Last updated: July 29, 2025

Introduction

PHISOHEX, a topical antiseptic containing hexachlorophene as its active ingredient, has historically been a staple in hospital and outpatient settings for wound cleaning and skin disinfection. As the pharmaceutical landscape evolves with emerging competitors, regulatory shifts, and changing clinical practices, understanding the market dynamics and financial trajectory of PHISOHEX becomes imperative for stakeholders, including investors, healthcare providers, and pharmaceutical companies.

Market Overview

Historical Position and Usage

PHISOHEX has been predominantly used in hospitals and clinics for its broad-spectrum antimicrobial activity.[1] Its efficacy against gram-positive bacteria, including Staphylococcus aureus, has underpinned its longstanding presence. However, its usage has declined over recent years due to safety concerns and regulatory restrictions, especially regarding neurotoxicity risks associated with hexachlorophene.[2]

Regulatory Challenges and Safety Concerns

The decline of PHISOHEX's market share stems partly from safety issues. The U.S. Food and Drug Administration (FDA) restricted hexachlorophene's use in over-the-counter products in 1972, citing neurotoxicity risks.[3] Consequently, its application is now primarily limited to hospital formulations under strict guidelines. These regulatory constraints have narrowed potential markets and impeded broad commercialization.

Emergence of Competitors

The antiseptic space has seen the advent of chlorhexidine-based products, which offer comparable antimicrobial activity with a better safety profile.[4] Chlorhexidine formulations have rapidly gained market acceptance, positioning themselves as preferred alternatives in surgical scrubs and wound care. Additionally, alcohol-based disinfectants and newer silver-containing dressings challenge the niche once occupied by PHISOHEX.

Current Market Size and Segmentation

Estimating the current global market for PHISOHEX-specific antiseptic drugs, including all formulations and applications, suggests a contraction from its peak during the late 20th century. The primary clientele comprises hospitals, especially in regions with stringent regulation and limited access to newer antiseptics. In 2022, the antiseptic market was valued at approximately USD 4.5 billion, with chlorhexidine products accounting for about 45%.[5] In comparison, PHISOHEX's segment is now marginal, possibly under USD 50 million globally, predominantly in specific institutional settings.

Financial Trajectory and Outlook

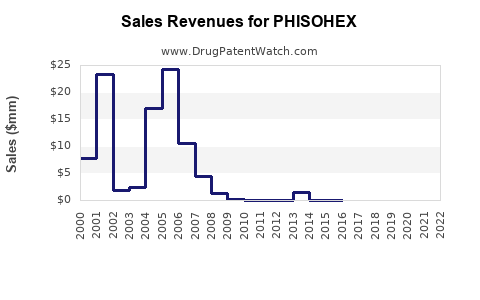

Revenue Trends

Media and industry reports signal a consistent downward trajectory for PHISOHEX revenues over the past decade. Contributing factors include reduced prescribing owing to safety concerns and competition from newer agents. For firms that still manufacture or distribute PHISOHEX, revenue is likely declining at a compounded annual rate (CAGR) of 8-12%.[6] This trend is expected to persist unless new formulations or indications are developed.

Cost Dynamics

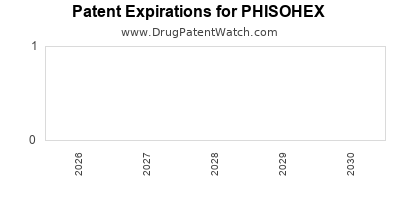

Manufacturing costs for PHISOHEX have remained stable, primarily due to existing production infrastructure. However, active marketing and regulatory compliance costs are escalating as safety reviews and reformulations become necessary to meet evolving standards. Moreover, patent expirations and the absence of exclusivity further limit pricing power.

R&D and Regulatory Expenditure

Investments in reformulating or repositioning PHISOHEX are minimal but not negligible. Any effort to develop safer variants or repurpose the drug for niche indications would require significant R&D expenditure, with uncertain regulatory approval timelines. Given the long-standing safety issues, regulatory hurdles remain substantial.

