Last updated: August 2, 2025

Introduction

MYSOLINE, generically known as methaqualone, is a sedative-hypnotic drug once widely prescribed for insomnia and anxiety. Originally synthesized in India in the 1950s and subsequently marketed internationally, MYSOLINE experienced significant commercial success during the mid-20th century. However, owing to its high abuse potential and associated addiction risks, it faced regulatory restrictions worldwide, leading to a dramatic decline in its medical usage and market presence. This article provides an in-depth analysis of the current market dynamics and financial trajectory of MYSOLINE, highlighting the factors influencing its standing and future prospects within the pharmaceutical landscape.

Historical Context and Regulatory Landscape

MYSOLINE's rise coincided with the post-World War II proliferation of sedatives and hypnotics. Its efficacy in managing sleep disorders initially propelled its widespread adoption. However, by the 1970s and 1980s, mounting evidence of abuse and dependence prompted regulatory authorities globally—including the U.S. Food and Drug Administration (FDA)—to classify methaqualone as a controlled substance. The Drug Enforcement Administration (DEA) classified it as Schedule I in the United States in 1984, effectively banning its legal manufacture, distribution, and use (the Schedule I status indicates a high potential for abuse with no accepted medical use).

Consequently, the pharmaceutical market for MYSOLINE contracted sharply, with pharmaceutical companies ceasing production and withdrawal from pharmacies and hospitals. Today, MYSOLINE’s presence is primarily confined to controlled substance registries and illegal markets, with minimal legitimate medical use. The historic regulatory crackdown significantly reshaped the drug’s market dynamics, setting the stage for a largely obsolete pharmaceutical profile.

Current Market Dynamics

1. Supply and Demand

The demand for MYSOLINE has virtually disappeared from legitimate markets, mainly driven by regulatory restrictions and safety concerns. The supply chain has been almost entirely dismantled within legal frameworks, and the drug’s distribution is largely clandestine. Black-market supply persists sporadically, often linked to illicit drug trafficking networks, but is constrained by legal risks, making it highly unstable and limited.

2. Regulatory Environment

Regulations heavily influence the drug's market trajectory:

- Global Controls: Countries have independently enacted stringent controls following international treaties. The United Nations Single Convention on Narcotic Drugs (1961, amended in 1972) classifies methaqualone as a Schedule IV (or equivalent) substance, indicating limited medical use and high abuse potential.

- National Laws: Most jurisdictions prohibit manufacturing, sale, or possession of MYSOLINE outside approved research contexts. In the U.S., it is classified as Schedule I under the Controlled Substances Act, reinforcing its illegal status.

- Future Trends: Stricter enforcement and increasing international cooperation further diminish the pharmaceutical prospects of MYSOLINE.

3. Clinical and Medical Use

Few countries or institutions maintain legal, approved indications for MYSOLINE. The decline in clinical prescriptions correlates with the emergence of safer, more effective alternatives like benzodiazepines and non-benzodiazepine hypnotics (e.g., zolpidem, eszopiclone). The safety profile and abuse potential of MYSOLINE make it an unlikely candidate for revived legitimate use, limiting its market to niche research or illicit channels.

4. Market Competitors and Alternatives

Modern hypnotics and sedatives have supplanted MYSOLINE in most medical contexts. The pharmaceutical landscape now favors drugs with better safety profiles, fewer addictive risks, and standardized production. The presence of generics for alternative medications further diminishes any potential niche for MYSOLINE, which remains largely obsolete.

Financial Trajectory and Market Outlook

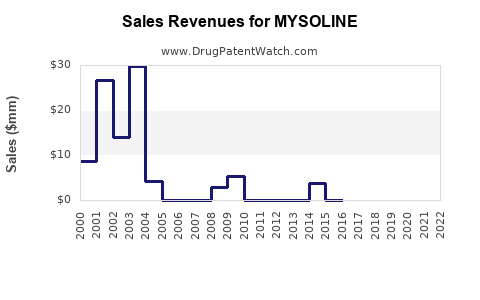

1. Historical Revenue and Market Size

During its peak, MYSOLINE generated substantial revenue, with sales peaking in the 1960s and 1970s. For example, in the United States alone, MYSOLINE sales reached hundreds of millions of dollars annually, reflecting widespread prescriber adoption. However, with regulatory bans and the emergence of superior drugs, revenues cratered by the late 20th century. Contemporary estimates place the current legitimate market value at negligible levels, primarily confined to research or illegal channels.

