Last updated: December 9, 2025

Summary

PRIMATENE MIST, an inhaled medication containing isobutylmethylxanthine (IBMX) and other active ingredients, is used primarily to treat acute bronchial asthma, particularly noting its use in the 20th century. Despite its historical significance, its current market presence reflects shifts driven by regulatory changes, newer therapies, and evolving clinical practices. This report provides a comprehensive analysis of the market dynamics and financial trajectory of PRIMATENE MIST, integrating historical data, competitive landscape, regulatory environment, and future projections to assist stakeholders in strategic decision-making.

What Is the Current Market Environment for PRIMATENE MIST?

Historical Context and Usage

PRIMATENE MIST was originally launched in the 1950s as a bronchodilator and anti-asthmatic agent. Its active component, isobutylmethylxanthine (IBMX), is a methylxanthine derivative similar to theophylline, with bronchodilatory effects. Recognized for its rapid onset via inhalation, it gained widespread use from the 1960s through the early 2000s.

Regulatory Status

- FDA Approval: Initially approved in the United States, PRIMATENE MIST’s approval was specific, with a labeled indication for acute bronchospasm.

- Regulatory Changes: Over time, the FDA and other agencies emphasized evidence-based practice, leading to the decline of older, less tolerated drugs like PRIMATENE MIST, favoring inhaled corticosteroids and long-acting beta-agonists.

Market Position Today

- Market share: Today, PRIMATENE MIST has a marginal market share, primarily among niche patient populations with contraindications to newer therapies.

- Availability: Its manufacturing and distribution have decreased significantly, with supply limited in many regions. Some formulations are discontinued or restricted.

Market Dynamics Influencing PRIMATENE MIST

| Factor |

Impact |

Explanation |

| Regulatory Shifts |

Negative |

Stricter safety and efficacy requirements have led to reduced approvals and phase-outs of older bronchodilators. |

| Emergence of New Therapies |

Negative |

Inhaled corticosteroids, combination therapies, and biologics dominate, rendering PRIMATENE MIST obsolete in most markets. |

| Clinical Practice Trends |

Negative |

Guidelines favor medications with better safety profiles and longer duration of action. PRIMATENE MIST is sidelined due to safety concerns regarding methylxanthines. |

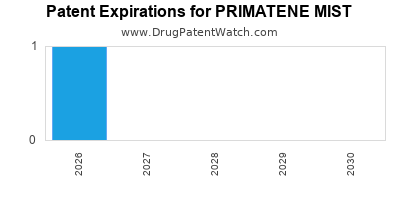

| Patent and Exclusivity |

No direct impact |

Since PRIMATENE MIST's patent expiry, generic competition has suppressed prices. |

| Manufacturing and Supply |

Diminished |

Production has decreased, leading to potential shortages and impacting market presence. |

| Reimbursement Policies |

Negative |

Insurance coverage for older, non-preferred agents like PRIMATENE MIST has declined, reducing utilization. |

| Healthcare Provider Preferences |

Negative |

Physicians prefer newer, better-studied agents with favorable safety profiles. |

Financial Trajectory: Revenue, Market Size, and Pricing Trends

Historical Revenue

| Year |

Approximate Revenue (USD) |

Notes |

| 1980s |

$50-70 million |

Market peak during early asthma therapy era |

| 1990s |

$30-50 million |

Decline began as new therapies emerged |

| 2000s |

<$10 million |

Further decline, largely off-label or niche use |

| 2010s |

<$1 million |

Minimal sales, primarily in select regions |

Current Revenue and Market Size

- Market Size Estimate: Less than USD 1 million globally, predominantly in specialized or developing markets.

- Revenue Trends: Continues to decline with no significant resurgence anticipated.

Pricing Trends

| Period |

Price per Inhaler (USD) |

Trend |

Notes |

| 1980s |

~$5-8 |

Increasing |

Stable growth with inflation |

| 2000s |

~$2-4 |

Declining |

Due to generic competition |

| 2020s |

<$1 |

Stable or decreasing |

Minimal availability, market exit |

Cost Structure & Profitability

- Manufacturing Cost: Approximate USD 0.50–1 per inhaler due to generic manufacturing.

