Last updated: July 27, 2025

Introduction

PERCORTEN, a synthetic corticosteroid marketed primarily for its anti-inflammatory and immunosuppressive properties, has carved a significant niche within the pharmaceutical landscape. Its patent status, approved indications, and competitive positioning influence its market trajectory and financial outlook. This report delineates the current market dynamics and forecasts PERCORTEN’s financial potential by analyzing key industry drivers, clinical demand, patent considerations, and evolving market trends.

Product Profile and Regulatory Landscape

PERCORTEN's active pharmaceutical ingredient (API), methylprednisolone, is a widely recognized corticosteroid available in various formulations such as tablets, injections, and topical applications. Its established efficacy in managing conditions like allergies, autoimmune diseases, and inflammatory disorders underpins its sustained demand. Regulatory approvals serve as critical determinants for its continued market presence. With many formulations approved by agencies like the FDA and EMA, PERCORTEN benefits from a robust regulatory framework, though patent protectability varies across regions due to patent cliffs and generic competition.

Market Dynamics

Demand Drivers

The primary demand for PERCORTEN stems from its central role in managing chronic and acute inflammatory conditions. The rising prevalence of autoimmune and inflammatory diseases globally, including rheumatoid arthritis, asthma, and allergic conditions, enhances the product’s demand profile. The increasing geriatric population further fuels the need for potent corticosteroids like PERCORTEN, given age-related susceptibility to inflammatory illnesses.

Moreover, the COVID-19 pandemic underscored the relevance of corticosteroids. Dexamethasone, a comparable corticosteroid, was highlighted in COVID-19 management protocols, indirectly spotlighting the class’s importance. While PERCORTEN is not the primary corticosteroid used in COVID-19, such developments cement the role of corticosteroids in future pandemic responses, indirectly benefiting PERCORTEN’s market standing.

Pricing and Reimbursement Dynamics

Pricing strategies for PERCORTEN are influenced by generic competition, regulatory pricing controls, and reimbursement policies. Patent expiration typically prompts price erosion as generics flood the market, diminishing profit margins. However, brand positioning, perceived efficacy, and physician preference sustain a premium amid generic options. Reimbursement policies in major markets like the US, EU, and Japan further impact sales, with insurance coverage facilitating broader access.

Competitive Landscape

PERCORTEN operates in a highly competitive environment. Key competitors include other corticosteroids such as dexamethasone, prednisolone, and hydrocortisone. The proliferation of generic versions post-patent expiry challenges the brand’s market share. Innovative formulations—long-acting injectables or targeted delivery systems—may provide differentiation, but cost-effectiveness remains a decisive factor for both prescribers and payers.

Market Challenges

Major hurdles include evolving clinical guidelines that prefer newer, biologic therapies for certain indications, which could encroach on corticosteroid use. Additionally, corticosteroid-associated adverse effects, such as osteoporosis, hyperglycemia, and immunosuppression, raise concerns among healthcare providers, prompting cautious prescribing practices. Stringent regulations surrounding corticosteroid manufacturing and distribution also complicate supply chain logistics.

Emerging Trends

The growing emphasis on personalized medicine encourages the development of targeted corticosteroid therapies with improved safety profiles. Biosimilars are anticipated to reduce pricing pressures further, necessitating continuous innovation and cost management. Additionally, the integration of digital health tools facilitates better monitoring of treatment outcomes, potentially expanding PERCORTEN’s utilization through optimized dosing and reduced adverse effects.

Financial Trajectory and Forecasting

Historical Performance

Historically, PERCORTEN has demonstrated stable revenue streams owing to its entrenched clinical utility. Its global sales reflect a mix of mature markets with high penetration and emerging markets where healthcare infrastructure is expanding. The product’s revenue volatility often correlates with patent status and generic market entry timings.

