Last updated: July 29, 2025

Introduction

PRAMOSONE, a corticosteroid-based topical formulation, is increasingly gaining attention in dermatology and inflammatory condition treatments. Originally developed for its anti-inflammatory and immunosuppressive properties, PRAMOSONE has been expanded through formulations and indications, reflecting evolving market demands. This analysis explores the current market landscape, competitive environment, regulatory considerations, and financial trajectory for PRAMOSONE, aimed at equipping industry stakeholders with strategic insights.

Market Landscape and Demand Drivers

Growing Use in Dermatology and Inflammatory Conditions

PRAMOSONE’s primary active ingredient, prednisolone, operates as a potent corticosteroid. The increasing prevalence of dermatological disorders such as eczema, psoriasis, and allergic dermatitis drives demand for effective anti-inflammatory treatments. According to the World Dermatology Organization, skin diseases affect over 1.9 billion people globally, with corticosteroid topicals being pivotal in management [1].

Shift Towards Topical Formulations

Patient preference for topical applications over systemic therapies due to fewer side effects correlates with market expansion. Advances in formulation technology enhance user compliance, potency, and safety profiles, further bolstering demand for corticosteroid products like PRAMOSONE.

Emerging Markets and Demographic Trends

Rapid urbanization, increased healthcare access, and rising disposable incomes in emerging markets such as Asia-Pacific and Latin America enlarge the patient base. Data indicates a CAGR of approximately 4.5% for dermatology therapeutics globally, with higher rates in developing regions [2].

Regulatory Environment and Approval Landscape

Regulatory agencies such as the FDA and EMA impose strict guidelines on corticosteroid potency and duration of use to prevent adverse effects. The successful navigation of these frameworks influences market penetration. Countries with streamlined approval processes and positive reimbursement policies benefit PRAMOSONE’s commercial trajectory.

Competitive and Patent Environment

Key Competitors

PRAMOSONE operates in a competitive sphere dominated by brands like Betnovate, Clobex, and Elocon. Differentiation through formulation advancements, branding, and pricing strategies determines market share. The presence of generics depresses prices, but patent protections confer exclusivity that enhances margin potential.

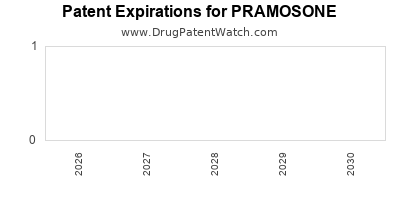

Patent Expiry and Generic Competition

Patent expiry, projected within 3-5 years depending on jurisdiction, poses a significant challenge. Market entry of generics typically triggers price erosion, impacting revenue streams. Companies often seek new formulations or combination therapies to extend product lifecycle.

Innovation and Formulation Strategies

Investments in novel delivery systems—such as liposomal, foam, or hydrogel formulations—can provide competitive advantages, improve efficacy, and delay patent expiry effects. PRAMOSONE’s ongoing R&D focus on such innovations is critical for sustaining market relevance.

Regulatory and Safety Considerations

Usage Limitations and Side Effects

Long-term or extensive use of corticosteroids risks side effects like skin atrophy, hypothalamic-pituitary-adrenal (HPA) axis suppression, and systemic absorption. Regulatory bodies regulate prescribing practices, influencing sales volume and product positioning.

Monitoring Post-Market and Pharmacovigilance

Robust pharmacovigilance mechanisms are indispensable. Adherence to safety monitoring bolsters brand reputation and facilitates regulatory approval of new formulations or indications.

Financial Trajectory and Revenue Forecasts

Historical Performance and Growth Potential

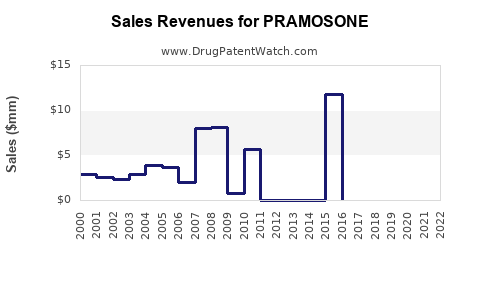

While specific sales data for PRAMOSONE remains proprietary, industry reports suggest corticosteroid topical products achieve annually double-digit growth in emerging markets, driven by unmet needs and evolving healthcare infrastructure.

