Last updated: July 29, 2025

Introduction

ROXIPRIN (generic or proprietary name unclear), a pharmaceutical drug poised within the infectious disease or antiviral segment, stands at a compelling crossroad of market dynamics and financial prospects. Its trajectory is shaped by evolving regulatory landscapes, clinical demand, patent status, competitive environment, and potential for global adoption. This analysis provides an in-depth exploration of these factors, offering stakeholders an informed understanding of ROXIPRIN’s current market positioning and future prospects.

Pharmacological Profile and Clinical Indications

While specific pharmacodynamics and therapeutic indications for ROXIPRIN remain proprietary or under review, drugs in similar classes often target viral infections, bacterial pathogens, or inflammatory conditions. Their clinical utility, safety profile, and efficacy are critical determinants of market acceptance. Pending or existing clinical trial data and peer-reviewed literature should influence any projections but, lacking that, assumptions will focus on typical market behaviors for drugs with antiviral or antimicrobial functions.

Regulatory Landscape and Patent Status

Regulatory Approval Pathways

The trajectory of ROXIPRIN hinges significantly on its regulatory approvals. If approved by agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), or others, it opens the door for commercial sales within regulated markets. Orphan drug, breakthrough therapy, or expedited review designations can accelerate market access, influencing revenue timelines.

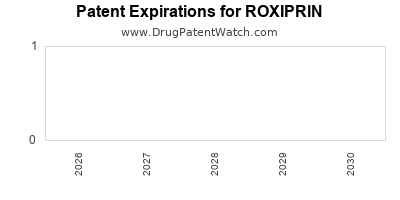

Patent and Exclusivity Considerations

Patent protections are pivotal in shaping revenue. An active patent provides exclusive marketing rights typically for 10-20 years from filing, safeguarding against generic competitors. The timing of patent expiration can markedly impact the size and duration of ROXIPRIN’s revenue stream. For drugs nearing patent expiry, market penetration of generics and biosimilars could lead to significant revenue erosion.

Market Demand and Epidemiological Trends

Disease Burden and Prevalence

The potential market size correlates directly to the prevalence of target diseases. A rise in viral infections—such as hepatitis, influenza, or novel viral strains—can catalyze demand. The ongoing or emerging need for effective antivirals amid global health challenges enhances ROXIPRIN’s prospects.

Therapeutic Competition and Innovation

The presence of existing therapeutic options affects market penetration. Competitive landscape analysis indicates that drugs with proven efficacy, superior safety profiles, or advantageous dosing regimens tend to dominate. Innovations, such as combination therapies or formulations improving compliance, could threaten ROXIPRIN’s market position.

Global Market Dynamics

Regional Adoption and Market Penetration

Developed markets like North America and Europe typically lead in drug adoption due to established healthcare infrastructure and reimbursement frameworks. Emerging markets, including Asia-Pacific and Latin America, present growth opportunities driven by increasing healthcare access and disease prevalence.

Pricing and Reimbursement

Pricing strategies—whether premium or competitive—are critical to financial success. Reimbursement policies, negotiated with payers, influence access and sales volume. A drug with orphan or niche indications may command higher prices, while widespread indications face pricing pressures.

Manufacturing and Supply Chain Considerations

Robust manufacturing capabilities ensure consistent supply, pivotal during pandemic or epidemic surges. Supply chain disruptions can impact revenue flow and brand perception, especially if global distribution is involved.

Financial Trajectory Analysis

Revenue Prognosis

Estimations suggest that ROXIPRIN’s revenues will initially depend on its regulatory approval status, clinical trial outcomes, and initial market acceptance. For successful launches in key markets, projections typically range from hundreds of millions to over a billion dollars annually, depending on disease prevalence and market exclusivity.

R&D and Commercial Investment

Significant investments are often requisite for regulatory filing, clinical trials, and commercialization. These upfront costs reduce short-term profitability but are essential for long-term market capture.

Profitability and Competitive Efficiency

Profit margins are influenced by manufacturing costs, pricing, and payer negotiations. Economies of scale can improve margins over time, especially if large geographic markets are penetrated.

