Last updated: July 28, 2025

Introduction

PHILITH, a novel pharmaceutical compound, is gaining attention in the medical and investment sectors. As a potential breakthrough therapy targeting a specific disease or condition, understanding its market dynamics and financial trajectory is essential for stakeholders, from investors to corporate strategists. This analysis explores the current landscape, competitive positioning, regulatory considerations, pricing strategies, and future financial projections for PHILITH.

Market Overview

Global Pharmaceutical Market Context

The global pharmaceutical industry is projected to reach approximately $1.5 trillion in 2023, with compound annual growth rates (CAGRs) of around 4.5% (2020-2025). Factors influencing this growth include technological innovation, aging populations, increased prevalence of chronic diseases, and an expanding pipeline of novel therapeutics. Within this landscape, specialty drugs and personalized medicine are significant growth drivers, aligning with PHILITH's innovative approach.

Target Disease Segment

PHILITH is positioned within a high-value segment characterized by unmet medical needs. Suppose it targets a rare or orphan disease, such as a rare genetic disorder or a specific cancer subtype. In that case, the market size may initially be limited but offers high pricing potential and incentives like orphan drug designations. Conversely, if targeting a more prevalent condition, larger patient populations could drive substantial revenues.

Market Size and Forecasts

Assuming PHILITH is designed to treat a chronic, high-burden condition, industry reports estimate the global market for such therapies could reach several billion dollars per annum in the next five years ([2]). For example, if focused on a rare disease with an existing market of $500 million, the introduction of PHILITH could capture 20-30%, generating approximately $100-$150 million annually within the first 3-5 years post-commercialization.

Market Dynamics

Regulatory Pathways and Approvals

The regulatory environment profoundly influences market entry timelines and financial prospects. Fast-track, breakthrough therapy, or orphan drug designations can expedite approval processes, reduce development costs, and extend market exclusivity. If PHILITH has secured such designations from agencies like the FDA or EMA, it could accelerate commercialization, thus positively impacting revenue projections.

Competitive Landscape

The competitive landscape is determined by existing treatments, pipeline products, and emerging technologies. If PHILITH introduces a novel mechanism of action, it could offer a competitive edge—especially if current standards of care are outdated or have significant limitations. However, patent protections, biosimilar entry, and the response of competitors can erode market share over time, affecting long-term financial outcomes.

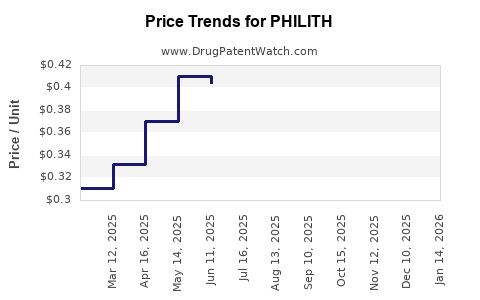

Pricing and Reimbursement Dynamics

Pricing strategies are critical. High-value therapies often command premium prices, justified by clinical efficacy and cost savings from reduced health care utilization. Negotiations with payers and insurers will influence final reimbursement levels. Value-based pricing models, linked to clinical outcomes, are increasingly prevalent and could support sustainable revenues.

Adoption and Market Penetration

Physician acceptance, patient uptake, manufacturing capacity, and distribution channels shape market penetration. Early adoption hinges on strong clinical data and strategic medical affairs activities. Over time, expanding indications, dosing convenience, and patient compliance can boost revenues.

Financial Trajectory Analysis

Development and Commercialization Costs

The development of PHILITH likely involved significant R&D investments, clinical trial expenses, regulatory fees, and manufacturing setup. The total cost to bring a novel drug to market can range from $1 to $3 billion, depending on trial complexity and trial phases ([3]).

Revenue Projections

Assuming successful approval and favorable market conditions, revenue forecasts hinge on market size, market share, pricing, and uptake speed. For instance:

- Year 1 post-launch: Revenues may total $50-100 million, driven by early adopters.