2. Patent and Manufacturing Status

The original patents for MYSOLINE have long expired, rendering it a generic compound. The discontinuation of authorized manufacturing efforts has minimized any revenue generation potential. Some illicit producers continue synthesizing methaqualone covertly, but these activities are unregulated and pose legal and reputational risks.

3. Investment and Commercial Viability

For pharmaceutical companies, investing in MYSOLINE offers limited financial upside due to:

- Regulatory hurdles prohibiting legal production and sale.

- Market saturation decades ago.

- Availability of more effective and safer therapeutic alternatives.

- Legal risks associated with illicit distribution.

Hence, direct investment in MYSOLINE derivative production is not economically viable or attractive for legitimate stakeholders.

4. Potential Resurgence Factors

Despite the current bleak outlook, some speculative factors could influence MYSOLINE's trajectory:

- Research Resurgence: Limited research into the pharmacological properties or potential therapeutic uses—though unlikely given safety concerns.

- Illicit Market Dynamics: The illicit drug trade may sustain certain clandestine supplies, but these are not legally recognized or financially incentivized.

- Regulatory Liberalization: Extremely improbable, given the drug’s history and safety profile.

Overall, the financial outlook remains stagnant with negligible legitimate revenue prospects.

Future Market Considerations

The future of MYSOLINE is primarily dictated by regulatory policies and public health priorities:

- Regulatory Trajectory: Continues to tighten restrictions globally. Any change toward re-legalization would require overwhelming scientific evidence demonstrating safety and therapeutic benefit, which is absent.

- Emerging Alternatives: Pharmacological innovation favors newer agents with lower abuse potential, continuously diminishing the likelihood of any resurgence.

- Market Opportunity: No substantive market opportunity exists at present. Any informal or clandestine use is neither sustainable nor commercially incentivized.

Conclusion

The market dynamics and financial trajectory of MYSOLINE are characterized by obsolescence and regulatory exclusion. Once a prominent sedative, it now exists on the fringes—primarily within illegal markets or historical reference points. The combination of proven abuse potential, regulatory retraction, and the advent of superior therapeutics has rendered MYSOLINE’s legitimate commercial prospects extinct.

Key Takeaways:

- MYSOLINE's decline is rooted in regulatory bans enacted in the 1980s, consolidating its status as a controlled substance with minimal legitimate market presence.

- Its current supply is limited to illicit channels, with negligible or no tracked revenue streams.

- The drug’s future remains bleak due to the availability of safer, more effective alternatives, and stringent international controls.

- Investments or commercial strategies centered on MYSOLINE are inherently unattractive, with legal and ethical considerations precluding legitimate market development.

- Any resurgence relies on speculative, high-risk illicit activities, which are neither sustainable nor advisable from a business perspective.

FAQs

1. Can MYSOLINE be legally prescribed today?

No. MYSOLINE (methaqualone) is classified as a Schedule I substance in the United States and tightly controlled in other jurisdictions, prohibiting its legal medical use.

2. Are there ongoing clinical studies involving MYSOLINE?

Currently, no significant clinical research involving MYSOLINE is known. The drug's safety concerns and availability of alternatives limit its research prospects.

3. What factors led to the decline of MYSOLINE’s market?

Its high abuse potential, addiction risks, and regulatory bans in the 1970s and 1980s led to a sharp decline in legitimate demand and manufacturing.

4. Is there any legitimate production of methaqualone today?

The legitimate pharmaceutical production has ceased in most parts of the world. Unauthorized clandestine manufacturing persists but is illegal and unsupervised.

5. Could MYSOLINE return as a therapeutic agent?

Unlikely, given regulatory restrictions, safety concerns, and the dominance of safer hypnotics and sedatives filling the market niche.

References

[1] U.S. Drug Enforcement Administration. Controlled Substance Schedule. https://www.dea.gov Druginfo (accessed 2023).

[2] WHO. Single Convention on Narcotic Drugs, 1961. Geneva: World Health Organization, 1961.

[3] US Food and Drug Administration. Regulatory Actions and Schedule Classification of Sedatives. FDA.gov, 1984.