Last updated: July 30, 2025

Introduction

NAPHCON-A, a prescription ophthalmic suspension combining Naphazoline HCl and Pheniramine Maleate, addresses allergic conjunctivitis by providing rapid relief from redness, itchiness, and swelling. As an over-the-counter (OTC) and prescription medication, NAPHCON-A has carved a niche within the ophthalmic treatment landscape. Its commercial success is heavily influenced by evolving market dynamics, regulatory environments, consumer behavior, and competitive pressures. This analysis dissects current market trends and forecasts the financial trajectory of NAPHCON-A, offering strategic insights for stakeholders.

Market Landscape and Growth Drivers

Prevalence of Allergic Conjunctivitis

The global prevalence of allergic conjunctivitis is estimated at approximately 15–40% among the general population, with increasing incidence attributed to environmental changes and urbanization. North America and Europe represent significant markets due to heightened awareness and healthcare access, with Asia-Pacific experiencing rapid growth due to rising pollution and allergy awareness (source: [1]). This widespread prevalence sustains steady demand for effective OTC and prescription treatments like NAPHCON-A.

Consumer Trends and Demand Dynamics

The growing preference for self-medication in minor ocular conditions fosters demand for OTC formulations. However, the complexity and potential side effects associated with misdiagnoses sustain the necessity for prescription-based therapies. Furthermore, amid pandemics and increased health consciousness, consumers seek fast-acting, easily accessible remedies, benefitting NAPHCON-A’s market position.

Regulatory Environment

Regulatory authorities like the FDA and EMA regulate ophthalmic drugs stringently. Simplified approval pathways for combination drugs and ongoing reviews of safety profiles influence NAPHCON-A’s market access. Pending approvals or label expansions could unlock new indications, expanding market potential. Conversely, regulatory hurdles or safety concerns may restrict product proliferation or lead to reformulations.

Competitive Landscape

NAPHCON-A faces competition from other antihistamine and decongestant combinations, including brands like Opcon-A and Visine-A, along with generics. The landscape is characterized by fierce price competition and innovation in delivery mechanisms. Novel formulations, such as preservative-free drops or sustained-release systems, threaten traditional combinations' dominance.

Market Dynamics Impacting NAPHCON-A

Pricing and Reimbursement

Pricing strategies significantly influence sales. NAPHCON-A’s placement as a prescription versus OTC product affects reimbursement schemes and patient out-of-pocket costs. Insurance coverage varies regionally, impacting accessibility and sales volume. Cost-effective formulations that demonstrate superior safety profiles or convenience gain competitive advantage.

Distribution Channels

Pharmaceutical wholesalers, retail pharmacies, and online platforms drive sales. E-commerce channels rapidly expand access, especially post-pandemic, narrowing geographic barriers. Direct-to-consumer marketing enhances patient awareness, boosting demand, provided regulatory guidelines are adhered to.

Innovation and Formulation Enhancements

Innovation in active ingredients, delivery mechanisms, and preservative-free options shape the product’s position. The trend toward preservative-free ophthalmic solutions aligns with increasing consumer safety expectations, potentially prompting reformulation of NAPHCON-A to adapt to market preferences.

Financial Trajectory

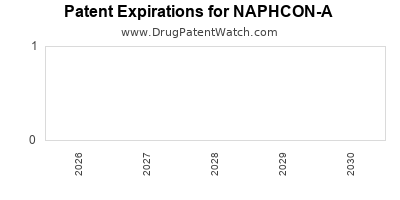

Historical Sales Data and Revenue Projections

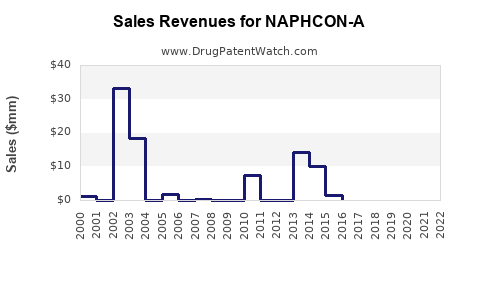

While precise proprietary sales data is limited publicly, market estimates place the global ophthalmic allergy treatment segment at CAGR (Compound Annual Growth Rate) of approximately 4-6% over the next five years [2]. NAPHCON-A's contribution depends on factors like market penetration, patent status, and marketing efforts.

