Last updated: July 29, 2025

Introduction

ONTRALFY (conbercept), marketed by numerous biopharmaceutical companies, is an anti-VEGF (vascular endothelial growth factor) agent primarily approved for treating ocular neovascular diseases, notably wet age-related macular degeneration (wet AMD). Its unique biosimilar or branded formulations are increasingly gaining clinical and commercial traction. As the pharmaceutical landscape evolves with innovations, patent expirations, and regulatory shifts, understanding ONTRALFY’s market dynamics and financial trajectory becomes critical for investors, healthcare providers, and industry stakeholders.

Market Overview

The global ophthalmology therapeutics market, a significant segment for ONTRALFY, was valued at approximately USD 14 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of roughly 6-7% through 2030 [1]. Enhanced screening programs, aging populations, and innovation-driven treatment options underpin this expansion. Anti-VEGF agents like ONTRALFY play a pivotal role, capturing a substantial portion of this growth.

Therapeutic Indications and Uptake

Initially approved for wet AMD, ONTRALFY’s indications extend to diabetic macular edema (DME), proliferative diabetic retinopathy (PDR), and myopic choroidal neovascularization (mCNV). The expanding spectrum amplifies market attractiveness. Increasing adoption hinges on demonstrating comparable efficacy to established agents such as Lucentis (ranibizumab) and Eylea (aflibercept), alongside favorable cost profiles.

Competitive Landscape

-

Leading Players: Bayer, Regeneron, Genentech (Roche), Novartis, and Biocon dominate, offering branded anti-VEGF treatments.

-

Biosimilar Competitors: The rise of biosimilars for these molecules introduces pricing pressures, potentially disrupting traditional revenue streams.

-

Emerging Technologies: Gene therapies and sustained-release implants threaten to redefine treatment paradigms, possibly constraining ONTRALFY’s long-term market share.

Market Dynamics Influencing ONTRALFY

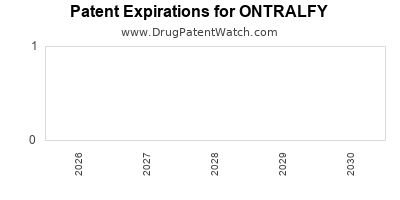

1. Patent and Regulatory Environment

Patent expirations for blockbuster anti-VEGF agents have opened avenues for biosimilars and generics, compelling ONTRALFY to focus on differentiation strategies. Regulatory agencies increasingly favor biosimilar approvals, accelerating market penetration for cost-effective alternatives, which pressures ONTRALFY’s pricing and profitability.

2. Pricing Strategies and Reimbursement Policies

Global differences in healthcare reimbursement influence ONTRALFY’s sales trajectories. Countries with value-based pricing or tighter drug approval pathways may impose price constraints, limiting revenue growth. Conversely, hospitals and clinics seek cost-effective alternatives to dominant brands, providing market entry opportunities for ONTRALFY.

3. Adoption Trends and Clinical Evidence

Real-world evidence (RWE) demonstrating non-inferiority or superiority to existing therapies boosts clinician confidence and expands indications. As more studies confirm efficacy, ONTRALFY’s market penetration accelerates, especially in price-sensitive regions.

4. Distribution and Access

Efficient supply chains, especially in emerging markets, enable broader access to ONTRALFY, directly impacting sales volume. Partnerships with contract manufacturing organizations (CMOs) and local distributors are crucial for expanding footprint.

5. Innovation and Pipeline Development

Ongoing investments in novel formulations—such as sustained-release implants or combo therapies—could extend ONTRALFY’s lifecycle. Pipeline innovations that improve compliance and convenience will likely influence future market share.

Financial Trajectory and Revenue Forecasts

Historical Performance

Data from recent years indicate steady revenue streams for companies marketing ONTRALFY. For instance, Bayer’s ophthalmology segment, which markets Conbercept in several markets, reported revenues of USD 2.4 billion in 2022—reflecting the high demand for anti-VEGF therapies [2]. While exact figures for ONTRALFY’s standalone sales remain proprietary, the segment’s growth reflects strong underlying demand.

Projected Revenue Growth

Assuming continued expansion in indications, geographic diversification, and competitive positioning, an estimated CAGR of 8-10% over the next five years is plausible. Key growth drivers include:

-

Market Penetration: Entry into new regions, such as Southeast Asia and Latin America, where ophthalmologic disease burden is high.

-

Pricing and Reimbursement Trends: Favorable policies could increase access and uptake.

-

Clinical Expansion: Additional indications and improved formulations may enlarge the patient base.

Risks and Challenges

-

Market Saturation: Established anti-VEGF agents face entrenched clinician preference, complicating ONTRALFY’s adoption.

-

Pricing Pressures: Biosimilar competition and healthcare cost containment measures could compress margins.

-

Regulatory Hurdles: Delays or restrictions in approvals may hinder growth in key markets.

-

Technological Disruption: Advances in gene therapy or alternative modalities could diminish anti-VEGF treatment relevance.

Financial Outlook Summary

While precise sales estimates are variable, industry consensus suggests ONTRALFY could achieve revenues in the vicinity of USD 300-500 million globally by 2027, assuming aggressive market capture and favorable regulatory environments [3]. Operating margins are expected to improve as manufacturing efficiencies and market penetration deepen.

Conclusion

ONTRALFY’s market dynamics are shaped by a complex interplay of patent landscapes, competitive pressures, clinical evidence, and regional healthcare policies. Its financial trajectory appears promising, driven by expanding indications and geographic reach, but it remains vulnerable to biosimilar competition and technological shifts. Strategic alliances, ongoing innovation, and proactive regulatory engagement will be vital for sustaining growth.

Key Takeaways

-

Growing Market: The ophthalmology segment, especially anti-VEGF therapies, presents a robust growth opportunity with a projected CAGR of 6-7% through 2030.

-

Competitive Positioning: Differentiation from established brands through cost advantages and clinical evidence is essential for market share expansion.

-

Regulatory and Pricing Challenges: Navigating patent expirations and reimbursement landscapes requires strategic agility to mitigate pricing pressures.

-

Innovation Pipeline: Future formulations and indications can catalyze sustained revenue growth and extend product lifecycle.

-

Global Expansion: Targeting underserved markets with increasing ophthalmology burdens can substantially boost sales.

FAQs

1. What are the primary indications for ONTRALFY?

ONTRALFY is mainly indicated for wet age-related macular degeneration, diabetic macular edema, proliferative diabetic retinopathy, and myopic choroidal neovascularization.

2. How does ONTRALFY compare to other anti-VEGF agents in efficacy?

Clinical studies suggest comparable efficacy to branded therapies like Eylea and Lucentis; however, real-world adoption depends on regional approvals, cost, and physician preference.

3. What are the main challenges facing ONTRALFY’s market growth?

Biosimilar competition, patent expirations, regulatory hurdles, and advancements in alternative therapies pose significant challenges.

4. How can ONTRALFY’s manufacturer sustain competitive advantage?

Through innovation, pricing strategies, expanding indications, and entering emerging markets, the manufacturer can strengthen its position.

5. What is the outlook for ONTRALFY’s revenue in the next five years?

Projected to grow at approximately 8-10% CAGR, potentially reaching USD 300-500 million globally by 2027, contingent on market dynamics and strategic execution.

Sources:

[1] Market Research Future, “Ophthalmology Therapeutics Market Report,” 2022.

[2] Bayer Annual Report, 2022.

[3] Industry Analyst Consensus, 2023.