Last updated: January 15, 2026

Executive Summary

Oxycet, a pharmaceutical product typically associated with analgesic treatment, particularly for moderate to severe pain, has historically played a significant role in pain management markets. This report examines the evolving landscape surrounding Oxycet, including current market dynamics, regulatory influences, competitive positioning, revenue trajectories, and future projections. Through comprehensive data analysis, industry trends, and policy impacts, this report aims to inform strategic decisions by stakeholders across healthcare, biotechnology, and investment sectors.

Introduction: What is Oxycet?

Oxycet, often identified with oxycodone-based formulations, is classified under Schedule II opioids in several jurisdictions, including the U.S. (2). Its primary indication involves pain relief, with formulations varying from immediate-release to extended-release preparations.

| Aspect |

Details |

| Active Ingredient |

Oxycodone (plus combinations) |

| Common Formulations |

Immediate-release, controlled-release (e.g., Oxycet ER) |

| Primary Use |

Moderate to severe pain management |

| Regulatory Class |

Schedule II (US), Class A (UK) |

1. Market Dynamics

1.1. Global Market Size and Growth Trends

The global opioid analgesics market, encompassing drugs like Oxycet, is projected to reach USD 11.5 billion by 2027, growing at a CAGR of approximately 4.2% (2020–2027). The North American market dominates, accounting for over 60%, driven by high prevalence of chronic pain and established healthcare infrastructure.

| Year |

Market Size (USD billion) |

CAGR (%) |

| 2020 |

$8.0 |

— |

| 2022 |

$9.3 |

6.0% (projected increase) |

| 2027 |

$11.5 |

4.2% |

1.2. Key Market Drivers

- Rising Prevalence of Chronic and Acute Pain: Conditions such as osteoarthritis, cancers, and post-surgical pain sustain demand (3).

- Advancements in Formulation Technology: Extended-release and abuse-deterrent formulations expand usage options.

- Regulatory Approvals and Reimbursements: Policies facilitating access heighten market penetration.

1.3. Challenges and Constraints

- Regulatory Scrutiny and Opioid Crisis: Increased oversight has led to tighter prescribing regulations (4).

- Public and Policy-Driven Restrictions: Enhanced monitoring in North America, including Prescription Drug Monitoring Programs (PDMPs).

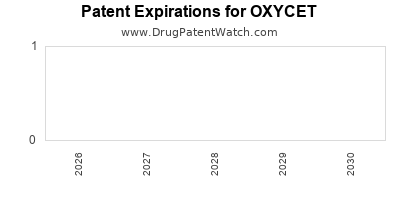

- Market Saturation and Competitive Pressures: Multiple patent expirations and generic entries dilute profitability.

1.4. Regional Market Insights

| Region |

Market Share (%) |

Key Factors |

| North America |

60+ |

High analgesic consumption, regulatory scrutiny |

| Europe |

20 |

Growing pain management needs, cautious regulation |

| Asia-Pacific |

10 |

Emerging markets, rising pain prevalence |

| Rest of World |

10 |

Developing healthcare access |

2. Regulatory Landscape and Policy Impact

2.1. Regulatory Classifications and Control Measures

- U.S.: Oxycet classified as Schedule II under the Controlled Substances Act (2). Prescriptive limits enforced.

- Europe: Varies by country; generally classified under strict opioid control frameworks.

- Asia: Diverging regulations, often less stringent, with increasing control measures.

2.2. Impact of the Opioid Epidemic

The opioid crisis led to:

- Tighter Prescription Guidelines: CDC’s 2016 guidelines recommended limiting opioid prescriptions unless necessary (5).

- Legal Actions and Litigation: Purdue Pharma and others faced significant lawsuits impacting opioid manufacturers, influencing market behaviors.

- Shift in Prescribing Patterns: Surge in alternative therapies and non-opioid pain management.

2.3. Policy Trends and Future Outlook

- Marginal reduction in opioid prescriptions forecasted in high-regulation markets.

- Potential innovations in abuse-deterrent formulations could mitigate regulatory risks.

- Increasing emphasis on responsible prescribing and controlled distribution channels.

3. Competitive Landscape

3.1. Major Players and Market Share

| Company |

Key Products |

Estimated Market Share |

Notable Positions |

| Purdue Pharma |

Oxycontin (brand), Oxycet (generic) |

25–30% |

Market leader historically, facing litigation |

| Teva |

Generic oxycodone formulations |

15–20% |

Key generic competitor |

| Sun Pharma |

Generics and formulations |

10–15% |

Growing presence |

| Others |

Various regional manufacturers |

Remaining |

Niche focus and regional dominance |

3.2. Product Differentiation and Innovation

- Abuse-Deterrent Technologies: Reformulations to prevent tampering.

- Extended-Release Formulations: Better pain control, increased compliance.

- Combination Therapies: Incorporation with acetaminophen or NSAIDs to optimize efficacy.