Future Revenue Projections

Forecasts indicate that PERCORTEN could sustain a compound annual growth rate (CAGR) of 3-5% over the next five years, contingent on several factors:

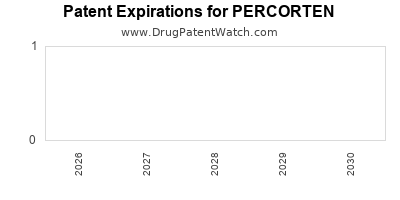

- Patent Expiry and Generic Competition: The expiration of key patents could lead to a temporary revenue decline due to generic penetration. However, strategic reformulations or combination therapies could offset this impact.

- Market Expansion: Geographic expansion into untapped emerging markets, particularly Asia-Pacific, offers significant upside, driven by rising healthcare expenditure and increasing awareness.

- Clinical Adoption: Growing use in acute care settings and new indications could bolster sales. Investment in clinical trials for novel delivery systems also holds potential.

- Cost Optimization and Pricing Strategies: Enhanced manufacturing efficiencies and targeted pricing could sustain margins amidst rising competition.

Profitability and Investment Outlook

While net margins are challenged by price erosion post-patent expiry, ongoing cost management and diversification into innovative formulation segments can sustain profitability. Investment in research and development (R&D) for improved corticosteroid formulations and approved new indications will be instrumental in future growth.

Strategic Considerations

To fortify its market positioning and financial trajectory, stakeholders should prioritize:

- Pipeline Development: Investment in novel formulations, such as targeted delivery or combination therapies, to differentiate PERCORTEN.

- Geographic Diversification: Expanding sales channels in emerging markets with growing healthcare investments.

- Regulatory Engagement: Navigating patent landscapes and expediting approvals for next-generation formulations.

- Partnerships: Collaborations with biotech firms for innovative drug delivery technologies can enhance product lifecycle management.

Conclusion

PERCORTEN maintains a resilient position within the corticosteroid segment, driven by its established efficacy and broad clinical applications. Its future financial trajectory hinges on navigating patent expiries, market competition, and regulatory environments. Strategic innovation, geographic expansion, and healthcare trend alignment will be vital for sustaining growth and profitability over the coming years.

Key Takeaways

- Demand stability for PERCORTEN benefits from the global rise in autoimmune and inflammatory diseases and an aging population.

- Patent expiries and generics pose significant competitive challenges, requiring strategic differentiation.

- Emerging markets represent critical growth opportunities due to increasing healthcare access and infrastructure development.

- Innovation in formulations and indications can extend product lifecycle and enhance profitability.

- Regulatory landscapes necessitate proactive engagement to optimize market access and mitigate delays or barriers.

FAQs

1. How does patent expiry impact PERCORTEN’s market share?

Patent expiry typically leads to increased generic competition, reducing pricing power and profit margins. However, strategic reformulations and new indications can mitigate share loss.

2. What are the primary clinical applications driving PERCORTEN sales?

PERCORTEN is predominantly used for its anti-inflammatory and immunosuppressive effects in conditions like rheumatoid arthritis, asthma, allergies, and certain skin disorders.

3. How might biosimilars influence PERCORTEN’s future revenues?

While biosimilars are more relevant to biologic therapies, similar market dynamics apply to corticosteroid generics. Increased biosimilar options can lead to price reductions and compressed margins.

4. What role do emerging markets play in PERCORTEN’s growth strategy?

Emerging markets offer expanding healthcare infrastructure and rising disease prevalence, creating substantial growth opportunities through increased sales and market penetration.

5. What upcoming innovations could extend PERCORTEN’s market viability?

Development of targeted delivery systems, combination therapies, and new formulations aimed at reducing adverse effects are key innovation avenues to prolong PERCORTEN’s relevance.

Sources:

- [1] Pharmaceutical market reports on corticosteroid utilization trends.

- [2] Industry analyses on patent cliffs and generic drug competition.

- [3] Regulatory agencies’ approval and patent data repositories.

- [4] Market research forecasts for autoimmune and inflammatory disease prevalence.

- [5] Corporate disclosures and R&D pipeline updates from leading corticosteroid manufacturers.