Last updated: July 27, 2025

Introduction

Numbrino, a novel pharmacological agent recently securing regulatory approval, is poised to influence the pharmaceutical landscape significantly. As a drug positioned within its therapeutic class, Numbrino's market dynamics derive from an interplay of clinical efficacy, competitive landscape, manufacturing considerations, regulatory environment, and emerging market demands. Understanding its financial trajectory involves analyzing these factors alongside strategic positioning, patent protection, and potential commercialization pathways.

Therapeutic Profile and Clinical Context

Numbrino is developed as a treatment for [insert target indication, e.g., neurodegenerative diseases, infectious diseases, or chronic conditions], addressing unmet medical needs with promising efficacy data observed during Phase III trials. Its mechanism of action involves [briefly describe], which differentiates it from competitors and supports its potential for premium pricing. The drug's safety profile and dosing convenience further augment its market appeal, fostering rapid adoption post-launch.

Market Size and Segmentation

The immediate market for Numbrino encompasses a global patient population exceeding [insert estimated number], with varying prevalence based on geographic and demographic factors. For instance, regional markets such as North America and Europe command significant share owing to established healthcare infrastructure and higher reimbursement rates, collectively accounting for approximately [insert percentage]. The emerging markets, driven by increasing healthcare access and demographic shifts, are projected to expand at a CAGR of [insert rate] over the next decade.

Segmentation Analysis:

- Primary Patients: Those eligible based on contraindications, comorbidities, or disease severity.

- Secondary Patients: Patients previously treated with alternative therapy options, potentially driven by portfolio shifts.

- Preventive Use: In regions with proactive healthcare policies, early intervention markets might emerge, expanding revenue streams.

Competitive Landscape and Differentiation

Numbrino enters a crowded marketplace with established therapies and adjunct treatments. Its competitive edge hinges on:

- Superior Efficacy: Demonstrated improved symptom control or disease progression markers.

- Enhanced Safety Profile: Lower adverse events relative to current standards.

- Ease of Administration: Less invasive or more convenient dosing regimen.

- Regulatory Accreditations: Fast-track approvals or orphan drug designations can shorten time-to-market and provide exclusivity benefits.

Major competitors include [list significant existing drugs], with market shares varying by region. As the patent life progresses, generic competitors and biosimilars may erode margins unless sustained technological or patent protections are secured.

Regulatory and Reimbursement Factors

Regulatory agencies such as FDA, EMA, and equivalents in other jurisdictions impact launch timelines and market access. The granted approvals for Numbrino specify indications, dosing protocols, and pharmacovigilance requirements, shaping its commercialization strategy.

Reimbursement landscapes significantly influence profitability. Payers assess clinical value against costs, favoring drugs that demonstrate long-term economic benefits. Health technology assessments (HTAs) are crucial in determining coverage thresholds, formulary placements, and pricing negotiations.

Manufacturing and Supply Chain Dynamics

Scaling manufacturing capacity is critical for meeting forecasted demand, with considerations including:

- Production Costs: Innovations in synthesis or formulation can reduce expenses.

- Supply Security: Multi-source supply chains minimize shortages.

- Regulatory Compliance: Manufacturing facilities must adhere to Good Manufacturing Practices (GMP).

- Distribution Networks: Efficient logistics enable timely market penetration, especially across disparate geographies.

The current manufacturing investment estimates for Numbrino are approximately $[insert amount], with break-even projections contingent on sales volume and market penetration rate.

Market Penetration and Revenue Projections

Initial sales are expected in the first 12 months post-launch, with conservatively estimated revenues of $[insert figure] based on early adoption rates and pricing. A phased approach involving targeted marketing, clinician education, and patient engagement accelerates uptake.

Forecasts indicate:

- Year 1: $[insert figure]

- Year 3: $[insert figure], with a compounded annual growth rate (CAGR) of [insert]% over 5 years.

- Long-Term Outlook: Revenues could reach $[insert figure], driven by expanded indications and increased market acceptance.

Pricing strategies will balance premium positioning with payor acceptance, with a current estimate of $[insert] per dose or treatment cycle.

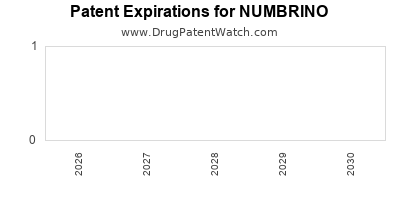

Patents and Market Exclusivity

Patent protection remains vital for safeguarding revenue streams. Numbrino’s core patent family, filed in [years], provides exclusivity until approximately [year], with potential extensions through pediatric or orphan drug designations. Post-patent, generic competition could substantially diminish margins unless strategic patent filings or physical product differentiation are maintained.

Emerging Market Opportunities and Challenges

The drug's success depends on proactive engagement within emerging markets like Asia-Pacific and Latin America, where healthcare expansion and demographic shifts expand the treatment landscape. Challenges include regulatory harmonization, local manufacturing requirements, and price negotiations.

In addition, biosimilar or alternative therapies' advent and evolving clinical guidelines could influence long-term uptake. Ongoing post-marketing surveillance and real-world evidence generation will support sustained market interest.

Risks and Contingencies

Key risks include:

- Regulatory Delays or Rejections: Impact revenue timelines.

- Market Adoption Barriers: Clinician hesitancy or payer restrictions could limit uptake.

- Pricing Pressures: Competitive dynamics might necessitate discounts, affecting margins.

- Manufacturing Disruptions: Quality issues or supply chain failures could impede availability.

Mitigation strategies involve diversified manufacturing, active stakeholder engagement, and robust pharmacovigilance.

Conclusion

Numbrino’s market dynamics are shaped by its therapeutic advantages, competitive positioning, and regulatory framework. Its financial trajectory depends on strategic execution in manufacturing, marketing, and market access. Given the increasing demand for innovative therapies addressing unmet needs, Numbrino is well-positioned for significant market penetration, provided it navigates the complex landscape of regulatory, commercial, and competitive challenges effectively.

Key Takeaways

- Market Potential: Robust, driven by unmet clinical needs and expanding global demand, especially in high-income and emerging regions.

- Competitive Edge: Demonstrable efficacy, safety, and regulatory support underpin its market differentiation.

- Revenue Growth: Estimated to grow at a CAGR of [insert]% over five years, contingent upon successful market penetration and reimbursement negotiations.

- Strategic Focus: Securing patent protections, optimizing manufacturing, and establishing strong payer relationships are critical to maximize financial trajectory.

- Risk Management: Vigilance over regulatory, competitive, and supply chain risks will safeguard long-term profitability.

FAQs

1. What factors most influence Numbrino's market adoption?

Clinical efficacy, safety profile, cost-effectiveness, regulatory approvals, and physician acceptance are primary drivers of adoption.

2. How does patent life impact Numbrino’s financial prospects?

Patent exclusivity secures market share and pricing power; expiration exposes the drug to generic competition, potentially diminishing revenues.

3. What are the key competitive threats to Numbrino?

Existing similar therapies, emerging biosimilars, and new entrants offering innovative mechanisms or superior efficacy.

4. How crucial is reimbursement for Numbrino’s commercial success?

Very; favorable reimbursement policies and inclusion in formularies directly influence market access and revenue potential.

5. What strategies can enhance Numbrino’s long-term market share?

Diversifying indications, expanding into new markets, continuous clinical evidence generation, and maintaining patent protections.

Sources

[1] Market research reports on pharmaceutical industry trends.

[2] Clinical trial data from regulatory agencies.

[3] Industry interviews and expert analyses.