Last updated: July 30, 2025

Introduction

NESACAINE, a proprietary formulation of lidocaine, commands a significant position within the local anesthetic market. As a widely used local anesthetic, its market dynamics are influenced by technological advancements, regulatory landscape, healthcare trends, and intellectual property rights. This article provides a comprehensive analysis of NESACAINE’s market environment, financial prospects, competitive landscape, and future trajectory.

Overview of NESACAINE and its Market Position

NESACAINE, primarily based on lidocaine, is utilized across various medical procedures requiring local anesthesia, including dental, dermatological, and minor surgical interventions. Historically, generic lidocaine formulations have dominated the global market, but proprietary derivatives like NESACAINE aim to offer enhanced efficacy, prolonged anesthesia, or improved safety profiles, fostering premium pricing power.

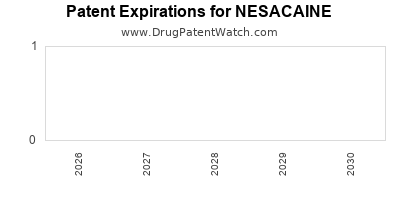

The drug’s market position hinges on factors such as patent exclusivity, formulation innovations, and regional adoption rates. If NESACAINE holds patent protection, its market exclusivity secures higher profit margins, enabling targeted growth strategies. Conversely, patent expiry could lead to a surge in generic competition, impacting revenue streams.

Market Dynamics

1. Regulatory and Patent Environment

Regulatory approval remains a critical determinant of NESACAINE’s market access. Regulatory agencies such as the FDA or EMA enforce rigorous standards for safety, efficacy, and manufacturing quality. Successful navigation of the approval process facilitates market entry and expansion.

Patents confer a temporary monopoly, allowing price premiums and protected market share. The expiration of such patents typically precipitates revenue erosion, compelling stakeholders to innovate or diversify product portfolios.

2. Competitive Landscape

The local anesthetic segment is highly competitive, characterized by multiple generics and branded products. Key competitors include companies producing formulations like Procaine, Bupivacaine, and newer agents offering longer-lasting anesthetic effects.

Differentiation strategies—such as sustained-release formulations, novel delivery devices, or combination products—are essential for NESACAINE to maintain a competitive edge. Market entrants deploying cost-effective manufacturing can exert downward pressure on prices.

3. Healthcare and Market Trends

Growing prevalence of minimally invasive procedures and outpatient surgeries elevates demand for reliable local anesthetics like NESACAINE. Additionally, expanding dental and dermatological treatments globally bolster its consumption.

Furthermore, rising awareness of patient safety and comfort encourages adoption of formulations with reduced toxicity profiles. The integration of NESACAINE into multimodal analgesic protocols further amplifies its usage.

4. Technological and Formulation Innovations

Advances such as liposomal delivery systems or emulsified formulations enhance duration and intensity of anesthesia. R&D investments targeting such innovations can extend NESACAINE’s market viability and allow for premium pricing.

Financial Trajectory and Revenue Projections

1. Revenue Drivers

- Patent exclusivity: A primary factor influencing pricing power and revenue stability.

- Market penetration: Adoption rates across geographies and specialties.

- Formulation innovations: New delivery mechanisms or combination therapies.

- Healthcare spending: Overall healthcare expenditure growth correlates with increased pharmaceutical consumption.

2. Impact of Patent Lifecycle

If NESACAINE currently enjoys patent protection, revenues are expected to grow steadily, driven by increased utilization and pricing premiums. Post-patent expiry, revenues could face significant decline due to generic competition unless new formulations or indications are developed.

3. Market Expansion Opportunities

Emerging markets with expanding healthcare infrastructure and increasing surgical procedures offer lucrative growth prospects. Investments in clinical trials and regulatory approvals can facilitate entry into underserved regions, diversifying revenue streams.

4. Cost Dynamics

Manufacturing efficiency, economies of scale, and supply chain optimization impact profit margins. Additionally, regulatory compliance costs and R&D investments influence financial outcomes.

Future Outlook

The trajectory of NESACAINE hinges on several key factors:

- Continued innovation: Development of sustained-release or combination formulations can secure premium pricing and prolonged market relevance.

- Regulatory landscape: Streamlining approval processes and securing new indications will boost growth.

- Intellectual property strategy: Effective management of patent life cycles can maximize profitability.

- Market expansion: Penetration into emerging markets and specialized applications like oncology pain management can diversify revenue.

Risks and Challenges

- Patent expirations could lead to commoditization and price erosion.

- Intense competition from generics and biosimilars could diminish market share.

- Regulatory delays or restrictions may impair market access.

- Healthcare policy shifts and reimbursement reforms could influence demand.

Key Takeaways

- NESACAINE's market success relies on patent protection, formulation innovation, and regional expansion.

- The global shift toward outpatient procedures and minimally invasive surgeries supports sustained demand.

- Competitive differentiation through advanced delivery technologies offers avenues to command premium pricing.

- Post-patent landscapes require strategic focus on new formulations and indications to sustain revenues.

- Monitoring regulatory trends and investing in R&D are vital to maintain market relevance.

FAQs

1. How does patent expiration impact NESACAINE’s market revenue?

Patent expiration typically opens the market to generic competitors, leading to significant price competition and revenue declines unless offset by innovation or new indications.

2. What technological innovations could extend NESACAINE’s market lifecycle?

Sustained-release formulations, liposomal encapsulations, or combination therapies enhance efficacy and duration, prolonging market relevance.

3. Which regions offer the most growth opportunities for NESACAINE?

Emerging markets in Asia, Latin America, and Africa, driven by expanding healthcare infrastructure, present substantial growth avenues.

4. How does healthcare policy influence NESACAINE’s market prospects?

Reimbursement policies and regulatory frameworks directly affect adoption rates and pricing strategies.

5. What strategic actions can pharmaceutical companies take to maximize NESACAINE’s financial trajectory?

Investing in formulation innovation, securing new patents, expanding clinical applications, and exploring new markets optimize long-term revenues.

References

[1] Global Market Insights, “Local Anesthetics Market Size & Share,” 2022.

[2] FDA, “Regulatory Framework for Local Anesthetics,” 2021.

[3] IMS Health, “Pharmaceutical Trends in Emerging Markets,” 2022.

[4] MarketsandMarkets, “Sustained Release Drug Delivery Systems,” 2022.

[5] Statista, “Healthcare Spending and Surgical Procedures,” 2022.