Last updated: July 30, 2025

Introduction

Robaxisal, a widely-prescribed combination of analgesic and antispasmodic agents, has established itself within the musculoskeletal pain treatment market. Key components typically include acetaminophen and carisoprodol, targeting acute muscle discomfort. As with several other drugs in the analgesic category, Robaxisal's market performance and financial trajectory are influenced by multifaceted factors including regulatory policies, healthcare demand, competitive landscape, and evolving consumer preferences. This analysis explores the current market dynamics and projects the financial outlook for Robaxisal, providing business stakeholders with a detailed understanding of its potential growth trajectory.

Market Landscape and Dynamics

1. Therapeutic Demand and Epidemiology

Robaxisal primarily caters to patients experiencing acute muscular pain, spasms, and prevention of similar conditions. The global prevalence of musculoskeletal disorders, particularly in aging populations, sustains steady demand [1]. For instance, the rising incidence of back pain and muscle injuries in North America and Europe, driven by aging demographics and sedentary lifestyles, supports sustained sales for analgesics with antispasmodic effects.

2. Regulatory Environment and Prescribing Trends

Regulatory agencies such as the FDA have approached drugs containing central nervous system (CNS) depressants, including carisoprodol, with increased scrutiny owing to abuse potential and side effects [2]. These regulations influence market access, prescribing patterns, and ultimately, sales trajectories. Recent bans or restrictions on carisoprodol in several jurisdictions have led to a decline in use, compelling manufacturers to reformulate or introduce alternatives. Conversely, regulatory favorability towards combination analgesics with low abuse potential sustains demand.

3. Competitive Landscape

Robaxisal faces competition from both generic and branded therapies. Generic versions of acetaminophen and other muscle relaxants, such as cyclobenzaprine, have eroded market share. Additionally, rising adoption of non-pharmacologic interventions like physiotherapy and neuromodulation affects the overall analgesic market. Companies investing in innovative formulations and delivery methods, such as extended-release variants, aim to capture unmet needs and extend the product lifecycle.

4. Market Penetration and Geographic Dynamics

Robaxisal's market penetration varies across regions, strongly influenced by healthcare infrastructure, physician prescribing habits, and medication reimbursement policies. North America remains a dominant market, but growth potential exists in emerging markets like Asia-Pacific, where increased healthcare access and demand for pain management bolster market size [3].

5. Safety Profile and Public Perception

Public concern regarding the side effects and abuse potential of certain components, notably carbamates derived from carisoprodol, influences consumer acceptance and physician prescribing behavior. The increasing emphasis on opioid-sparing pain management paradigms aligns with a preference for non-addictive analgesics, affecting reliance on traditional combination drugs.

Financial Trajectory and Forecasting

1. Revenue Trends and Historical Performance

Robaxisal's revenue streams have experienced fluctuations owing to regulatory shifts, patent expirations, and competition. Historical data suggest that while initial sales were robust, recent years record a plateau or slight decline, particularly in regions tightening restrictions on CNS depressants [4].

2. Impact of Regulatory Changes

Regulatory interventions restricting or banning components like carisoprodol are pivotal. For example, the US Drug Enforcement Administration's scheduling of carisoprodol as a schedule IV controlled substance in 2012 curtailed usage, leading to revenue decline within the North American market [2]. Similar restrictions in other countries exacerbate the challenge. Manufacturers are responding through reformulations or marketing shifts toward alternative compositions.

3. Emerging Opportunities

Innovation in formulation—such as combination drugs with lower abuse risk and enhanced delivery—can reverse declining trends. Investment in clinical research to establish safety and efficacy further enhances product appeal. Moreover, expanding into adult and geriatric populations where musculoskeletal pain prevalence is higher provides growth opportunities.

4. Market Forecast (2023-2030)

Given current trends, the global analgesic and antispasmodic market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.5% [3]. However, the specific trajectory for Robaxisal will depend on its strategic response to regulatory pressures and competitive dynamics.

