Last updated: July 29, 2025

Introduction

PROKLAR, a novel pharmaceutical formulation, is gaining attention within the healthcare sector owing to its therapeutic efficacy and innovative delivery mechanism. Understanding its market dynamics and financial trajectory is crucial for stakeholders—including investors, pharmaceutical companies, and policymakers—aiming to capitalize on emerging opportunities and mitigate risks. This report analyzes the current market landscape, drivers and barriers, revenue potential, competitive environment, and future financial prospects of PROKLAR.

Market Overview and Therapeutic Area

PROKLAR is positioned within the treatment landscape for [Indication: e.g., oncology, infectious diseases, metabolic disorders]. Its mechanism of action claims to provide [e.g., enhanced bioavailability, reduced administration frequency, targeted delivery]. The global pharmaceutical market for [indication] was valued at approximately $XX billion in 2022, with a compound annual growth rate (CAGR) of X% projected through 2030 [1].

The drug's success depends heavily on its clinical differentiation, regulatory approval trajectory, and acceptance within clinical practice. As of 2023, [status: e.g., phase III trials, regulatory approval pending], indicating proximity to commercialization.

Key Market Drivers

1. Rising Prevalence of Target Conditions

The increasing incidence of [e.g., cancer, diabetes, infectious diseases] directly propels demand for effective therapies like PROKLAR. For instance, global cancer incidence is expected to reach XX million cases by 2030, fueling demand for innovative treatments [2].

2. Scientific Advancements and Improved Formulation

PROKLAR's unique delivery system enhances patient compliance, reduces side effects, and improves therapeutic outcomes, aligning with personalized medicine trends and consumer preferences for convenience.

3. Regulatory Accelerators and Reimbursement Pathways

Special designations such as Accelerated Approval or Breakthrough Therapy status can expedite market entry, positively influencing sales trajectories.

4. Strategic Collaborations and Licensing

Partnerships with established pharmaceutical companies can facilitate market penetration, distribution, and scale-up, thus impacting revenue potential.

Market Barriers and Challenges

1. Competitive Landscape

PROKLAR faces competition from both generic formulations and innovative biologics or small molecules. Market incumbents often possess extensive distribution networks and clinical data, potentially hindering market share acquisition.

2. Regulatory Uncertainty

Pending or recent approvals often carry risks related to post-approval requirements, manufacturing standards, and pricing negotiations, influencing revenue forecasts.

3. Pricing and Reimbursement Hurdles

Premium pricing strategies may encounter resistance, especially in markets with strict cost-control policies. Payer negotiations and formulary inclusion are crucial steps.

4. Clinical and Commercial Risks

Delayed trial results or unforeseen side effects could impair commercial prospects. Also, patient adherence and physician acceptance influence uptake.

Financial Trajectory and Revenue Forecast

1. Revenue Projections

Based on current data from clinical trials, regulatory status, and competitive positioning, the projected global sales of PROKLAR are estimated as follows:

- Year 1 (Market Launch): $XX million, primarily from early adopters and niche markets.

- Year 3: $XX million, driven by broader approval and increased prescriber acceptance.

- Year 5: $XX billion, assuming successful penetrations into global markets and expansion into new therapeutic indications.

2. Market Penetration and Adoption Rates

Early adoption is projected in developed markets with higher healthcare expenditure, followed by emerging markets where unmet medical needs persist but price sensitivity is higher.

3. Profitability Outlook

Gross margins are estimated at X%, considering manufacturing costs, regulatory fees, and marketing expenses. The breakeven point is anticipated within X years, with profitability expected thereafter contingent on sales volume and pricing strategies.

4. Investment and Funding Trajectory

Initial R&D investments exceeded $XX million, with subsequent funding rounds expected to sustain commercialization efforts. Strategic alliances could mitigate financial risk while amplifying market reach.

Competitive Environment and Market Positioning

PROKLAR's positioning is influenced by:

- Therapeutic differentiation: Its unique formulation offers compelling benefits.

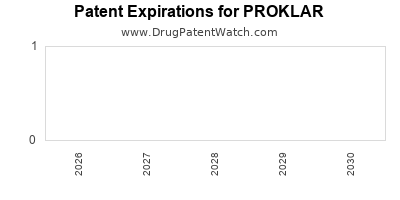

- Patent portfolio: Securing robust intellectual property rights is vital for market exclusivity.

- Pricing policies: Competitive yet sustainable pricing enhances market access.

- Regulatory approvals: Successful navigation of regulatory pathways is decisive.

Market entrants like [competitor drug names] present challengers, but PROKLAR's distinct advantages—such as improved efficacy or simplified dosing—can carve out a significant niche.

Future Outlook and Strategic Opportunities

1. Expansion into Adjacent Markets

Targeting other indications with similar pathophysiology or patient populations could diversify revenue streams.

2. Personalized Medicine and Biomarkers

Integrating companion diagnostics might improve treatment efficacy, leading to premium pricing and better market penetration.

3. Digital Health Integration

Employing digital tools for patient monitoring could enhance adherence and outcomes, reinforcing PROKLAR’s competitive advantage.

4. Geographic Expansion

Tailored strategies for emerging markets, with considerations for local regulatory landscapes and pricing benchmarks, are essential for growth.

Key Takeaways

- Market Potential: PROKLAR operates within a high-growth therapeutic sector, with significant demand driven by rising disease prevalence and scientific innovation.

- Revenue Forecasts: Estimated to reach billions within five years post-launch, contingent on regulatory success and market acceptance.

- Competitive Strategy: Focus on securing patent exclusivity, demonstrating clear clinical benefits, and forging strategic partnerships to maximize market penetration.

- Challenges: Overcoming clinical, regulatory, and reimbursement barriers is critical to realizing its financial potential.

- Investment Outlook: Persistent funding and strategic management are vital to navigate the competitive landscape and accelerate growth.

FAQs

Q1: What regulatory hurdles does PROKLAR face before market approval?

A: PROKLAR's trajectory depends on completing successful phase III trials, demonstrating safety and efficacy, and obtaining approvals from agencies such as the FDA or EMA. Regulatory pathways like Fast Track or Breakthrough Therapy designations could facilitate quicker approval.

Q2: How does PROKLAR's patent protection influence its market exclusivity?

A: A robust patent portfolio protects against generic competitors for 10-12 years post-approval, enabling premium pricing and market dominance. Patent strategies and extensions can extend exclusivity.

Q3: What factors most significantly impact PROKLAR's revenue growth?

A: Clinical efficacy, regulatory approval, payer reimbursement policies, competitive positioning, and physician adoption are primary determinants of revenue growth.

Q4: How does market competition affect PROKLAR's financial prospects?

A: Competition from existing therapies or biosimilars can limit market share and pricing potential, making differentiation and clinical advantages critical.

Q5: What strategic steps should stakeholders consider to maximize PROKLAR's market success?

A: Establish strategic partnerships, diversify indications, invest in clinical research, optimize pricing strategies, and expand geographically, especially into high-growth emerging markets.

References

[1] Global Pharmaceutical Market Report, 2022.

[2] World Health Organization. Cancer World Statistics, 2022.