PRESTALIA Drug Patent Profile

✉ Email this page to a colleague

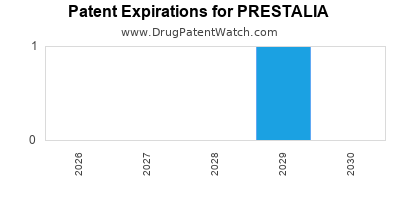

When do Prestalia patents expire, and what generic alternatives are available?

Prestalia is a drug marketed by Adhera and is included in one NDA. There is one patent protecting this drug and one Paragraph IV challenge.

This drug has thirty patent family members in twenty-seven countries.

The generic ingredient in PRESTALIA is amlodipine besylate; perindopril arginine. There are fifty drug master file entries for this compound. Additional details are available on the amlodipine besylate; perindopril arginine profile page.

DrugPatentWatch® Generic Entry Outlook for Prestalia

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be October 5, 2029. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PRESTALIA?

- What are the global sales for PRESTALIA?

- What is Average Wholesale Price for PRESTALIA?

Summary for PRESTALIA

| International Patents: | 30 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Patent Applications: | 2 |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for PRESTALIA |

| What excipients (inactive ingredients) are in PRESTALIA? | PRESTALIA excipients list |

| DailyMed Link: | PRESTALIA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for PRESTALIA

Generic Entry Date for PRESTALIA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Paragraph IV (Patent) Challenges for PRESTALIA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| PRESTALIA | Tablets | amlodipine besylate; perindopril arginine | 3.5 mg/2.5 mg, 7 mg/5 mg and 14 mg/10 mg | 205003 | 1 | 2016-11-04 |

US Patents and Regulatory Information for PRESTALIA

PRESTALIA is protected by one US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of PRESTALIA is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-001 | Jan 21, 2015 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-002 | Jan 21, 2015 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-003 | Jan 21, 2015 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for PRESTALIA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-001 | Jan 21, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-002 | Jan 21, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Adhera | PRESTALIA | amlodipine besylate; perindopril arginine | TABLET;ORAL | 205003-003 | Jan 21, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for PRESTALIA

When does loss-of-exclusivity occur for PRESTALIA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 07220435

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0708278

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 44467

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1389603

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0160644

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 17753

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 89182

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 4716

Estimated Expiration: ⤷ Get Started Free

Patent: 0801777

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 89182

Estimated Expiration: ⤷ Get Started Free

France

Patent: 97866

Patent: FORME CRISTALLINE ALPHA DU SEL D'ARGININE DU PERINDOPRIL, SON PROCEDE DE PREPARATION, ET LES COMPOSITIONS PHARMACEUTIQUES QUI LA CONTIENNENT (New alpha crystalline form of perindopril arginine salt are angiotensin I converting enzyme inhibitor, useful for the manufacture of drugs to treat cardiovascular diseases)

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0125433

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 29669

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 27898

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 55454

Estimated Expiration: ⤷ Get Started Free

Patent: 09534295

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 1035

Patent: ? CRYSTALLINE FORM OF THE ARGININE SALT OF PERINDOPRIL, A PROCESS FOR ITS PREPARATION AND PHARMACEUTICAL COMPOSITIONS CONTAINING IT

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 456

Patent: KRISTALNI OBLIK ARGININSKE SOLI PERINDOPRILA, POSTUPAK NJENE PROIZVODNJE I FARMACEUTSKE SMEŠE KOJE JE SADRŽE (CRYSTALLINE FORM OF THE ARGININE SALT OF PERINDOPRIL, PROCESS FOR PREPARING IT, AND PHARMACEUTICAL COMPOSITIONS COMPRISING IT)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 276

Patent: FORME CRISTALLINE ALPHA DU SEL D'ARGININE DU PERINDOPRIL, SON PROCEDE DE PREPARATION, ET LES COMPOSITIONS PHARMACEUTIQUES QUI LA CONTIENNENT

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0367

Patent: A crystalline form of the arginine salt of perindopril, process for preparing it, and pharmaceutical compositions comprising it

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 083535

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 89182

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 754

Patent: KRISTALNI OBLIK ARGININSKE SOLI PERINDOPRILA, POSTUPAK NJENE PROIZVODNJE I FARMACEUTSKE SMEŠE KOJE JE SADRŽE (CRYSTALLINE FORM OF THE ARGININE SALT OF PERINDOPRIL, PROCESS FOR PREPARING IT, AND PHARMACEUTICAL COMPOSITIONS COMPRISING IT)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 89182

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0807024

Patent: Alpha crystaline form of the arginine salt of perindopril, process for preparing it, and pharmaceutical compositions comprising it

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 080106948

Patent: ALPHA; CRYSTALLINE FORM OF THE ARGININE SALT OF PERINDOPRIL, PROCESS FOR PREPARING IT, AND PHARMACEUTICAL COMPOSITIONS COMPRISING IT