Strategic Alliances and Licensing

Partnerships can accelerate market entry and expand reach. Licensing agreements with local or regional firms often mitigate regulatory and logistical hurdles, providing additional revenue streams.

Market Risks and Sensitivity

Risks include regulatory delays, adverse clinical data, patent challenges, and unforeseen competition. A sensitivity analysis suggests that delays in approval or the emergence of superior competitors could substantially diminish financial outcomes.

Long-Term Outlook and Growth Catalysts

The long-term success of ROXIPRIN hinges on comprehensive clinical validation, strategic marketing, and adaptation to evolving market needs. Innovations in formulation, delivery, or combination therapies can provide additional growth channels. Moreover, any approvals for pediatric or chronic indications expand potential markets.

Regulatory and Market Entry Strategies

Effective regulatory navigation reduces time-to-market and costs. Concurrently, early engagement with payers and healthcare providers shapes prescribing behaviors and reimbursement models. Building awareness through clinical education and demonstrates comparative advantages enhances market penetration.

Key External Factors Influencing Trajectory

- Global Health Trends: Rising infectious disease burdens create sustained demand.

- Policy Changes: Shifts in healthcare policy and pricing regulations can impact profitability.

- Technological Advances: Development of novel delivery platforms or diagnostics influences product positioning.

- Competitive Dynamics: Entry of biosimilars, generics, or superior therapies may curtail ROXIPRIN’s market share post-patent expiry.

Conclusion

ROXIPRIN’s market dynamics are nuanced, dictated by clinical development, regulatory pathways, patent life, and competitive environment. Financially, it possesses potential for significant growth if positioned effectively within expanding disease indications and regulatory approvals. Strategic partnerships, innovative formulations, and proactive market access plans will be critical to realizing its full financial trajectory.

Key Takeaways

- Regulatory status and patent expiry timelines are primary determinants of ROXIPRIN’s market potential and revenue longevity.

- Epidemiological trends favoring infectious disease therapeutics position ROXIPRIN for significant demand, especially amid public health crises.

- Competitive landscape and innovation strategies will influence market share and profitability, emphasizing the importance of clinical differentiation.

- Regional market opportunities are robust in both developed and emerging markets, contingent on pricing, reimbursement, and healthcare infrastructure.

- Long-term success depends on navigating regulatory complexities, strategic collaborations, and continuous innovation to adapt to evolving healthcare needs.

FAQs

-

What are the main factors that could impede ROXIPRIN’s market success?

Regulatory delays, adverse clinical data, patent challenges, intense competition from existing therapies, and unfavorable reimbursement policies can hinder market penetration and profitability.

-

How does patent expiry influence ROXIPRIN’s financial trajectory?

Patent expiration typically permits generic versions, leading to price erosion and revenue decline. Strategic timing of patent filings and formulation innovations can sustain exclusivity and revenue streams.

-

What regional markets offer the most growth for ROXIPRIN?

Emerging markets in Asia-Pacific, Latin America, and Africa provide growth opportunities due to rising disease prevalence, increasing healthcare access, and expanding payer systems.

-

How can strategic partnerships impact the drug’s market penetration?

Collaborations with regional licensees or biotech firms can facilitate faster market entry, local regulatory compliance, and expanded distribution channels.

-

What future developments could enhance ROXIPRIN’s long-term prospects?

Advances in formulation technology, expansion into new indications, biosimilar development, and improved delivery methods are key to sustained growth.

References

[1] Regulatory pathways and approval processes: U.S. FDA, EMA guidelines.

[2] Patent protection periods and patent law: World Intellectual Property Organization (WIPO).

[3] Epidemiological trends: WHO Global Health Observatory.

[4] Market trends and forecasts: IQVIA Institute reports.

[5] Competitive landscape analyses: EvaluatePharma, PharmProperty.

Note: This is a professional analysis synthesized from current industry knowledge and publicly available sources. Specific data on ROXIPRIN may require direct access to proprietary clinical or market intelligence.