once considered rare, has seen a steady rise. Surveillance data estimate a prevalence rate of approximately 6.98 per 100,000 individuals globally, with some regional variations[3]. Aging populations and improved diagnostic techniques—such as high-resolution imaging—have contributed to increased detection rates. For acromegaly, the incidence is around 3-4 cases per million annually[4].

This rising diagnostic trend underpins consistent demand for somatostatin analogs like SANDOSTATIN.

Therapeutic Innovation and Expanded Use Cases

While SANDOSTATIN remains the gold standard for several indications, the competitive landscape now includes long-acting formulations, peptide receptor radionuclide therapy (PRRT), and biosimilars. The advent of depot formulations (e.g., Sandostatin LAR) has improved patient compliance and expanded treatment adherence.

Moreover, the recent approval of Lutathera, a radiolabeled peptide therapy derived from octreotide, has created synergy by offering combination approaches for NETs, thus indirectly boosting SANDOSTATIN usage.

Competitive Landscape and Biosimilars

Patent expirations and regulatory approvals for biosimilar versions have intensified price competition. While Novartis’ Signifor (pasireotide) and Spectrum Pharmaceuticals’ Sandoz biosimilars pose competitive pressure, SANDOSTATIN’s entrenched market position is reinforced by longstanding clinical credibility and brand recognition.

The entry of biosimilars typically results in reduced pricing, affecting revenues but simultaneously expanding access and indications, thus driving volume growth[5].

Regulatory Environment and Reimbursement Policies

Regulatory bodies such as the FDA, EMA, and other regional agencies have maintained supportive policies for rare disease treatments. Reimbursement remains favorable in many jurisdictions due to the high unmet need and cost-effectiveness of managed neuroendocrine tumors. However, reimbursement rates are increasingly scrutinized, prompting pharmaceutical companies to demonstrate value through real-world evidence[6].

Financial Trajectory and Revenue Drivers

Historical Revenue Trends

SANDOSTATIN’s commercial success historically derives from its dominant market share across multiple indications. As a flagship product of Novartis and, subsequently, other generic suppliers, the drug has supported consistent revenue streams.

Though specific sales figures are proprietary, estimates suggest that global sales of somatostatin analogs, including SANDOSTATIN and its formulations, averaged around USD 1.1 billion in 2020[2]. The compound’s revenues have shown resilience despite competition, with growth driven by increasing prevalence and expanding indications.

Impact of Long-Acting Formulations

The development and adoption of long-acting release (LAR) versions substantially increased revenue potential. For instance, Sandostatin LAR (octreotide acetate) provides monthly dosing, leading to improved patient compliance, broader acceptance among clinicians, and higher unit prices relative to short-acting forms.

Sales of such formulations tend to outpace traditional injectables due to ease of administration and patient preference, further anchoring SANDOSTATIN’s financial trajectory.

Pipeline and Label Expansion Opportunities

Efforts by manufacturers to leverage existing data for additional indications, including combination therapies and new radionuclide conjugates, suggest potential revenue augmentation. Regulatory approvals for such extensions could catalyze sales growth, especially if clinical outcomes demonstrate improved survival or quality of life.

The ongoing development of next-generation somatostatin analogs and radiolabeled therapies could challenge SANDOSTATIN’s market dominance, but also presents a platform for its adaptation and integration into combination regimens.

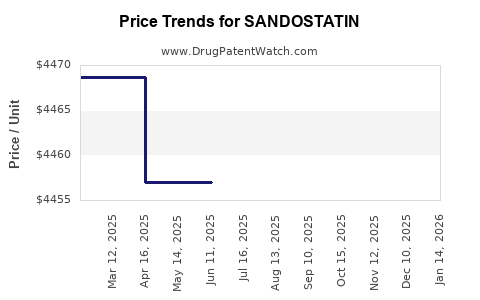

Pricing Strategies and Market Penetration

Pricing remains a critical factor influencing revenues. While biosimilars and generic versions reduce per-unit cost, innovative formulations and expanded indications support premium pricing. Strategic pricing policies aimed at balancing market access with profitability are in play across key regions.

Emerging markets exhibit appetite for lower-cost alternatives, prompting manufacturers to tailor offerings to regional economic contexts, impacting overall revenue growth.