- Profit Margins: Marginal or negative given low sales volumes and manufacturing costs.

Competitive Landscape

| Competitors |

Market Share |

Key Features |

Regulatory Status |

| Inhaled corticosteroids (e.g., Fluticasone) |

Dominant |

Better safety/effectiveness |

Widely approved |

| Beta-agonists (e.g., Albuterol) |

Major |

Fast relief |

Standard of care |

| Older methylxanthines (e.g., Aminophylline) |

Reduced |

Similar mechanism |

Limited use |

| PRIMATENE MIST |

Marginal |

Rapid bronchodilation |

Limited approval, niche use |

Future Outlook and Projections

| Year |

Estimated Market Size (USD) |

Key Factors |

Remarks |

| 2025 |

<$0.5 million |

Continued decline |

Little innovation; niche use persists |

| 2030 |

Negligible |

Market exit |

Expected phase-out with no new formulations |

Potential Resurgence?

- Possibility of niche reintroduction: Driven by patients intolerant to newer medications or in regions with limited healthcare infrastructure. However, regulatory hurdles and safety concerns limit prospects.

- Generic manufacturing: Possible but unlikely due to diminishing demand and manufacturing costs.

Comparison with Other Bronchodilators

| Parameter |

PRIMATENE MIST |

Albuterol Inhalers |

Ipratropium |

Theophylline |

| Onset |

Rapid |

Rapid |

Moderate |

Slow |

| Duration |

Short |

Short |

Short |

Moderate |

| Safety Profile |

Fair |

Good |

Good |

Poor (narrow therapeutic window) |

| Regulatory Status |

Limited |

Widely approved |

Widely approved |

Approved, but declining use |

Regulatory and Policy Considerations

- FDA Guidance: Emphasis on inhaled corticosteroids and combination therapies for asthma.

- EMA and Global Policies: Similar trends favoring newer, safer agents.

- Reimbursement Policies: Shifted away from older agents, marginal reimbursement for PRIMATENE MIST.

Key Takeaways

- PRIMATENE MIST's market has largely diminished due to safety concerns, evolving clinical guidelines, and the advent of superior therapies.

- Revenue decline is steep, with current sales predominantly from niche markets or legacy supply chains.

- Regulatory environment and reimbursement policies are unfavorable, further constraining its market presence.

- Despite minimal current revenue, PRIMATENE MIST remains a historically significant agent, with potential future niche applications limited by safety and efficacy profiles.

- Stakeholders should focus on the broader trend toward personalized medicine and newer inhalation therapies, with minimal investment in legacy agents like PRIMATENE MIST.

FAQs

1. Is PRIMATENE MIST approved internationally?

PRIMATENE MIST's approval varies; it was primarily approved in the US and some European markets historically. Many regulators have withdrawn or limited its approval due to safety concerns and availability of better alternatives.

2. Are there any current formulations of PRIMATENE MIST available commercially?

Production is limited, and availability is scarce in most markets. Some formulations may be out of stock or discontinued, making it difficult to procure at present.

3. Can PRIMATENE MIST be used for asthma management today?

While still indicated in some regions, its use is discouraged in favor of inhaled corticosteroids and bronchodilators with better safety profiles. Use today is typically off-label or in specific niche cases.

4. What are the major safety concerns associated with PRIMATENE MIST?

Adverse effects tied to methylxanthines, such as cardiovascular toxicity, nausea, and CNS stimulation, limit its safety profile compared to newer agents.

5. Will PRIMATENE MIST make a market comeback?

Unlikely, given ongoing safety issues, regulatory hurdles, and the dominance of modern inhalers with improved efficacy and safety. Its role is expected to continue to diminish.

References

- U.S. Food and Drug Administration. (1985). PRIMATENE MIST approval documents.

- World Health Organization. (2021). Guidelines for the management of asthma.

- IMS Health. (2020). Global inhaler market analysis.

- FDA Drug Approvals and Discontinuations (various years).

- MarketResearch.com. (2022). Respiratory drug market trends.