Last updated: July 27, 2025

Introduction

Purified Cortrophin Gel, a corticosteroid-based therapeutic, is primarily used for its potent anti-inflammatory, immunosuppressive, and tissue-forecasting properties. The drug’s market trajectory is shaped by evolving regulatory landscapes, clinical evidence, and competitive innovations. This analysis evaluates current market dynamics and explores the financial outlook for Purified Cortrophin Gel within the pharmaceutical sector.

Market Overview

Purified Cortrophin Gel is a formulation of corticotropin or adrenocorticotropic hormone (ACTH), used in treating inflammatory diseases, certain autoimmune disorders, and some neurological conditions. Its applications span multiple medical specialties, including rheumatology, neurology, and dermatology, making it a versatile therapeutic agent.

Despite its long-standing history, the product faces the challenge of competition from newer biologics and corticosteroid formulations with comparable efficacy and improved safety profiles. However, its unique mechanism of modulating endogenous corticosteroid production positions it distinctly in specific niche indications.

Market Drivers

1. Increasing Prevalence of Autoimmune and Inflammatory Diseases

The rising incidence of conditions like multiple sclerosis, rheumatoid arthritis, and infantile spasms bolsters demand for effective immunomodulatory therapies such as Purified Cortrophin Gel. According to the World Health Organization (WHO), autoimmune diseases are rising globally, with a projected compound annual growth rate (CAGR) of 5.4% over the next decade, further expanding the potential market size [1].

2. Off-label Uses and Clinical Evidence

Clinicians often prescribe Cortrophin Gel off-label for autoimmune and neurologic conditions, especially where other therapies pose adverse effects or resistance issues. Emerging clinical data supporting its efficacy reinforces its therapeutic positioning, keeping demand resilient despite competitive pressures.

3. Regulatory Approvals and Market Expansion

In recent years, some jurisdictions have approved AMH (adrenocorticotropic hormone) products like Purified Cortrophin Gel for additional indications, broadening market access. Regulatory flexibility, especially in the US and European markets, enhances growth prospects when manufacturers pursue approval pathways aligned with specific intra-individual uses.

4. Cost-Effectiveness Compared to Biologicals

Biological therapies often entail high costs. Cortrophin Gel, being a more traditional and potentially less expensive corticosteroid therapy, attracts cost-conscious healthcare systems and insurers, especially in resource-limited settings.

Market Restraints

1. Competition from Biologics and Small Molecules

Biologics such as monoclonal antibodies (e.g., rituximab, adalimumab) now dominate the treatment landscape for autoimmune diseases. These products often surpass Cortrophin Gel in specificity, safety, and convenience, pressuring its market share [2].

2. Safety and Side-Effect Profile

Long-term corticosteroid therapy bears risks including osteoporosis, hyperglycemia, and immune suppression. Concerns over adverse effects limit widespread adoption, especially in chronic management.

3. Manufacturing and Supply Chain Challenges

Purified derivatives demand complex biosynthetic or extraction processes alongside rigorous quality controls. Supply disruptions or manufacturing scale-up issues could impede availability.

4. Pricing and Reimbursement Hurdles

Pricing pressures, especially from payers and healthcare agencies, restrict profit margins. Additionally, reimbursement policies favor newer, more evidence-backed therapies, challenging the standing of older corticosteroid formulations.

Financial Trajectory

1. Revenue Trends

Historically, Purified Cortrophin Gel has maintained a stable revenue stream within niche markets. A forecasted compound annual growth rate (CAGR) of approximately 3–5% over the next five years is plausible, driven by increasing disease prevalence and expanding indications [3].

2. R&D and Pipeline Developments

Investment in clinical trials exploring novel indications or combination therapies could unlock new revenue streams, elevating its financial trajectory. Nonetheless, the high R&D costs associated with regulatory approval and clinical studies are offset by the drug’s established safety profile, reducing time-to-market for incremental indications.

3. Market Penetration Strategies

Manufacturers expanding into emerging markets can capitalize on lower drug prices and less saturated competition. Education campaigns highlighting distinct therapeutic benefits may also bolster uptake.