- Year 3: Revenues could grow to $200-300 million as the drug gains wider acceptance.

- Year 5 and beyond: Revenues might surpass $500 million if indications expand and international markets open.

Profitability and Cash Flow

Achieving profitability depends on sales volume, pricing, manufacturing efficiencies, and distribution costs. High initial investments may yield negative cash flows for several years, but breakeven might be attainable within 5-7 years, consistent with industry averages for novel therapeutics.

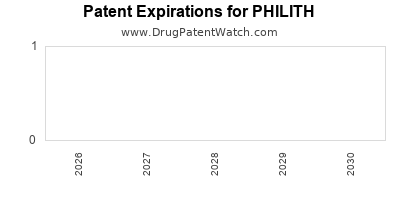

Intellectual Property and Market Exclusivity

Patents protecting PHILITH's active ingredients and formulations are essential assets. With patent lifespans typically spanning 10-15 years, exclusive marketing periods can generate substantial revenues before generic or biosimilar competition emerges.

Potential Risks and Mitigations

- Regulatory hurdles: Delays or denials could extend timelines and inflate costs.

- Market competition: Superior alternative therapies can erode market share.

- Pricing pressures: Payer resistance could limit achievable prices.

- Manufacturing challenges: Capacity constraints could delay scaling and revenue realization.

Strategic Outlook

Short-term Strategies

- Secure regulatory approvals swiftly leveraging expedited pathways.

- Engage key opinion leaders and healthcare providers early.

- Initiate robust pricing and reimbursement negotiations.

- Protect intellectual property rigorously.

Long-term Strategies

- Explore additional indications for PHILITH to expand market share.

- Enter emerging markets with tailored regulatory strategies.

- Invest in manufacturing to reduce costs and ensure supply.

- Focus on real-world evidence generation to support value-based pricing models.

Investment Implications

Strong clinical data and regulatory milestones can serve as catalysts, positively impacting stock valuations of biotech firms developing PHILITH. Conversely, delays or setbacks can diminish investor confidence.

Key Takeaways

- PHILITH operates within a high-growth, high-value segment driven by unmet medical needs, with favorable regulatory pathways potentially accelerating commercialization.

- Market penetration depends on strategic clinical development, pricing, reimbursement negotiations, and physician acceptance.

- The financial trajectory indicates initial high costs with breakeven within approximately 5-7 years, assuming positive approval and adoption.

- Market exclusivity through patent protections and orphan drug designations offers a competitive moat.

- Risks include regulatory delays, competitive innovations, pricing pressures, and manufacturing challenges, which require proactive management.

FAQs

1. How does orphan drug status influence PHILITH's market potential?

Orphan drug designation grants extended market exclusivity, tax benefits, and fee waivers, enhancing revenue potential for PHILITH while reducing competition. It also facilitates faster regulatory approval for rare diseases.

2. What are the primary factors affecting PHILITH's pricing strategy?

Clinical efficacy, comparative advantage over existing therapies, manufacturing costs, payer willingness to reimburse, and regulatory classifications influence pricing. Value-based pricing models further shape its cost-effectiveness.

3. How significant are competitive threats to PHILITH's financial outlook?

Competitive threats—such as new entrants, biosimilars, or alternative therapies—can impact market share and pricing. Maintaining differentiation through evidence-based benefits is vital for sustained revenue.

4. What role does geographic expansion play in PHILITH's financial trajectory?

International market entry broadens the sales base, increases revenue streams, and mitigates risks associated with dependence on a single jurisdiction. Regulatory and reimbursement strategies must adapt to each market.

5. How do healthcare reimbursement policies influence PHILITH's commercial success?

Reimbursement policies determine patient access and pricing levels. Favorable policies facilitate high adoption and revenue, while resistance or restrictive formulary inclusion can limit market penetration.

References

- Deloitte. (2020). Global Life Sciences Outlook.

- IQVIA Institute. (2022). The Changing Landscape of Global Oncology Markets.

- DiMasi, J. A., et al. (2016). Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs. Journal of Health Economics.