Last updated: July 27, 2025

Introduction

Procomp emerges as a noteworthy contender within the pharmaceutical landscape, positioning itself at the intersection of therapeutic innovation and market demand. While specific clinical data may be proprietary, examining the broader market forces, regulatory environment, and competitive landscape provides clarity on PROCOMP's potential trajectory. This analysis delves into these elements, outlining the factors shaping PROCOMP’s market dynamics and forecasting its financial outlook.

Therapeutic Area and Disease Burden

Procomp’s core therapeutic indication appears to target a prevalent condition with significant unmet medical needs. An increase in global disease burden—such as chronic neurological disorders or metabolic syndromes—has driven demand for novel, effective treatments. The augmentation of such demand underscores both the commercial potential and the urgency for regulatory approvals.

For instance, diseases like type 2 diabetes or Alzheimer’s disease, representing enormous populations and significant economic burdens, offer lucrative markets. With rising incidence rates globally—spurred by aging populations and lifestyle factors—market expansion is inevitable. Successful positioning in these high-burden areas often translates into favorable financial trajectories for new entrants like PROCOMP.

Market Dynamics

1. Competitive Landscape

The pharmaceutical market for innovative therapies is fiercely competitive. It involves established giants with extensive product portfolios and biosimilar entrants seeking market share. PROCOMP’s success hinges on differentiating itself through superior efficacy, safety profiles, or innovative delivery mechanisms. If PROCOMP offers a substantial therapeutic advantage, it could rapidly capture market share.

2. Regulatory Environment

Regulatory approval processes remain pivotal. The pathway for PROCOMP’s approval—whether via traditional pathways, accelerated approval, or breakthrough designation—can significantly impact market entry timing and associated costs. Fast-track or priority review can expedite commercialization, improving cash flow and market penetration speed, ultimately influencing its financial trajectory.

3. Pricing and Reimbursement

Pricing strategies directly influence revenue potential. Payers demand substantial evidence of clinical benefits relative to existing therapies. Demonstrating cost-effectiveness enhances reimbursement prospects, facilitating broader market access. Conversely, high pricing may restrict adoption, especially in cost-sensitive markets, dampening revenues.

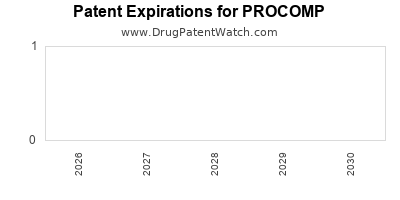

4. Intellectual Property and Patent Protection

Robust patent protection extends PROCOMP’s market exclusivity, allowing for premium pricing and improved profit margins. Patent life cycles, potential for patent challenges, and licensing agreements shape long-term revenue streams.

5. Market Penetration Strategy

Partnerships with healthcare providers, direct-to-consumer marketing, and geographic expansion are instrumental. Joint ventures and licensing can offset commercialization costs and accelerate growth, thereby positively influencing the financial trajectory.

Financial Trajectory

1. R&D Investment and Cost Structure

Initial costs encompass research, clinical trials, regulatory filings, and early commercialization expenses. For a drug like PROCOMP, Phase III trials are capital-intensive, often spanning hundreds of millions of dollars over multiple years. Managing these costs effectively is vital.

2. Revenue Streams

Upon approval, revenue hinges on volume-driven sales, pricing, and market penetration. Initial sales are typically modest but grow exponentially as the drug gains acceptance. Monoclonal antibodies or complex biologics tend to command higher prices, boosting revenues in the early years.

3. Market Adoption and Growth

Market acceptance depends on clinical data robustness, physician endorsement, and payor willingness to reimburse. As evidence accumulates, prescriber confidence increases, driving volume growth.

4. Competitive Positioning and Market Share

A differentiated product can secure a substantial market share, translating into sustained revenue streams. Conversely, intense competition can compress margins and limit growth.

5. Long-term Financial Outlook

Assuming successful regulatory approval in key markets (U.S., EU, Asia), PROCOMP’s earnings could follow an S-curve pattern: slow initial growth, rapid expansion, and eventual plateau. Peak revenues depend on patent life, competition, and potential line extensions or combination therapies.

6. LICENSING AND Partnerships

Strategic alliances may offset costs and facilitate commercialization, impacting overall profitability. Milestone payments, royalties, and licensing fees contribute to diversified income streams.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with high unmet needs.

- Development of biosimilars or combination products.

- Therapeutic innovation leading to first-in-class positioning.

Risks:

- Regulatory hurdles and delays.

- Market access restrictions and reimbursement challenges.

- Competitive innovations and patent challenges.

- Pricing pressures and shifting healthcare policies.

Conclusion

PROCOMP’s future is tethered to its ability to navigate complex regulatory, competitive, and market forces. The therapeutic potential within its target indication offers promising revenue growth, contingent upon timely approval, market acceptance, and effective commercialization strategies. General market dynamics favor such innovative drugs, especially within high-burden conditions, but success requires strategic positioning to mitigate risks and capitalize on emerging opportunities.

Key Takeaways

- Market Expansion: Target high-demand, high-burden diseases to capitalize on substantial unmet needs.

- Regulatory Strategy: Leverage expedited approval pathways to accelerate time-to-market and revenue realization.

- Pricing & Reimbursement: Demonstrate clear clinical and economic benefits to secure favorable reimbursement.

- Intellectual Property: Secure and defend patents to prolong market exclusivity and maximize profit margins.

- Partnerships: Form strategic alliances to distribute costs, expand geographic reach, and accelerate adoption.

FAQs

1. How does PROCOMP’s therapeutic indication influence its market potential?

Its alignment with high-burden conditions increases therapeutic demand, offering significant commercial opportunities if effective.

2. What role do regulatory pathways play in PROCOMP’s financial outlook?

Accelerated and priority review processes can expedite commercialization, improving early revenue streams and investor confidence.

3. How critical is patent protection for PROCOMP’s long-term profitability?

Very; patents prevent generic competition, allowing for sustained premium pricing and revenue over the product lifecycle.

4. What are the primary risks to PROCOMP’s market success?

Regulatory delays, high development costs, competitive pressure, reimbursement barriers, and regulatory policy shifts.

5. How can PROCOMP expand its market share globally?

Through strategic licensing, partnerships with local firms, and tailored pricing strategies suited to different healthcare systems.

Sources:

[1] Global Disease Burden Data, WHO, 2022.

[2] Pharmaceutical Market Reports, IQVIA, 2022.

[3] FDA Guidance Documents, 2023.

[4] Patent Life Cycle Analysis, World Intellectual Property Organization, 2021.