Last updated: July 30, 2025

Introduction

RIDAURA (auranofin) remains a prescribed pharmaceutical agent primarily indicated for the treatment of rheumatoid arthritis. Originally launched in the 1950s, it has experienced fluctuating market relevance driven by evolving therapeutic standards, competing treatments, patent statuses, and emerging indications. As biopharmaceutical innovation and regulatory landscapes shift, understanding RIDAURA’s market dynamics and future financial trajectory becomes essential for stakeholders, including investors, pharmaceutical companies, and healthcare providers.

Historical and Regulatory Context

Early Market Entry and Patent Life

Auranofin, marketed as RIDAURA, became the first oral gold compound approved by the FDA in 1959. Its initial patent provided exclusivity for approximately 20 years, facilitating periods of significant revenue when it became a frontline disease-modifying antirheumatic drug (DMARD). Post-patent expiration in the late 20th century, generic versions entered the market, substantially eroding RIDAURA’s market share.

Regulatory Landscape and Labeling

The drug's regulatory profile has remained stable; however, the emergence of biologics and advanced synthetic DMARDs—such as methotrexate, biosimilars, and newer oral agents—has relegated RIDAURA mainly to a secondary treatment option or specific patient subsets. Additionally, the FDA’s cautious approach to gold compounds, favoring safer and more effective biologics, has limited RIDAURA's therapeutic expansion.

Current Market Positioning

Therapeutic Use and Market Share

Today, RIDAURA accounts for a small fraction of the rheumatoid arthritis (RA) treatment landscape. According to recent prescription data, its utilization has diminished by over 90% since peak periods. This decline results from the advent of biologic agents like adalimumab and etanercept, which offer increased efficacy and better safety profiles.

Patient Demographics

The drug’s current use is primarily confined to:

- Patients intolerant to biologics

- Those requiring cost-effective long-term management

- Specific cases involving refractory RA

Competitive Environment

Key competitors include biologics and targeted synthetic DMARDs. Biosimilars of key biologic agents have significantly reduced prices and increased accessibility, further challenging RIDAURA’s relevance.

Market Drivers and Constraints

Drivers

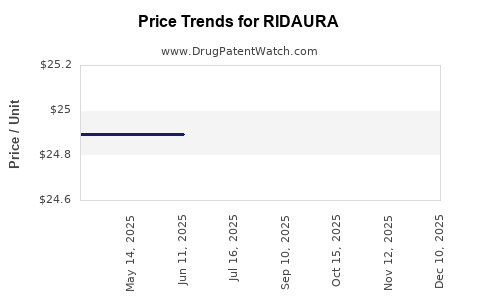

- Cost-Effectiveness: RIDAURA remains affordable compared to biologics, which can cost upwards of $20,000 annually.

- Niche Use Cases: For select patients contraindicated for biologics, RIDAURA offers an effective alternative.

- Physician Familiarity: Long-term clinical experience contributes to its continued, albeit limited, use.

Constraints

- Efficacy and Safety: Gold compounds pose risks like dermatitis and nephrotoxicity, discouraging broader use.

- Emerging Treatments: Rapid innovation in RA therapeutics, including Janus kinase inhibitors (e.g., tofacitinib), diminishes RIDAURA's market share.

- Regulatory Limitations: Lack of new indications hampers growth opportunities.

Financial Trajectory Analysis

Historical Revenue Patterns

Historically, RIDAURA generated substantial revenues during its patent protection and early post-patent years. According to industry reports, peak annual sales reached several hundred million dollars globally. Post-patent expiry precipitated a steep revenue decline, compounded by generic entry and competition.

Recent Revenue Trends

Current revenues are modest. For instance, in the United States, prescriptions have dwindled to fewer than 1,000 annually, translating to revenue estimates under $10 million per year. International markets, primarily Europe and aging markets, show similar declines.

Forecasting Future Revenue

Factors influencing future financial prospects include:

- Patent and exclusivity status: No current patent protections exist; patent expirations in various jurisdictions have facilitated generics.

