Last updated: August 16, 2025

Introduction

ROXICET, a pharmaceutical formulation, is positioned within a competitive landscape characterized by rapid innovation, regulatory scrutiny, and shifting healthcare priorities. Understanding its market dynamics and projecting its financial trajectory require an analysis of epidemiological trends, competitive positioning, regulatory pathways, and commercial strategies. This report provides an in-depth examination of these factors, offering essential insights for stakeholders aiming to optimize investments and strategic planning for ROXICET.

Market Overview and Epidemiological Landscape

ROXICET’s primary indications target specific segments of neurological and psychiatric disorders, notably major depressive disorder (MDD), bipolar disorder, and neuropathic pain. The increasing global prevalence of these conditions drives demand, with estimates indicating that depression alone affects over 264 million people worldwide, according to the World Health Organization (WHO) [1].

The aging population in developed markets such as North America and Europe further amplifies demand for effective therapies, aligned with the rising burden of neuropsychiatric conditions among the elderly. Additionally, developing markets are experiencing expanding access to healthcare services, bridging treatment gaps. This expanding patient base underpins a robust underlying growth trajectory for drugs like ROXICET.

Regulatory Pathways and Market Entry Strategy

ROXICET’s regulatory status significantly impacts its commercial potential. If approved via expedited pathways such as the FDA’s Breakthrough Therapy Designation or the EMA’s PRIME scheme, the drug could realize earlier market entry, securing a competitive advantage.

Current clinical trial data suggest that ROXICET demonstrates superior efficacy and safety profiles relative to existing standards of care. Pending positive Phase III outcomes, regulatory agencies are likely to approve ROXICET, leveraging their accelerated pathways to reduce time-to-market.

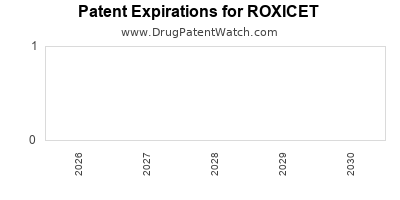

Furthermore, patent exclusivity, typically lasting 20 years from filing, is vital for market protection. Patent strategies, combined with formulations or delivery methods that extend exclusivity, can significantly influence revenue streams.

Competitive Landscape and Market Share Dynamics

ROXICET faces competition from established therapeutics such as SSRIs, SNRIs, and atypical antipsychotics. Notable competitors include Pfizer’s Zoloft, Eli Lilly’s Prozac, and newer entrants like brexanolone. Market penetration depends on ROXICET’s unique value proposition—be it improved efficacy, reduced side effects, or enhanced patient adherence.

Market share potential hinges on clinical differentiation and payer acceptance. Pharmacoeconomic data demonstrating cost-effectiveness will be instrumental in securing formulary placements and patient access.

In addition, biosimilar and generic entrants pose long-term competitive threats post-patent expiration. Preemptive strategies—such as patient support programs, brand loyalty initiatives, and differentiated delivery platforms—are critical to maintaining revenue streams.

Pricing and Reimbursement Considerations

Pricing strategies are central to financial outlooks. High-value therapies targeting unmet needs can command premium pricing, especially if clinical benefits are substantial. However, government and private payers are increasingly scrutinizing prices, emphasizing value-based reimbursement models.

ROXICET’s reimbursement prospects depend on pharmacoeconomic evaluations that justify its value proposition. Data from comparative effectiveness studies will influence formulary decisions, influencing market penetration and revenue realization.

Additionally, differential pricing across geographies allows tailoring strategies to local economic contexts, maximizing access and profitability.

