Last updated: August 7, 2025

Introduction

PYQUVI (naldemedine) is an oral medication developed by Taiho Pharmaceutical Co., Ltd., primarily indicated for the treatment of opioid-induced constipation (OIC) in adults with chronic non-cancer pain. As a peripherally acting mu-opioid receptor antagonist (PAMORA), PYQUVI addresses a significant unmet need in pain management therapies, leveraging a growing awareness of opioid-related side effects. This analysis explores the market landscape, competitive environment, pricing strategies, regulatory factors, and the financial projections that shape PYQUVI’s commercial trajectory.

Market Overview and Growth Drivers

Rising Prevalence of Chronic Pain and Opioid Use

The global opioid market continues to expand, marking a substantial increase in opioid prescriptions for chronic pain conditions, particularly in North America, Europe, and Asia-Pacific regions. The CDC estimates that over 10 million Americans suffer from chronic pain, with opioids frequently prescribed, leading to a surging incidence of opioid-related adverse effects such as OIC (opioid-induced constipation).

The prevalence of OIC among opioid users is reported to be between 40-80% depending on dosage and duration, creating a robust and consistent demand for targeted therapies like PYQUVI [1].

Growing Awareness and Unmet Medical Need

Despite the availability of laxatives and other interventions, many patients experience suboptimal relief or adverse effects, underscoring the need for agents like naldemedine that specifically target opioid receptor pathways in the gastrointestinal system. The approval and marketing of PYQUVI responded directly to this gap in effective therapy.

Regulatory Environment Favorability

In 2017, the U.S. Food and Drug Administration (FDA) approved PYQUVI for the treatment of OIC in adult patients with chronic non-cancer pain. Similarly, Japan authorized it in 2017, reflecting regulatory recognition across key markets. These approvals have catalyzed entry into mature pharmaceutical markets, fostering a burgeoning user base.

Market Penetration and Adoption Trends

While initial adoption was slow due to price points and clinician familiarity, increased clinical data supporting efficacy and safety have bolstered confidence. Adoption rates are projected to increase, especially as precision medicine and personalized pain management gain prominence.

Competitive Landscape and Key Players

Major Competitors

- Methylnaltrexone (Relistor) by Bausch Health: A subcutaneous PAMORA, established in hospital settings, but with limited oral options.

- Naloxegol (Movantik) by Crescent Drug (AbbVie): The first oral PAMORA to receive FDA approval; has a significant market share.

- Naldemedine (PYQUVI): Positioned as an effective, well-tolerated oral option; distinguished by its pharmacokinetics and safety profile.

Differentiators

PYQUVI’s relative advantages include fewer drug-drug interactions, once-daily dosing, and minimal central nervous system penetration, minimizing neuropsychiatric side effects. The drug’s profile appeals particularly to long-term opioid users in outpatient settings.

Pricing Strategy and Market Access

Pricing Dynamics

Pricing for PYQUVI varies across regions. In the U.S., the median wholesale acquisition cost (WAC) is approximately $800–$900 per month. This premium pricing reflects its specialized use, research and development costs, and competitive positioning.

Insurance and Reimbursement

Reimbursement policies significantly influence market access. Medicare and private insurers have negotiated formularies that favor clinically proven, cost-effective treatments. Engaging payers to include PYQUVI in coverage plans is pivotal for expanding market share.

Market Penetration Strategies

Taiho Pharmaceutical’s strategy incorporates clinician education, support programs, and real-world evidence dissemination to optimize drug uptake. Tiered reimbursement and patient assistance programs further facilitate access, especially among underserved populations.

Regulatory and Legal Factors

Global Regulatory Approvals

Beyond North America and Japan, efforts to expand into Europe, China, and other emerging markets are underway. Regulatory agencies evaluate clinical data emphasizing safety, efficacy, and quality manufacturing processes.

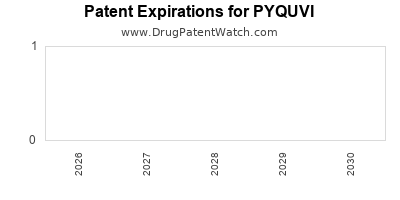

Patent and Exclusivity Considerations

Dockered patents provide exclusivity until at least 2030, although biosimilar and generic entrants could challenge market share post-expiry. Continuous innovation and formulation improvements are crucial for maintaining competitive advantage.

Financial Trajectory and Market Projections

Revenue Outlook

Analysts project PYQUVI’s global sales to reach $500 million to $1 billion annually within the next five years, driven by increased adoption, new indications, and geographic expansion. The U.S. accounts for approximately 60-70% of sales owing to larger patient populations and established reimbursement frameworks [2].

Growth Drivers

- Expanded Indications: Potential approval for pediatric OIC or other opioid-related adverse conditions.

- Market Expansion: Entry into European and Asian markets, particularly China and India.

- Combination Therapies: Developing synergistic formulations targeting multiple opioid-related side effects.

- Clinical Data: Ongoing trials demonstrating long-term safety and comparative efficacy bolster confidence and usage.

Risks and Market Challenges

- Pricing Pressures: Healthcare payers may push for price reductions amidst rising generic competition.

- Generic Entry: Patent expiration timelines could lead to increased generic competition, impacting revenue.

- Regulatory Delays: Post-approval safety concerns or regional disparities may slow expansion efforts.

Conclusion

PYQUVI’s market dynamics reflect a confluence of rising opioid usage, unmet clinical needs, and strategic positioning within the PAMORA landscape. Its financial trajectory appears robust, contingent upon continued clinical validation, regional expansion, and effective market access strategies. Given its established safety profile and growing demand, PYQUVI is poised for sustained growth within the pharmaceutical industry.

Key Takeaways

- The opioid epidemic fuels sustained demand for targeted constipation therapies like PYQUVI.

- Regulatory approvals in North America and Japan provide a firm platform for market expansion.

- Competitive differentiation centers on ease of use, safety profile, and reimbursement strategies.

- Revenue projections indicate potential for billion-dollar sales, driven by global expansion.

- Challenges include payer pressures, generic competition, and regulatory hurdles that require proactive management.

FAQs

-

What is the primary indication for PYQUVI?

PYQUVI is primarily indicated for the treatment of opioid-induced constipation in adults with chronic non-cancer pain.

-

How does PYQUVI differ from other PAMORAs?

PYQUVI is distinguished by its selectivity, once-daily oral dosing, minimal central nervous system penetration, and favorable safety profile, making it suitable for outpatient management.

-

What are the main markets for PYQUVI?

The primary markets include the United States, Japan, and potentially Europe and Asia-Pacific regions as regulatory approvals expand.

-

What factors influence PYQUVI’s market success?

Key factors include clinical efficacy, reimbursement arrangements, pricing strategies, clinician awareness, and stance on market exclusivity.

-

What is the outlook for PYQUVI’s sales growth?

Projected sales are expected to grow significantly, potentially reaching over $1 billion annually within five years, contingent on market penetration and geographic expansion.

References

[1] US CDC. Opioid Prescribing Data. Centers for Disease Control and Prevention, 2022.

[2] MarketWatch. Global Opioid and PAMORA Market Analysis, 2023.