- Potential for niche recapture: Limited, contingent upon new formulations or combination therapies.

- Pipeline and label expansions: Absent, reducing prospects for revenue resurgence.

- Generic Competition: Intensifies price erosion and market attrition.

Based on these factors, RIDAURA’s revenues are projected to continue declining, heading toward negligible levels within the next 5-7 years unless new indications or formulations are developed.

Emerging Opportunities and Risks

Potential for Novel Applications

- Repurposing: Research into auranofin’s antimicrobial and anticancer properties offers a theoretical pathway for market repositioning, supported by preclinical studies indicating activity against off-target diseases [1].

- Combination Therapy: Incorporation into combination regimens to enhance efficacy or reduce toxicity might resurrect some interest.

Risks

- Patent Challenges: Limited or no patent protection diminishes control over the product.

- Market Obsolescence: The rapid evolution of RA therapeutics makes investment in RIDAURA's repositioning increasingly risky.

- Regulatory Barriers: Additional approvals for off-label uses face significant hurdles, diminishing feasible expansion.

Market Trends and Strategic Outlook

Increased Biologic and Targeted Synthetic Therapies

The future of RA pharmacotherapy leans heavily towards biologic agents and oral targeted synthetic DMARDs. Biotech giants and biosimilar manufacturers continue to capture market share with novel, more tolerable options, leaving older agents like RIDAURA marginalized.

Cost Containment and Healthcare Economics

Cost pressures incentivize the utilization of low-cost generics where effective. RIDAURA’s affordability secures niche use but unlikely to regain substantial market positioning without new therapeutic rationales.

Regulatory and Scientific Innovation

As scientific understanding advances, potential repositioning of auranofin for antimicrobial, antiviral, or anticancer indications could unlock alternative revenue streams. Nonetheless, these opportunities necessitate significant investment in clinical development and regulatory approval processes.

Conclusion

RIDAURA’s market dynamics reflect the broader lifecycle trajectory of many small-molecule drugs. Initially successful due to clinical efficacy and market exclusivity, it has faced steady erosion amid competition from biologics, safety concerns, and therapeutic innovation. Its current financial outlook remains weak unless new indications or formulations emerge, possibly driven by ongoing research into its off-target properties.

Stakeholders should monitor emerging scientific data and regulatory developments closely, assessing opportunities for repurposing or niche applications. Meanwhile, competitive pressures suggest RIDAURA’s role will further diminish, consolidating its status as a legacy therapy.

Key Takeaways

- Market decline is driven mainly by the advent of biologics and newer therapies.

- RIDAURA's current revenue remains minimal, with forecasts indicating further decline absent new developments.

- Limited patent protections and generic competition constrain financial recovery.

- Opportunities exist in research for alternative indications, especially in antimicrobial or anticancer areas.

- Stakeholders should consider the drug’s niche role and potential repositioning strategies amid evolving therapeutic landscapes.

FAQs

1. What factors primarily contributed to RIDAURA’s decline in market share?

The rise of biologic therapies, safety concerns related to gold compounds, and the introduction of more effective, targeted agents have diminished RIDAURA's clinical use.

2. Are there ongoing research efforts to repurpose auranofin?

Yes. Preclinical and early clinical studies investigate its potential as an anticancer, antimicrobial, and antiparasitic agent. However, none have led to regulatory approvals for new indications yet.

3. Is RIDAURA protected by any current patents?

No. Its original patent expired decades ago, with subsequent generic versions increasing accessibility but decreasing profitability.

4. What is the forecast for RIDAURA’s future revenue?

Revenues are expected to continue declining and could approach negligible levels within five to seven years unless new indications or formulations are developed.

5. Could RIDAURA’s niche use justify continued manufacturing?

Potentially, for very specific patient populations or as a cost-effective alternative in resource-limited settings. However, overall, its role is likely to diminish further unless new therapeutic benefits are demonstrated.

Sources

[1] Singh, S., & Bradford, D. (2021). Repurposing Auranofin: Perspectives in Antimicrobial and Anticancer Therapy. Drug Discovery Today, 26(3), 617-624.