Last updated: August 4, 2025

Introduction

OSTEOLITE, a pharmaceutical entity specializing in bone health therapeutics, stands at the convergence of rising unmet needs in osteoporosis management and innovative drug development. Its market position and financial prospects are shaped by a complex interplay of clinical efficacy, regulatory pathways, competitive landscape, and demographic trends. This analysis delineates the current market dynamics and evaluates OSTEOLITE’s financial trajectory within the evolving pharmaceutical ecosystem.

Market Overview and Epidemiological Landscape

Osteoporosis remains a significant public health challenge, affecting over 200 million individuals worldwide, primarily women over 50, with significant economic burden due to fracture-related morbidity and mortality [1]. The global osteoporosis market was valued at approximately USD 9.3 billion in 2022 and is projected to expand at a CAGR of 4.8% through 2030, driven by aging populations and increased awareness.

OSTEOLITE’s therapeutic focus aligns with this expanding market, aiming to offer innovative solutions that surpass existing standards of care, including bisphosphonates, denosumab, and selective estrogen receptor modulators (SERMs). The increasing penetration of novel biologics and personalized medicine approaches signals a dynamic scenario that could favor OSTEOLITE’s growth.

Regulatory Landscape and Approval Pathways

Delivery of OSTEOLITE’s pipeline candidates hinges on navigating complex regulatory channels. The drug’s investigational status necessitates successful Phase III trial outcomes to secure approvals from agencies such as the U.S. FDA and EMA. Accelerated pathways, including Breakthrough Therapy designation or Fast Track status, could expedite market entry if preliminary data demonstrate substantial improvement over existing therapies [2].

The regulatory environment’s receptiveness to biosimilars and novel therapeutics influences OSTEOLITE’s strategic planning, with emphasis on demonstrating significant clinical benefits to secure premium market positioning and pricing.

Competitive Landscape

OSTEOLITE contends with both established players—Pfizer, Amgen, and Novartis—and emergent biotech firms innovating in osteoporosis therapeutics. The advent of targeted biologics and gene therapies introduces additional competition, emphasizing the need for differentiation through unique mechanisms of action, superior safety profiles, or combination therapies.

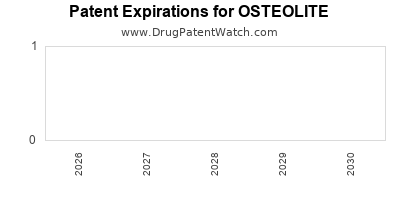

Patent protections and exclusivity periods critically impact market share retention; heterogeneity in patent landscapes presents both constraints and opportunities for OSTEOLITE’s market expansion.

Market Penetration and Adoption Dynamics

Adoption of new osteoporosis treatments hinges on clinical efficacy, safety, cost-effectiveness, and physician familiarity. Healthcare providers often exhibit inertia, favoring well-established therapies unless compelling clinical data supports switching or early adoption.

OSTEOLITE’s ability to demonstrate clear advantages in fracture risk reduction, minimal adverse effects, or convenience can accelerate adoption rates. Additionally, reimbursement policies and payer dynamics significantly influence access and patient uptake.

Financial Trajectory and Revenue Projections

Revenue Outlook:

Assuming successful Phase III trials and regulatory approval within the next 24-36 months, OSTEOLITE could target initial launch revenues ranging from USD 250 million to USD 500 million in the first year, based on comparable therapeutic launches. Market penetration rates are projected to accelerate over five years, reaching USD 1 billion in global annual revenue contingent on market acceptance.

Cost Structure:

Developmental expenses, including clinical trials, regulatory fees, and manufacturing scale-up, are substantial, with initial R&D investments potentially exceeding USD 500 million. Post-approval, expenses stabilize around commercial operations, marketing, and ongoing pharmacovigilance.

Profitability Outlook:

Gross margins for novel biologics typically range between 60-80%, with net margins approaching 25-35% following successful commercialization and market penetration. Licensing deals, collaborations, or partnerships can further enhance revenue streams and mitigate risks.

Funding and Investment:

To attain these milestones, OSTEOLITE will seek funding through venture capital, partnerships, or potential IPOs. Investor confidence hinges on robust clinical data, strategic alliances, and clear pathway to commercialization.

Market Risks and Opportunities

Risks:

- Clinical trial failures or delays could significantly impact financial forecasts.

- Competitive innovations may diminish the market share potential.

- Regulatory hurdles or changes in reimbursement policies may constrain market access.

- Pricing pressures and managed care constraints could impact profitability.

Opportunities:

- Advancements in personalized medicine enable targeted therapies tailored to genetic profiles, offering OSTEOLITE a competitive edge.

- Strategic partnerships for distribution, co-marketing, and R&D can accelerate growth.

- Expansion into emerging markets where osteoporosis prevalence is rising offers substantial incremental revenue.

Strategic Recommendations

- Prioritize high-impact clinical trials showcasing distinctive efficacy and safety benefits.

- Engage proactively with regulators to explore expedited pathways.

- Develop comprehensive market access strategies including payor negotiations and real-world evidence generation.

- Invest in physician education and patient awareness campaigns to facilitate early adoption.

- Explore strategic alliances with biotech firms for pipeline diversification.

Key Takeaways

- Market significance: The osteoporosis therapeutics market is poised for sustained growth, driven by demographic shifts and unmet medical needs, providing fertile ground for innovative therapies like OSTEOLITE.

- Regulatory strategy critical: Success hinges on timely and successful clinical trials, with an emphasis on leveraging accelerated approval pathways.

- Competitive positioning: Differentiation through superior efficacy, safety, or delivery mechanisms is essential to capture market share amid established treatments and emergent biologics.

- Financial outlook: Early revenues post-approval could reach hundreds of millions, with profitability contingent on market penetration, pricing, and operational efficiencies.

- Risk mitigation: Careful clinical, regulatory, and market assessment strategies are crucial to navigate risks and capitalize on opportunities.

FAQs

1. When can OSTEOLITE expect to reach the market?

Possible early market entry could occur within 3-4 years if Phase III trials demonstrate positive results and regulatory approvals proceed smoothly.

2. What distinguishes OSTEOLITE’s approach from existing osteoporosis treatments?

OSTEOLITE aims to deliver enhancements in efficacy, safety, or convenience, potentially through novel biologics or targeted therapies that address underlying disease mechanisms.

3. What are the primary risks facing OSTEOLITE’s financial trajectory?

Risks include clinical trial failures, delays in regulatory approval, competitive innovation, and market access challenges driven by reimbursement and pricing pressures.

4. How does demographic change influence OSTEOLITE’s market potential?

An aging global population with increasing osteoporosis prevalence underscores the long-term growth potential for OSTEOLITE’s therapeutics.

5. What strategic moves can OSTEOLITE make to maximize market success?

Early clinical success, aggressive market access strategies, strategic partnerships, and investing in physician and patient awareness are key to accelerating adoption.

Sources

[1] International Osteoporosis Foundation. Osteoporosis Facts and Statistics. [Online] Available at: https://www.iofbonehealth.org/

[2] U.S. Food and Drug Administration. Expedited Programs for Serious Conditions. [Online] Available at: https://www.fda.gov

In conclusion, OSTEOLITE’s pathway to market success is primarily defined by its ability to innovate within a burgeoning market while navigating complex regulatory, competitive, and payer landscapes. Strategic planning, clinical excellence, and market positioning will determine its financial trajectory in the coming years.