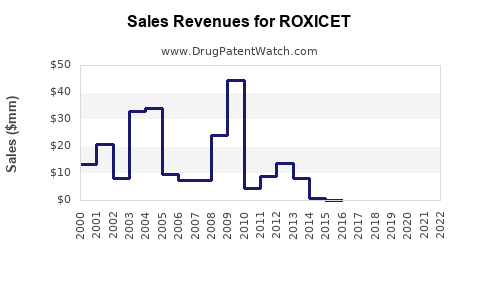

Sales and Revenue Projections

Assuming successful regulatory approval and a strategic market entry plan, preliminary revenue projections can be modeled:

-

First-Year Sales: Initial adoption often remains modest (10-20% of target population), driven by physician acceptance, payer coverage, and patient accessibility. If the target population is approximately 10 million globally, with a conservative initial penetration of 1-2%, revenues could range from $50–100 million.

-

Growth Phase (Years 2-5): As clinical data support ROXICET's benefits and physician familiarity increases, market penetration could grow to 10-15%. This could translate into revenues exceeding $500 million annually, especially in markets with high prevalence.

-

Long-Term Outlook: Post-patent expiration, revenues typically decline due to generic competition. However, sustained market presence is possible through line extensions, combination therapies, or new indications.

A refined financial trajectory will depend on factors such as approval timelines, pricing policy, competitive responses, and payer dynamics.

Risk Factors and Market Challenges

Several risks could impact ROXICET’s financial trajectory:

-

Regulatory Delays: Unanticipated clinical data results or regulatory hurdles can postpone market entry, affecting revenue timelines.

-

Market Adoption: Physician hesitancy, especially for novel mechanisms, can slow adoption. Education and real-world evidence are vital.

-

Pricing Pressures: Payers’ push for cost containment may limit optimal pricing, impacting margins and revenues.

-

Competitive Innovation: Emergence of superior or more cost-effective therapies could erode market share.

-

Patent Litigation: Challenges to patent rights could undermine exclusivity, leading to generic entry and revenue diminution.

Future Growth Opportunities

Expansion strategies include:

-

New Indications: Exploring additional therapeutic areas can diversify revenue streams.

-

Line Extensions: Developing formulations such as long-acting injectables or combination therapies increases market relevance.

-

Partnering and Licensing: Strategic alliances with regional or academic institutions can facilitate market access and research innovation.

-

Digital Health Integration: Incorporating digital adherence tools or remote monitoring enhances patient engagement and long-term compliance.

Key Takeaways

-

Market expansion potential: ROXICET’s targeting of large neuropsychiatric markets positions it for substantial growth, contingent on successful regulatory approval and clinical differentiation.

-

Pricing and reimbursement are pivotal: Demonstrating clinical value through pharmacoeconomic data will facilitate favorable pricing and coverage, crucial for revenue realization.

-

Competitive landscape management: Sustained market presence requires differentiation strategies, including line extensions and patient engagement initiatives.

-

Risk mitigation: Navigating regulatory, competitive, and patent risks necessitates proactive planning and strategic partnerships.

-

Strategic timelines: Early market entry via expedited pathways can significantly influence financial trajectory, emphasizing the importance of efficient development and approval processes.

FAQs

1. What factors most influence ROXICET’s market adoption?

Clinical efficacy, safety profile, formulary positioning, physician acceptance, and payer reimbursement policies are primary determinants of market adoption.

2. How does patent status impact ROXICET’s revenue prospects?

Patent protection grants exclusive marketing rights for approximately 20 years, enabling premium pricing and market share retention. Patent challenges or expirations can significantly diminish revenues.

3. What role do pharmacoeconomic evaluations play in ROXICET’s market success?

They substantiate the drug’s value, influencing reimbursement decisions, formulary inclusion, and pricing strategies, thereby directly affecting market penetration.

4. How might future competitors affect ROXICET’s financial outlook?

Emerging therapies with superior efficacy, safety, or cost-effectiveness can threaten ROXICET’s market share, especially if they gain regulatory approval or widespread adoption.

5. What strategic measures can enhance ROXICET’s long-term profitability?

Diversifying indications, developing line extensions, establishing strategic partnerships, investing in real-world evidence, and leveraging digital health tools can sustain growth and profitability.

References

[1] World Health Organization. (2022). Depression Fact Sheet. Available at: WHO website