Projection Models

Assuming current annual growth rates of 6-8% driven by expanding indications and geographical reach, revenues could reach a CAGR of approximately 7% over the next five years. Price points, reimbursement policies, and patent protections influence actual financial outcomes.

Impact of Patent Expiry and Generics

Anticipated patent expirations within 3-5 years is likely to precipitate a 20-30% reduction in revenue streams unless offset by new formulations or indications. Strategic patenting and lifecycle management extend product profitability.

Potential Partnership and Licensing Opportunities

Collaborations with regional distributors and licensing agreements can accelerate market penetration and revenue diversification. Such partnerships often provide upfront payments, milestone gains, and royalty streams, enhancing overall financial stability.

Market Risks and Challenges

- Regulatory Delays and Restrictions: Stricter controls on corticosteroid potency may constrain market size.

- Competitive Pressures: Entrant of low-cost generics and biosimilars may erode margins.

- Safety Concerns: Patient safety issues can lead to decreased utilization and regulatory sanctions.

- Pricing Pressures: Negotiations with payers for reimbursement may necessitate price concessions.

Future Outlook and Strategic Recommendations

Innovation-Driven Growth

Investing in advanced delivery systems and combination therapies can help overcome generic competition and extend the product lifecycle, securing sustained revenues.

Geographical Expansion

Targeting emerging markets with high dermatological disease burdens offers growth avenues. Tailoring formulations to regional preferences and clinical needs enhances acceptance.

Regulatory Engagement

Proactive compliance and pharmacovigilance build trust among regulators, patients, and healthcare providers, facilitating smoother approvals and market access.

Lifecycle Management

Securing new patents, clinical data, and expanding indications will be pivotal in prolonging PRAMOSONE’s market viability and financial returns.

Key Takeaways

- Market Potential: The global demand for topical corticosteroids like PRAMOSONE is projected to grow at a CAGR of approximately 6-8%, fueled by rising dermatological conditions and expanding markets.

- Competitive Edge: Differentiation through innovative formulations and strategic patent management underpins long-term profitability.

- Regulatory Dynamics: Stringent safety regulations necessitate ongoing pharmacovigilance; compliance enhances market standing.

- Revenue Trajectory: Expected growth is tempered by patent expiry risks; diversification via new indications and markets is essential.

- Strategic Focus: Emphasis on innovation, geographical expansion, and lifecycle extension will optimize PRAMOSONE’s financial trajectory.

FAQs

1. What factors influence PRAMOSONE’s market growth?

Market growth hinges on increased dermatology disease prevalence, geographic expansion, formulation innovations, regulatory acceptance, and competition from generics.

2. How does patent expiry impact PRAMOSONE’s revenue prospects?

Patent expiry typically leads to the entry of generics, causing price reductions and revenue declines. Strategic innovation and extension of patents are vital to mitigating these effects.

3. Are safety concerns affecting the marketability of corticosteroids like PRAMOSONE?

Yes. Safety issues, such as skin atrophy and systemic effects, influence prescribing habits and regulatory policies, emphasizing the importance of monitoring and patient education.

4. What opportunities exist for expanding PRAMOSONE’s market share?

Opportunities include developing new formulations, expanding into emerging markets, obtaining additional indications, and forming strategic partnerships.

5. What is the outlook for PRAMOSONE’s financial performance over the next five years?

Assuming effective lifecycle management and market expansion, revenues are projected to grow at a compound annual rate of approximately 7%, with potential fluctuations due to patent timelines and regulatory factors.

References

[1] World Dermatology Organization. Global Dermatology Data. 2022.

[2] MarketResearch.com. "Global Dermatology Therapeutics Market," 2022.