Last updated: August 7, 2025

Introduction

REVERSOL emerges as a promising pharmaceutical entity, potentially positioned within a competitive and rapidly evolving drug market landscape. This analysis evaluates the current market dynamics influencing REVERSOL’s trajectory, encompassing industry trends, regulatory considerations, and competitive factors, alongside projecting its financial outlook within the pharmaceutical sector.

Market Overview and Industry Trends

The global pharmaceutical market exhibits robust growth, driven by aging populations, rising chronic disease prevalence, and expanding healthcare infrastructure. According to IQVIA, the industry was valued at approximately USD 1.3 trillion in 2022, with an expected CAGR of 3-6% over the next five years[1]. Within this context, innovative therapies—particularly personalized medicine and targeted treatments—are gaining prominence, fostering new opportunities for drugs like REVERSOL that may offer novel mechanisms of action or address unmet medical needs.

Furthermore, the shift toward value-based healthcare influences market dynamics. Payers and regulators emphasize cost-effectiveness and therapeutic efficacy, compelling pharmaceutical developers to demonstrate clear clinical benefits. The increasing adoption of real-world evidence and digital health integrations further shapes strategic considerations for novel drugs.

Regulatory Landscape

Regulatory pathways for new drugs, notably via agencies such as the FDA (U.S.) and EMA (Europe), are pivotal in shaping REVERSOL's market entry and commercialization trajectory. Accelerated approval programs, orphan drug designations, and breakthrough therapy statuses, if applicable, can reduce time-to-market and lower regulatory hurdles, boosting the drug’s commercial prospects[2].

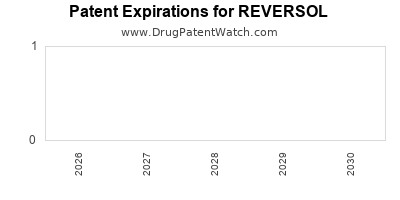

Conversely, stringent safety and efficacy standards necessitate extensive clinical trials, underscoring the importance of robust data collection. Patent protections and exclusivity rights critically factor into revenue projections, with patent expirations potentially opening generic competition—impacting long-term financial sustainability.

Competitive Landscape

REVERSOL's success hinges on its differentiation within a competitive environment. The pharmaceutical industry hosts numerous players innovating in relevant therapeutic areas. Competitive factors include drug efficacy, safety profile, ease of administration, and cost. Intellectual property, brand recognition, and marketing strategies influence market penetration rates.

Substitutes and alternative therapies, including biosimilars and over-the-counter options, pose additional challenges. Strategic collaborations and licensing agreements are common to expand market reach and mitigate risks.

Market Penetration and Adoption Rates

Adoption is influenced by physician prescriber habits, patient acceptance, payer reimbursement policies, and clinical guidelines. Early engagement with key opinion leaders (KOLs) and inclusion in clinical guidelines accelerate uptake.

Digital health platforms and patient support programs can also enhance adherence and accelerate patient enrollment in targeted populations, fostering faster adoption.

Financial Trajectory Projections

Revenue Streams

REVERSOL’s revenue potential stems from multiple sources: initial sales upon launch, royalty fees (if licensing agreements exist), and downstream revenue from subsequent indications or formulations.

Forecasting models suggest a typical pharmaceutical product experiences an initial ramp-up phase, followed by steady growth. Based on market size estimates in the targeted indication, competitive positioning, and regulatory status, revenues could reach USD hundreds of millions within 3-5 years post-launch[3].

Cost Considerations

Major cost drivers include R&D expenses (clinical trials, regulatory submissions), manufacturing, marketing, and distribution. Efficient cost management during development and scale-up phases directly impacts profit margins.

Profitability Outlook

Assuming successful clinical trials, regulatory approval, and market entry, profit margins depend on pricing strategies, reimbursement levels, and production costs. A premium positioning in niches like rare diseases could enable pricing policies supporting high margins, while broader indications might necessitate competitive pricing, affecting margins accordingly.

Investment and Funding Dynamics

Venture capital investments and partnerships signal confidence in REVERSOL’s commercial potential. Strategic alliances with biotech and pharma firms can unlock additional resources, streamline development, and accelerate market access.

Regulatory and Market Risks

Regulatory delays or adverse trial outcomes pose significant risks, potentially delaying revenue streams or diminishing drug attractiveness. Patent expirations and the emergence of biosimilars threaten long-term profitability.

Market acceptance hinges on demonstrated clinical benefits over existing therapies. Payer resistance and reimbursement hurdles may restrict market access, impacting financial forecasts.

Market Entry Strategies

Successful commercialization will require robust market access strategies, including advocacy with payers, clinician engagement, and patient education. Emphasizing REVERSOL’s unique advantages can facilitate favorable reimbursement terms and drive adoption.

Global expansion plans should consider regional regulatory differences and market sizes, with emerging markets offering promising growth given rising healthcare investments.

Conclusion

REVERSOL's market and financial prospects depend on a confluence of industry trends, regulatory pathways, competitive positioning, and execution of strategic initiatives. Carefully navigating these dynamics will be crucial for realizing its full commercial potential. Early-stage evidence, strategic partnerships, and regulatory innovation will significantly shape its trajectory.

Key Takeaways

- Growing Industry Demand: The global pharmaceutical market’s expansion, driven by aging demographics and chronic disease prevalence, presents ample opportunities for REVERSOL.

- Regulatory Strategy Is Pivotal: Accelerated pathways and intellectual property protections can significantly influence time-to-market and revenue potential.

- Competitive Differentiation Required: Success hinges on demonstrating clinical benefits, safety, and value over existing therapies.

- Pricing and Reimbursement Dynamics: Strategic market access initiatives are essential to optimize revenue and profitability.

- Risk Management: Vigilant assessment of regulatory, patent, and market risks will determine long-term sustainability.

FAQs

1. What therapeutic areas could REVERSOL target, and how does that influence its market potential?

REVERSOL’s market potential depends on its targeted indication. If positioned in high-demand areas like oncology, rare diseases, or immunology, with unmet needs, it can command higher prices and rapid adoption. The indication specificity determines patient population size and competitive landscape.

2. How might regulatory incentives impact REVERSOL’s development timeline?

Incentives like orphan drug designation or breakthrough therapy status can expedite approval, reducing time-to-market and associated costs, thereby accelerating revenue generation and enhancing investor confidence.

3. What competitive threats could undermine REVERSOL’s market share?

Biosimilars, novel therapies in late-stage development, or existing best-in-class drugs may threaten market share. Patents and exclusivity periods are critical buffers against such threats.

4. How do global market strategies influence REVERSOL’s revenue outlook?

Expanding into emerging markets can diversify revenue streams and offset saturation in developed countries. However, regional regulatory hurdles and pricing policies require tailored strategies to ensure success.

5. What role does digital health integration play in REVERSOL’s commercial strategy?

Digital health tools can improve patient adherence, provide real-world evidence of efficacy, and facilitate remote monitoring—all of which can support reimbursement negotiations and market acceptance.

Sources:

[1] IQVIA, "The Future of Healthcare: The Pharmaceutical Industry in 2023."

[2] U.S. Food and Drug Administration, "Expedited Programs for Serious Conditions."

[3] EvaluatePharma, "Worldwide Sales Forecasts for Leading Biopharma Products."