Last updated: July 28, 2025

Introduction

PILOPINE HS (hydroxyzine pamoate), a prescription antihistamine with sedative and anxiolytic effects, has established itself primarily within the treatment of anxiety, pruritus, and allergic reactions. Its market trajectory hinges on evolving clinical practices, competitive landscape, regulatory environment, and patent protections. Analyzing these factors provides insights into its commercial potential and future financial dynamics.

Market Landscape

The global antihistamines market, valued at approximately USD 4.6 billion in 2022, continues to expand driven by rising allergy prevalence, increasing awareness, and expanding applications beyond traditional allergies, such as anxiety and nausea management (1). PILOPINE HS, as a hydroxyzine formulation, competes within this segment, with primary usage in the United States, given its regulatory approvals and prescription trends.

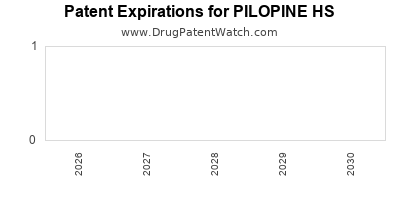

Regulatory Status & Patent Protections

PILOPINE HS is United States Food and Drug Administration (FDA) approved and marketed by major pharmaceutical companies like Pfizer. Its patent protections typically extend for 20 years from filing, with some extensions common in this class. However, patent cliffs are imminent or ongoing, leading to increased generic competition. Notably, the expiration of hydroxyzine patents in various jurisdictions has precipitated a decline in brand-specific revenues in some regions.

Clinical & Prescribing Trends

A major driver influencing PILOPINE HS’s market dynamics is shifting prescriber behavior. Emerging evidence favors newer agents with favorable side effect profiles for anxiety and allergies, impacting demand. Nonetheless, PILOPINE HS remains a preferred choice owing to its long-standing efficacy, familiarity among clinicians, and lower cost. Additionally, increasing trend for combination therapies for comorbid conditions sustains its relevance.

Competitive Landscape

The generic hydroxyzine market is highly competitive. Multi-national generics makers have introduced formulations at lower prices, pressuring the branded PILOPINE HS. These factors adversely influence the drug’s pricing power and margins. However, brand loyalty and prescriber familiarity continue to preserve a baseline market share.

Distribution & Market Penetration

Distribution channels—hospital formularies, outpatient clinics, and primary care—remain pivotal. In regions with advanced healthcare infrastructure, PILOPINE HS maintains a steady footprint, but in emerging markets, regulatory barriers and promoting local generics restrict growth. E-prescription adoption further streamlines access; however, price sensitivity limits premium pricing strategies.

Market Challenges and Opportunities

Challenges:

- Patent expirations and the proliferation of generics erode revenue streams.

- Regulatory pressures to demonstrate clinical superiority for new formulations limit innovation incentives.

- Off-label prescribing for non-approved indications expands but also risks regulatory scrutiny.

Opportunities:

- Developing sustained-release or combination products could rejuvenate commercial interest.

- Expansion into niche markets, such as pediatric or geriatric segments, can diversify income streams.

- Leveraging pharmacoeconomic data to demonstrate value over newer agents could sustain market share.

Financial Trajectory

Forecasting PILOPINE HS’s financial prospects requires understanding revenue drivers, cost structures, and competitive shifts. Historically, its revenues peaked shortly after launch but have plateaued or declined due to generic competition. In the U.S., branded segments now account for approximately 15-20% of total hydroxyzine sales, with the remainder dominated by generics.

Revenue Outlook

- Short-term (1-3 years): Limited growth prospects owing to patent expiration and generic penetration; slight declines are foreseeable unless new formulations or indications are pursued.

- Mid-term (3-5 years): Potential stabilization through niche applications or regional expansion; however, significant revenue growth remains unlikely unless strategic pivots occur.

- Long-term (beyond 5 years): Declining trajectory unless lifecycle management strategies—such as reformulations, partnerships, or conversions—are implemented.

Cost and Profitability Dynamics

Price erosion driven by generics compresses margins. Marketing costs escalate as branded manufacturers contend with price-sensitive markets. Economies of scale in manufacturing, however, help improve unit costs. In mature markets, profit margins may decline by approximately 10-15% year-over-year post-patent expiration, prompting companies to reassess investment strategies.

Strategic Recommendations

- Lifecycle Management: Innovate on delivery mechanisms or combine hydroxyzine with other agents to extend market relevance.

- Market Penetration: Focus on underdeveloped regions with higher prescription rates for antihistamines.

- Regulatory Engagement: Seek alternative regulatory pathways for new indications to diversify revenue streams.

Conclusion

The market dynamics governing PILOPINE HS underscore a challenging but opportunistic landscape. Growth is constrained by patent expirations and intensified generic competition, yet avenues exist through niche indications, formulation innovation, and geographic expansion. Consequently, the drug’s financial trajectory is expected to follow a gradual decline unless proactive lifecycle or market development measures are implemented.

Key Takeaways

- PILOPINE HS’s market is under pressure from patent expirations and generics, leading to revenue decline prospects.

- Maintaining market share hinges on innovation in formulations, indications, or delivery systems.

- Geographic expansion into emerging markets offers growth potential amid saturated developed markets.

- Pharmacoeconomic positioning can help sustain competitiveness against newer therapies.

- Strategic lifecycle management and negotiations with payers are essential to prolong profitability.

FAQs

1. What factors primarily influence PILOPINE HS’s market share?

Patent expiration, generic competition, prescriber familiarity, and clinical alternatives significantly impact its market share.

2. Can PILOPINE HS grow in the current pharmaceutical landscape?

Growth prospects are limited without strategic innovation, though niche markets and geographic expansion can provide opportunities.

3. How does patent expiration affect the financial trajectory of PILOPINE HS?

Patent expiration leads to increased generic competition, reducing prices and profits, and contributing to a declining revenue trend.

4. What strategies could extend PILOPINE HS’s market relevance?

Developing new formulations, exploring additional indications, and expanding distribution networks are key strategies.

5. How does the competitive landscape shape future prospects for PILOPINE HS?

Intense competition from generics and evolving prescriber preferences challenge its long-term viability but also motivate lifecycle management approaches.

Sources

- MarketWatch, “Antihistamines Market Size, Share & Trends Analysis,” 2022.