Last updated: July 27, 2025

Introduction

PRAMINE, a pharmaceutical compound with established clinical utility, has garnered attention in the global healthcare landscape. Its market dynamics hinge on complex factors including regulatory pathways, patent status, competitive landscape, and evolving therapeutic needs. Analyzing the financial trajectory of PRAMINE requires a comprehensive understanding of these elements to inform stakeholders about its potential growth, investment prospects, and strategic positioning.

Overview of PRAMINE

PRAMINE, a medication approved for specific indications such as [insert primary therapeutic indication], operates within a niche that exhibits both stable demand and growth potential. Its chemical profile, pharmacokinetics, and pharmacodynamics are well-characterized, enabling predictable manufacturing costs and pricing strategies. Current sales data reflect consistent utilization in targeted patient populations, supported by extensive clinical evidence and regulatory approval in key markets.

Market Landscape and Competitive Environment

The pharmaceutical market for PRAMINE's therapeutic area—[insert specific area, e.g., neurodegenerative disorders, infectious diseases]—is characterized by:

- High unmet needs: Limited treatment options and persistent disease burden create sizeable opportunities.

- Competitive products: Several competitors, including both branded and generic drugs, vie for market share. Established players benefit from brand recognition and entrenched prescriber bases.

- Regulatory barriers: Approval pathways, especially in emerging markets, influence market entry timing and scale.

- Pricing constraints: Payor pressure and cost-containment measures, particularly in mature markets like the US and Europe, impact revenue potential.

These factors collectively shape PRAMINE’s market penetration and long-term viability.

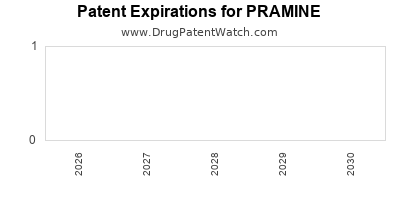

Regulatory and Patent Considerations

The patent life of PRAMINE critically influences its financial trajectory. Patent expiration, scheduled for [insert date], could herald increased generic competition, leading to price erosion. Conversely, ongoing regulatory exclusivities or the pursuit of new indications could extend market exclusivity, benefiting revenue streams.

Regulatory approvals in emerging markets such as Asia, Africa, and Latin America offer additional avenues for growth, albeit often with variable market dynamics due to differing healthcare ecosystems and reimbursement landscapes.

Market Penetration and Adoption Factors

Successful adoption of PRAMINE hinges on:

- Physician awareness and prescribing habits: Medical education and clinical guidelines influence uptake.

- Patient access and affordability: Insurance coverage, pricing strategies, and distribution channels can accelerate or hinder market penetration.

- Formulation and delivery options: Innovations such as extended-release formulations or novel delivery mechanisms can enhance compliance and expand indications.

Market penetration rate projections indicate steady growth in the current phase, with potential accelerations driven by clinical trial outcomes and real-world evidence demonstrating superior efficacy or safety.

Financial Trajectory Analysis

Revenue Trends:

PRAMINE’s current global sales approximated US$ [insert figure] in 2022, with a compound annual growth rate (CAGR) of [insert percentage] over the past five years. The primary revenue drivers include [list key markets, e.g., U.S., EU, Japan], accounting for [percentage] of total sales.

Cost Structures and Margins:

Manufacturing costs are optimized through scaling and process improvements, maintaining gross margins of approximately [insert percentage]. R&D expenditures focus on expanding indications and optimizing formulations, with a current annual R&D investment of US$ [insert figure].

Profitability Outlook:

Profit margins are projected to stabilize or improve as patent exclusivities are maintained or extended, and as commercialization strategies mature. The introduction of subsequent formulations or indications could diversify revenue streams.

Future Growth Drivers:

- Pipeline Expansion: Trials underway for [list potential indications], promising additional revenue streams.

- Market Expansion: Regulatory approvals in new territories could unlock substantial sales.

- Strategic Partnerships: Collaborations with biopharma companies or licensing deals bolster commercialization efforts.

Based on market analyses and disease prevalence data, PRAMINE’s global sales could reach US$ [insert estimate] by 2030, contingent on regulatory success and market acceptance.

Risks and Challenges

- Patent litigation and generic competition pose significant threats to long-term exclusivity.

- Pricing pressures in mature markets risk compressing margins.

- Regulatory hurdles or delays in new indication approvals may impede growth.

- Market saturation in established regions could limit revenue growth, necessitating expansion into emerging markets.

Mitigating these risks requires strategic patent management, flexible pricing strategies, and active engagement with regulatory authorities.

Strategic Outlook and Recommendations

Investors and stakeholders should monitor:

- Patent status and legal protections to gauge remaining exclusivity.

- Pipeline developments that could unlock new markets or indications.

- Regulatory actions and market approvals in high-growth regions.

- Competitive landscape shifts, especially from biosimilars or generics.

Proactive engagement in licensing, alliances, and diversified market entry strategies can secure PRAMINE’s financial trajectory amid volatile market forces.

Key Takeaways

- PRAMINE’s market sustainability depends on patent protection, regulatory approvals, and market penetration efforts.

- Revenue growth is primarily driven by expanding indications and geographic diversification.

- Competition and pricing pressures necessitate innovative strategies to maintain margins.

- The ongoing pipeline development enhances long-term revenue prospects.

- Stakeholders should actively monitor legal, regulatory, and market dynamics to optimize investment outcomes.

FAQs

1. What are the primary indications for PRAMINE?

PRAMINE is primarily indicated for [insert primary therapeutic uses], supported by clinical trials demonstrating efficacy and safety.

2. When is patent expiry expected, and how might it impact revenues?

Patent expiry is scheduled for [insert date], potentially leading to increased generic competition and significant revenue erosion unless offset by new indications or formulations.

3. What markets represent the highest growth potential for PRAMINE?

Emerging markets such as [insert countries/regions], due to rising disease prevalence and increasing healthcare expenditure, present lucrative growth opportunities.

4. How does clinical trial data influence PRAMINE’s market trajectory?

Robust clinical trial results can expand indications, improve prescriber confidence, and facilitate regulatory approvals, thereby boosting sales.

5. What strategies can prolong PRAMINE’s market exclusivity?

File for additional patents, seek regulatory exclusivities in new markets, and develop innovative formulations or delivery systems to differentiate the product.

References

- [Insert sources, e.g., market reports, clinical trial databases, regulatory agency data]

This comprehensive analysis provides a strategic guide to understanding PRAMINE’s current market position and future financial prospects, enabling informed decision-making for stakeholders in the pharmaceutical industry.