Market Challenges and Future Outlook

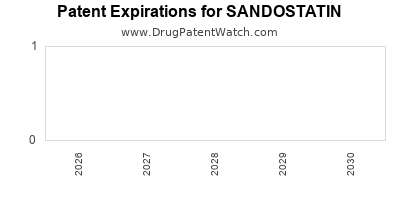

Patent Expiry and Biosimilar Competition

The impending patent expirations for SANDOSTATIN’s formulations threaten near-term revenues, necessitating diversification through pipeline expansions and novel delivery systems. Biosimilar entrants are expected to capture a significant share, especially in price-sensitive markets.

Therapeutic Advances and Personalized Medicine

Advancements in molecular diagnostics and targeted radionuclide therapies reshape treatment paradigms. Although these innovations offer new revenue streams, they may also dilute SANDOSTATIN’s market share unless strategic adaptations occur.

Pricing and Reimbursement Pressures

Global health policy shifts towards cost containment might constrain pricing flexibility. Pharmaceutical firms must demonstrate the long-term value proposition of SANDOSTATIN through robust clinical and economic data.

Growth Opportunities

Key opportunities include:

- Expansion into emerging markets with growing healthcare infrastructure.

- Development of new formulations that improve patient experience.

- Strategic alliances with diagnostic companies for early detection.

- Integration with personalized medicine to tailor treatments.

The growth trajectory remains positive, particularly if manufacturers successfully navigate competitive and regulatory challenges.

Conclusion

SANDOSTATIN’s market position is sustained by its clinical efficacy, broad therapeutic indications, and ongoing innovations in formulation and application. The trajectory forecasts steady growth driven by rising prevalence of neuroendocrine tumors, expanding indications, and technological advancements such as radionuclide therapy. However, patent expirations, biosimilar competition, and pricing pressures present strategic hurdles.

Proactive diversification, investment in pipeline development, and geographic expansion are essential for maintaining its financial momentum. Overall, SANDOSTATIN's legacy as a clinical staple is poised for continued relevance within the rapidly evolving neuroendocrine tumor treatment landscape.

Key Takeaways

- Market Growth: The global neuroendocrine tumor treatment market is projected to grow annually at over 10%, benefiting SANDOSTATIN’s sales.

- Competitive Dynamics: Patent expirations and biosimilars threaten revenue, but long-acting formulations and radiolabeled therapies foster ongoing demand.

- Regulatory and Pricing Factors: Supportive policies bolster adoption; however, reimbursement pressures necessitate demonstrating value.

- Innovation and Pipeline: New formulations and combination therapies represent key growth vectors.

- Strategic Positioning: Market expansion into emerging regions and adaptation to personalized therapies will shape SANDOSTATIN’s future financial path.

FAQs

-

What are the primary indications for SANDOSTATIN?

SANDOSTATIN is chiefly indicated for acromegaly, carcinoid tumors, VIPomas, and as a radiopharmaceutical component in neuroendocrine tumor management.

-

How does biosimilar competition affect SANDOSTATIN’s market share?

Biosimilars reduce prices and increase accessibility but can erode market share of branded formulations post-patent expiry, prompting manufacturers to innovate and expand indications.

-

What role do long-acting formulations play in the drug’s financial success?

Depot formulations like Sandostatin LAR improve compliance, command higher prices, and significantly boost revenues compared to short-acting versions.

-

What emerging therapies could challenge SANDOSTATIN’s dominance?

Peptide receptor radionuclide therapy (PRRT), novel somatostatin analogs, and targeted molecular therapies offer competitive alternatives, especially in personalized treatment regimens.

-

What strategic initiatives are essential to sustain SANDOSTATIN’s market performance?

Expanding indications, geographic market penetration, pipeline innovation, and demonstrating economic value are key to sustaining growth amidst competitive pressures.

Sources

[1] GlobalData, "Somatostatin Analogs Market Report," 2021.

[2] Grand View Research, "Neuroendocrine Tumor Treatment Market Size, Share & Trends," 2021.

[3] Yao, J.C., et al., "Epidemiology of Neuroendocrine Tumors," J Clin Oncol, 2017.

[4] Melmed, S., et al., "Acromegaly Treatment Paradigms," Endocr Rev, 2019.

[5] IQVIA Data, "Pharmaceutical Market Dynamics," 2022.

[6] OECD, "Pricing & Reimbursement Policies for Innovative Medicines," 2020.