- Short-term (1-3 years): Moderate decline in mature markets due to regulation, with potential stabilization through product reformulation or marketing strategies.

- Mid-term (4-6 years): Market stabilizes as formulations adapt, with new product launches and expanded indications.

- Long-term (7+ years): Growth potential hinges on innovation, entering emerging markets, and aligning with evolving pain management guidelines.

5. Revenue Generation Strategies

To capitalize on future growth prospects, stakeholders should prioritize:

- Formulation innovation: Developing non-addictive alternatives or extended-release formulations.

- Market diversification: Targeting emerging markets with rising healthcare access.

- Adherence to regulations: Proactively reformulating or repositioning the product to meet regulatory standards.

- Brand repositioning: Emphasizing safety profiles and combination advantages in marketing.

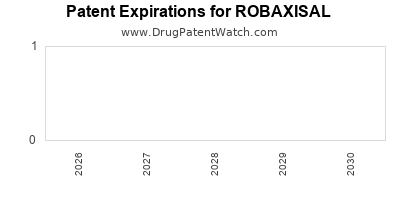

Regulatory and Patent Outlook

While Robaxisal's patent landscape is crucial in safeguarding market share, patent expirations in the coming years may open doors for generic competition, impacting pricing and revenues. Strategic patent filings for improved formulations can prolong exclusivity and optimize profit margins.

Key External Drivers Influencing Financial Trajectory

- Policy shifts: Pain management guidelines favoring opioid alternatives influence prescribing patterns.

- Healthcare trends: Increasing utilization of non-pharmacologic therapies may dampen demand.

- Societal concerns: Growing awareness of drug abuse potential may restrict usage.

- Economic factors: Healthcare spending patterns and insurance coverage impact accessibility and affordability.

Conclusion and Strategic Implications

Robaxisal's market and financial trajectory are shaped by regulatory, competitive, and societal factors. While challenges stemming from safety concerns and regulatory restrictions pose risks, strategic innovation and market expansion can sustain demand. To navigate the evolving landscape successfully, stakeholders must focus on reformulation efforts, diversify geographic presence, and align with contemporary pain management protocols.

Key Takeaways

- The decline in Robaxisal’s traditional markets due to regulatory restrictions necessitates strategic adaptation.

- Innovation in safer, non-addictive formulations is critical for future growth.

- Emerging markets offer substantial opportunity owing to rising healthcare investments and aging populations.

- Regulatory vigilance and proactive compliance are essential to maintain market access and revenue.

- Diversification of product offerings and geographic expansion are vital to offset current declining trends.

FAQs

Q1: What are the main factors driving the decline of Robaxisal’s market share?

A: Regulatory restrictions on components like carisoprodol, increasing competition from generics and alternative therapies, and public concerns about safety and abuse potential primarily drive the decline.

Q2: Can reformulating Robaxisal restore its market position?

A: Yes. Reformulations that reduce abuse potential and improve safety profiles can enhance regulatory approval, physician acceptance, and consumer trust, thereby restoring market viability.

Q3: What emerging markets hold promise for Robaxisal?

A: Countries in Asia-Pacific and Latin America, characterized by rising healthcare expenditure, expanding access, and growing awareness of musculoskeletal conditions, present promising opportunities.

Q4: How will regulatory trends influence Robaxisal’s future sales?

A: Stricter regulations around CNS depressants may limit sales unless the product is reformulated or repositioned with improved safety and efficacy profiles.

Q5: What alternative strategies should manufacturers pursue to sustain Robaxisal’s revenue?

A: They should focus on innovation, diversification, strategic branding emphasizing safety, compliance with evolving regulations, and market expansion into emerging regions.

References

[1] World Health Organization. (2020). Musculoskeletal conditions. Retrieved from WHO database.

[2] Substance Abuse and Mental Health Services Administration. (2012). Regulatory status of carisoprodol.

[3] MarketWatch. (2022). Global pain management therapeutics market forecast.

[4] IQVIA. (2021). US analgesic sales and market trends report.