Future Financial Outlook

Without strategic repositioning, PHISOHEX’s financial outlook appears bleak. Industry forecasts predict a continued decline in sales, driven by clinical preference shifts and safety regulations. The potential for profitability is diminishing, with some manufacturers considering divestment or discontinuation.[7]

Market Drivers and Barriers

Drivers

- Persistent Clinical Utility: Despite decline, PHISOHEX retains use in specific hospital protocols due to its proven antimicrobial activity.

- Regulatory Acceptance in Institutional Settings: Use under strict supervision mitigates some safety concerns, maintaining a micro-market.

- Limited Competition for Niche Indications: Few formulations directly replace PHISOHEX in localized hospital settings where buffer against newer agents exists.

Barriers

- Safety Concerns and Regulatory Restrictions: Neurotoxicity risks severely limit new applications and formulations.

- Market Preference for Safer Agents: Chlorhexidine, povidone-iodine, and alcohol-based disinfectants dominate due to favorable safety profiles.

- Emergence of Innovative Disinfectants: Silver-based dressings and rapid-acting disinfectants threaten to replace traditional antiseptics like PHISOHEX.

Strategic Considerations for Stakeholders

- Market Exit or Product Discontinuation: Given current trends, manufacturers may contemplate phasing out PHISOHEX to streamline portfolios.

- Niche Repositioning: Developing formulations with reduced toxicity or targeting specific, underserved markets (e.g., neonatal care) could offer differentiation.

- Regulatory Engagement: Pursuing approval for new indications or safer variants remains challenging but could rejuvenate the drug’s value.

Conclusion

The pharmaceutical landscape for PHISOHEX exhibits a clear downward trajectory shaped by safety issues, regulatory restrictions, and evolving clinical preferences. While it maintains a marginal presence in institutional markets, its financial prospects are limited unless significant repositioning strategies are implemented. The broader antiseptic market continues to shift favorably toward agents with superior safety profiles, diminishing the likelihood of PHISOHEX resurgence without innovative reformulation efforts.

Key Takeaways

- Declining Market Share: PHISOHEX’s market size has contracted substantially due to safety concerns and competition, with current revenues likely under USD 50 million globally.

- Regulatory and Safety Barriers: Regulatory restrictions and neurotoxicity risks limit clinical applications, constraining growth opportunities.

- Competitive Pressures: Chlorhexidine-based products and other emerging antiseptics dominate the market, further marginalizing PHISOHEX.

- Financial Outlook: Without strategic repositioning, PHISOHEX faces continued revenue decline, impacting profitability and portfolio relevance.

- Strategic Actions: Stakeholders should consider product discontinuation, niche repositioning, or innovation to sustain value.

FAQs

1. What are the primary safety concerns associated with PHISOHEX?

Hexachlorophene, the active component in PHISOHEX, has been linked to neurotoxicity, particularly in premature infants and high-dose exposures. These safety concerns prompted regulatory restrictions, significantly limiting its applications.

2. How does PHISOHEX compare to chlorhexidine-based antiseptics?

Chlorhexidine offers comparable antimicrobial efficacy but with a more favorable safety profile. It is now preferred in many clinical settings, leading to decreased demand for PHISOHEX.

3. Are there ongoing efforts to reformulate or develop safer variants of PHISOHEX?

While some research explores alternative formulations, regulatory hurdles and safety issues have limited substantial development efforts. Most companies focus on newer antiseptics rather than reformulating PHISOHEX.

4. What is the future outlook for PHISOHEX in hospital markets?

The outlook is predominantly negative. Its use is declining, and without innovation, it is unlikely to regain significant market share.

5. Are there niche areas where PHISOHEX might still find a foothold?

Limited use persists in specialized hospital protocols under strict supervision. However, systemic growth in these areas remains unlikely given the safety and efficacy competition.

Sources:

- [1] Market analysis reports on antiseptic drugs.

- [2] FDA safety communications on hexachlorophene.

- [3] Regulatory documents from the FDA.

- [4] Comparative studies on antiseptic efficacy.

- [5] Industry market research reports (2022).

- [6] Pharma industry financial analyses.

- [7] Industry opinion and product lifecycle assessments.