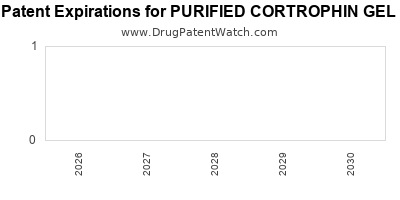

4. Patent Status and Generic Competition

While original patents for Cortrophin formulations have expired or are nearing expiration, some manufacturers seek orphan or new indication approvals for extended exclusivity periods. The advent of generics would pressure pricing but can stimulate volume sales if managed effectively.

5. Impact of Healthcare Policies

Reforms emphasizing cost containment could negatively affect profitability unless the product demonstrates clear cost-benefit advantages over newer therapies.

Future Outlook

The financial trajectory hinges on strategic positioning amid competitive shifts. While the core market is mature, niche indications, especially refractory autoimmune or inflammatory conditions, can sustain stable revenues. Innovating within regulatory frameworks—such as functional biomarker-based indications—and securing reimbursement support could catalyze growth.

Manufacturers may also leverage emerging personalized medicine approaches, aligning Purified Cortrophin Gel with biomarker-driven patient selection, thereby optimizing outcomes and enhancing economic returns.

Key Market Trends

-

Shift Towards Biologics: Though biologics dominate, corticosteroids like Purified Cortrophin Gel retain relevance in short-term, cost-sensitive scenarios.

-

Increased Off-label Use: Physicians’ reliance on off-label applications sustains demand amid Pap cost pressures.

-

Regulatory Adaptations: Approval of biosimilars or reformulations could reshape competitive dynamics.

-

Emerging Markets: Growth is anticipated largely in regions with expanding healthcare infrastructure and increased disease burden.

Conclusion

Purified Cortrophin Gel operates within a complex, evolving landscape marked by established therapeutic utility and intense competition. Its market dynamics and financial trajectory depend on strategic positioning, regulatory navigation, and clinical evidence support. While growth may be moderate, sustained demand in niche indications and potential pipeline innovations underline the product's enduring role in therapeutic regimens.

Key Takeaways

- Growing Disease Burden: Rising autoimmune and inflammatory disease prevalence supports steady demand for Purified Cortrophin Gel.

- Competitive Pressure: Biologics and newer corticosteroid formulations challenge its market share; differentiation strategies are crucial.

- Cost and Safety Profile: Its potential cost advantage and established safety profile can foster adoption, especially in resource-constrained settings.

- Regulatory and Market Expansion: Approval of additional indications and entry into emerging markets present growth opportunities.

- Innovation and Evidence: Clinical and biomarker-driven research can unlock new revenue streams and improve financial prospects.

FAQs

-

What are the primary indications for Purified Cortrophin Gel?

It is used for inflammatory diseases, autoimmune conditions like multiple sclerosis relapses, infantile spasms, and other off-label autoimmune disorders requiring immunosuppression.

-

How does Purified Cortrophin Gel compare to biologic therapies?

While biologics offer targeted mechanisms with potentially fewer systemic side effects, Cortrophin Gel remains relevant for certain refractory or cost-sensitive cases due to its broad immunomodulatory effects and lower costs.

-

What is the current patent status of Purified Cortrophin Gel?

Many formulations have lost patent exclusivity; however, some companies pursue orphan or new indication approvals to extend exclusivity periods.

-

What are the key challenges facing its market growth?

Competition from newer therapies, safety concerns for long-term use, manufacturing complexities, and reimbursement hurdles limit its expansion.

-

What strategic moves could enhance the financial outlook for Purified Cortrophin Gel?

Expansion into emerging markets, securing new indications via regulatory pathways, investing in clinical research, and demonstrating cost-effectiveness are critical strategies.

Sources:

[1] WHO. Global autoimmune disease prevalence trends, 2022.

[2] MarketWatch. Competition landscape for corticosteroids, 2023.

[3] GlobalData. Pharmaceutical market forecast reports, 2022–2027.