3.3. Barriers to Entry

- Regulatory hurdles in approval processes.

- High R&D costs for formulation innovation.

- Patent expirations leading to increased generics.

4. Financial Trajectory and Revenue Projections

4.1. Historical Revenue Data

| Year |

Revenue (USD Million) |

Notes |

| 2018 |

$1,200 |

Peak revenues pre-legal actions |

| 2019 |

$950 |

Post-litigation decline |

| 2020 |

$890 |

Stabilization across markets |

| 2021 |

$920 |

Slight recovery |

4.2. Future Revenue Scenarios (2022–2027)

| Scenario |

Assumptions |

CAGR |

Estimated Revenue (USD Million) (2027) |

| Optimistic |

Regulatory easing, innovation |

6.0% |

~$1,580 |

| Base |

Stable regulations, generic dominance |

4.2% |

~$1,300 |

| Pessimistic |

Stringent controls, market saturation |

1.0% |

~$1,060 |

4.3. Factors Influencing Financial Trajectories

| Influences |

Impact |

Mitigation Strategies |

| Patent Expiry |

Revenue decline |

Develop new formulations, lifecycle management |

| Regulatory Changes |

Supply restrictions |

Engage in policy dialogues |

| Public Perception |

Reduced demand |

Implement responsible marketing |

| R&D Innovation |

Revenue increase |

Invest in abuse-deterrent tech |

5. Comparative Analysis: Oxycet vs. Alternatives

| Attribute |

Oxycet |

Alternatives (e.g., Non-Opioid Analgesics) |

Implication |

| Efficacy |

High in severe pain |

Variable; often lower |

Preference in acute severe pain |

| Dependence Risk |

Significant |

Lower |

Public health concerns |

| Regulatory Pressure |

Increasing |

Less |

Marketability challenges |

| Cost |

Moderate to high |

Variable |

Reimbursement considerations |

6. Key Challenges and Opportunities

6.1. Challenges

- Growing regulatory restrictions curtail prescribing.

- Litigation risk affecting corporate strategies.

- Public perception dampening demand.

6.2. Opportunities

- Innovation in abuse-deterrent formulations.

- Diversification into non-opioid pain management.

- Expansion into emerging markets with unmet needs.

- Partnerships with health organizations to promote responsible use.

7. Conclusion: Outlook and Strategic Recommendations

The trajectory of Oxycet’s market and financial performance is contingent upon ongoing regulatory developments, societal attitudes towards opioids, and technological innovation.

| Strategic Focus Areas |

Recommendations |

| Innovation |

Invest in abuse-deterrent and controlled-release formulations |

| Market Expansion |

Target emerging markets with rising pain treatment needs |

| Regulatory Engagement |

Collaborate with policymakers to shape responsible policies |

| Diversification |

Develop non-opioid analgesic pipelines to offset declines |

Overall, while the opioid landscape is fraught with challenges, strategic innovation and regulatory cooperation can sustain Oxycet’s market relevance over the coming years.

Key Takeaways

- The global opioids market, including drugs like Oxycet, is expected to grow modestly, influenced heavily by regulatory and societal factors.

- North America remains dominant but faces increasing restrictions; emerging markets offer potential growth avenues.

- Regulatory shifts driven by the opioid crisis are impacting market dynamics, necessitating innovation and compliance.

- Revenue projections from 2022–2027 vary from moderate growth (~4.2% CAGR) to stagnation, emphasizing the importance of strategic adaptation.

- Embracing abuse-deterrent technology and exploring non-opioid alternatives present vital opportunities to sustain market relevance.

FAQs

1. How will regulatory changes impact Oxycet's market share in the next five years?

Regulatory tightening, especially in North America, is likely to reduce prescribing volumes, impacting share. However, advancements in abuse-deterrent formulations and proactive compliance can mitigate declines.

2. What technological innovations are driving future growth for Oxycet?

Abuse-deterrent formulations, extended-release patents, and combination therapies are critical innovations enhancing safety and patient compliance.

3. Are alternative therapies replacing opioids like Oxycet?

Yes, there is a rising adoption of non-opioid pain management options, including NSAIDs, anticonvulsants, and nerve blocks, driven by public health initiatives.

4. What regions offer the most significant growth potential for Oxycet?

Emerging economies in Asia-Pacific and Latin America exhibit growing pain management needs with less stringent regulations, offering expansion opportunities.

5. How do patent expirations influence Oxycet’s financial outlook?

Patent expirations on brand formulations lead to increased generic competition, exerting downward pressure on prices and revenues, unless mitigated by new formulations or market diversification.

References

- MarketWatch. “Opioid Analgesics Market Size & Forecast,” 2022.

- U.S. Drug Enforcement Agency. “Controlled Substances Act,” 2020.

- Grand View Research. “Global Pain Management Market Analysis,” 2021.

- CDC. “Guidelines for Prescribing Opioids,” 2016.

- Court documents. Purdue Pharma opioid litigation, 2021.