In the United States, ophthalmic combination drugs generate estimated revenues of $150–$200 million annually. NAPHCON-A’s share aligns with its prescription prevalence and formulary access. Conservative forecasts project a revenue CAGR of 3–4% over the next three years, driven by increased allergy prevalence and expanding indications.

Profitability Outlook

Margins hinge on manufacturing costs, pricing strategies, and competitive pressures. High-potency formulations and economies of scale can improve profitability. However, price erosion typical of combination ophthalmic drugs and regulatory costs for compliance might temper profit growth.

Emerging Opportunities and Risks

Potential expansion into the OTC domain could amplify sales volumes but might impact margins due to pricing pressures. Innovation-driven differentiation, such as preservative-free formulations or longer-acting variants, could command premium pricing, positively influencing financial trajectories.

Regulatory uncertainties, potential side-effect profiles, and the advent of biosimilars or generics pose risks to revenue streams. Additionally, changing prescribing patterns influenced by clinician preferences or new evidence may alter demand.

Strategic Considerations

- Market Expansion: Targeting emerging markets with rising allergy prevalence offers growth opportunities, contingent upon navigating local regulatory landscapes.

- Formulation Innovation: Developing preservative-free or sustained-release versions could meet consumer demand for safety and convenience, boosting sales.

- Brand Positioning: Emphasizing efficacy and safety in marketing campaigns can enhance brand loyalty amid generic competition.

- Partnership and Licensing: Collaborations with distributors and biotech firms could accelerate market access and innovation.

Conclusion

NAPHCON-A operates within a dynamic ophthalmic allergy treatment market characterized by steady demand, evolving regulatory frameworks, and intensifying competition. Its financial trajectory hinges on strategic positioning, innovation, and regional expansion. While projected growth remains moderate, focused efforts on formulation improvements and market diversification can enhance its financial performance over the coming years.

Key Takeaways

- The rising global incidence of allergic conjunctivitis sustains an expanding market segment for NAPHCON-A.

- Regulatory pathways and consumer preferences for safety and convenience influence product development and market access.

- Competition from generics and alternative formulations necessitates strategic innovation for sustained profitability.

- Geographic expansion and reformulation efforts are critical for revenue growth amidst a mature market.

- Balancing pricing strategies with regulatory compliance and consumer demand fosters long-term financial stability.

FAQs

1. What factors most significantly influence NAPHCON-A’s market growth?

Prevalence of allergic conjunctivitis, regulatory approval processes, formulation innovations, consumer awareness, and competitive pricing strategies primarily dictate growth prospects.

2. How does regulatory approval impact the financial trajectory of NAPHCON-A?

Regulatory approval determines market access, influences reimbursement, and allows for label expansion, directly affecting sales potential and profitability.

3. What are the main competitive threats to NAPHCON-A?

Generic competitors, alternative combination products, and emerging new formulations, especially preservative-free or sustained-release options, pose significant threats.

4. Can NAPHCON-A successfully expand into the OTC market?

Potentially, provided safety profiles, efficacy data, and regulatory criteria support over-the-counter classification, which could boost sales volume substantially.

5. What future innovations could influence NAPHCON-A’s market position?

Development of preservative-free formulations, longer-lasting delivery systems, and novel active ingredients could enhance the product’s appeal and financial performance.

Sources

[1] Global Allergy Report, World Allergy Organization, 2022.

[2] Market Research Future, Ophthalmic Allergic Conjunctivitis Treatment Market Reports, 2021.