Estimated Expiration: ⤷ Get Started Free

Patent: 120001818

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 81982

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 905

Patent: α КРИСТАЛЛИЧЕСКАЯ ФОРМА АРГИНИНОВОЙ СОЛИ ПЕРИНДОПРИЛА, СПОСОБ ЕЕ ПОЛУЧЕНИЯ И ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ, КОТОРАЯ ЕЕ СОДЕРЖИТ;α-КРИСТАЛІЧНА ФОРМА АРГІНІНОВОЇ СОЛІ ПЕРИНДОПРИЛУ, СПОСІБ ЇЇ ОДЕРЖАННЯ І ФАРМАЦЕВТИЧНА КОМПОЗИЦІЯ, ЯКА ЇЇ МІСТИТЬ (α-CRYSTALLINE FORM OF PERINDOPRIL ARGININE SALT, METHOD FOR MAKING SAME, AND PHARMACEUTICAL COMPOSITIONS CONTAINING SAME)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering PRESTALIA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| European Patent Office | 1354873 | Sel de périndopril et les compositions pharmaceutiques qui le contiennent (Salt of perindopril and pharmaceutical compositions containing it) | ⤷ Get Started Free |

| Ecuador | SP045441 | NUEVA SAL DE PERINDOPRIL Y COMPOSICIONES FARMACÉUTICAS QUE LO CONTIENEN | ⤷ Get Started Free |

| New Zealand | 524478 | Arginine salt of perindopril ((2S)-2-[(1S)-carbethoxybutylamino]-1-oxo-propyl-(2S, 3aS, 7aS)perhydroindole-carboxylic acid) and pharmaceutical compositions containing it | ⤷ Get Started Free |

| Slovenia | 1989182 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 200300334 | НОВАЯ СОЛЬ ПЕРИНДОПРИЛА И СОДЕРЖАЩИЕ ЕЕ ФАРМАЦЕВТИЧЕСКИЕ КОМПОЗИЦИИ | ⤷ Get Started Free |

| Montenegro | 00454 | NOVA SO PERINDOPRILA I FARMACEUTSKE KOMPOZICIJE KOJE SADRŽE TU SO (NOVEL PERINDOPRIL SALT AND PHARMACEUTICAL COMPOSITIONS CONTAINING SAME) | ⤷ Get Started Free |

| Eurasian Patent Organization | 005676 | НОВАЯ СОЛЬ ПЕРИНДОПРИЛА И СОДЕРЖАЩИЕ ЕЕ ФАРМАЦЕВТИЧЕСКИЕ КОМПОЗИЦИИ (SALT OF PERINDOPRIL AND PHARMACEUTICAL COMPOSITIONS CONTAINING IT) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for PRESTALIA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1915993 | C300625 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: COMBINATIE BEVATTENDE ALISKIREN, OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, EN AMLODIPINE, OF EEN FARMACEUATISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/11/686/001-056 20110414 |

| 1915993 | 92315 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: COMBINAISON COMPRENANT ALISKIREN,OU UN DE SES SELS PHARMACEUTIQUEMENT ACCEPTABLE,ET AMLODIPINE,OU UN DE SES SELS PHARMACEUTIQUEMENT ACCEPTABLE |

| 0502314 | C300478 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: TELMISARTAN, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT, EN AMLODIPINE, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT, IN HET BIJZONDER AMLODIPINEBESILAAT; REGISTRATION NO/DATE: EU/1/10/648/001-028 20101007 |

| 0678503 | C300499 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: COMBINATIE OMVATTEND ALISKIREN OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, EN AMLODIPINE OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/11/686/001-056 20110114 |

| 0443983 | C300445 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: VALSARTAN, AMLODIPINE EN HYDROCHLOORTHIAZIDE EN FARMACEUTISCH AANVAARDBARE ZOUTEN DAARVAN; REGISTRATION NO/DATE: EU/1/09/569/001-060 20091016 |

| 1507558 | 2012/018 | Ireland | ⤷ Get Started Free | PRODUCT NAME: ALISKIREN OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, AMLODIPINE OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF AND HYDROCHLOROTHIAZIDE OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF.; NAT REGISTRATION NO/DATE: EU/1/11/730/001-060 20111122; FIRST REGISTRATION NO/DATE: SWITZERLAND 6167801-6167805 20110705 |

| 1507558 | 12C0033 | France | ⤷ Get Started Free | PRODUCT NAME: ALISKIRENE OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE E CELUI-CI, AMLODIPINE OU SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELUI-CI, ET HYDROCHLOROTHIAZIDE OU SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELUI-CI; NAT. REGISTRATION NO/DATE: EU/1/11/730/001 20111122; FIRST REGISTRATION: CH - 6167801 20110705 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Prestalia

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.