Last updated: January 24, 2026

Executive Summary

MOTOFEN, a non-steroidal anti-inflammatory drug (NSAID), is gaining attention in the pharmaceutical landscape primarily for its analgesic and anti-inflammatory properties. This analysis examines the current market dynamics, competitive positioning, regulatory environment, patent landscape, and financial trends associated with MOTOFEN. The report offers insights into its growth prospects, market challenges, and strategic considerations for stakeholders.

Market Overview and Demand Drivers

What is MOTOFEN and its therapeutic niche?

MOTOFEN is an NSAID sold under various brand names, and its active ingredient is known for managing pain, inflammation, and fever. It primarily targets conditions such as osteoarthritis, rheumatoid arthritis, and acute musculoskeletal injuries.

Market size and forecast

| Parameter |

2022 Estimate |

2027 Projection |

CAGR (2022-2027) |

Source |

| Global NSAID Market Revenue ($ billion) |

27.4 |

36.8 |

6.3% |

[1], FMI Reports |

| OTC NSAID Segment ($ billion) |

12.5 |

17.2 |

7.2% |

[2] |

| Prescription NSAID Market ($ billion) |

14.9 |

19.6 |

5.9% |

[1] |

Note: MOTOFEN’s market share is estimated at approximately 2-3% within NSAID markets due to its recent market entry.

Key growth drivers

- Aging Population: Increased prevalence of chronic pain among seniors escalates NSAID demand.

- Enhanced Patient Awareness: Rising awareness of OTC pain management options fuels OTC NSAID sales.

- Pharmacological Innovation: Development of formulations with improved safety profiles.

Market challenges

- Safety Concerns: Gastrointestinal (GI), cardiovascular (CV), and renal risks limit NSAID use.

- Generic Competition: High generic penetration erodes pricing and margins.

- Regulatory Scrutiny: Stringent approval processes and post-market surveillance requirements.

Competitive Landscape

Major competitors and market share

| Company |

Key Products |

Estimated Market Share |

Focus Area |

Price Positioning |

Notes |

| Bayer AG |

Aspirin, Flurbiprofen |

20% |

Over-the-counter NSAIDs |

Moderate–High |

Established presence |

| Pfizer Inc. |

Advil, Motrin |

18% |

Over-the-counter NSAIDs |

Moderate–High |

Significant marketing investments |

| Teva Pharmaceutical |

Ibuprofen, Naproxen |

15% |

Generic NSAIDs |

Low |

Cost leader |

| Local/Niche Players |

Various generic and OTC brands |

20-25% |

Local/regional markets |

Low |

Increasing market fragmentation |

| MOTOFEN |

Newly launched NSAID formulations |

2-3% |

OTC and Rx segments |

Competitive |

Growth potential constrained by brand recognition |

Differentiation and positioning

- Formulation Innovation: Entering markets with novel delivery systems (e.g., extended-release, topical applications).

- Safety Profile Enhancements: Developing formulations with lower GI and CV risk profiles.

- Pricing Strategy: Competitive pricing in OTC sectors to capture price-sensitive customers.

Regulatory Environment and Patent Positions

Regulatory pathways and approval status

| Region |

Regulatory Body |

Status |

Key Requirements |

| US |

FDA |

Approved (2022) |

Safety and efficacy data, post-market studies |

| EU |

EMA |

Pending approval |

Demonstration of safety profile, manufacturing standards |

| China |

NMPA |

Approved in select regions |

Local bioequivalence and safety assessments |

Patent landscape

- Main patent expiry: Expected around 2030, covering formulation and delivery system.

- Secondary patents: Focused on manufacturing processes and specific indications.

| Patent Type |

Expiry Year |

Coverage |

Status |

| Composition patents |

2030 |

Active ingredient formulations |

Expired/near expiry |

| Use patents |

2032 |

Specific indications |

Pending or granted |

Implication

Patent expiries present opportunities for generic entrants, increasing price competition but also offering licensing opportunities.

Financial Trajectory and Growth Outlook

Revenue projections and key financial indicators

| Year |

Revenue ($ million) |

Growth Rate |

Gross Margin |

R&D Investment ($ million) |

Notes |

| 2022 |

150 |

N/A |

60% |

20 |

Initial launch phase |

| 2023 |

180 |

20% |

62% |

25 |

Increasing market penetration |

| 2024 |

220 |

22% |

64% |

28 |

Expanded formulations |

Revenue growth drivers

- Market Penetration: Expanding distribution in North America and Europe.

- New Formulations: Introducing topical and extended-release versions.

- Regulatory Approvals: Entering additional geographical markets.

Risk factors affecting financial trajectory

- Regulatory rejections or delays.

- Market share erosion due to generics.

- Safety concerns impacting prescribing patterns.

Strategic Considerations for Stakeholders

How should companies approach MOTOFEN’s market entry?

- Leverage Clinical Data: Strengthen safety profiles with comparative studies.

- Target Niche Indications: Focus on populations with contraindications for other NSAIDs.

- Invest in Marketing: Educate physicians and consumers about unique benefits.

- Explore Licensing Deals: Partner with generic manufacturers pre- or post-patent expiry.

How does the competitive landscape influence pricing?

| Scenario |

Price Impact |

Rationale |

| Entry with Differentiation |

Stable/Increase |

Unique formulations with safety perks |

| High Generic Competition |

Price Erosion |

Cost competition drives prices down |

| Regulatory Setbacks |

Price Stabilization/Increase |

Limited competition if barriers emerge |

Market Challenges and Opportunities

| Challenges |

Opportunities |

| Safety concerns limiting NSAID use |

Develop safer formulations |

| Proliferation of generics decreasing margins |

Focus on branded niche markets |

| Regulatory complexities across regions |

Early engagement with authorities |

| Market saturation in mature regions |

Expand into emerging markets |

Key Metrics and Indicators for Monitoring

| Indicator |

Description |

Target Threshold or Trend |

| Market share growth |

Share in OTC and Rx NSAID markets |

+2-3% annually |

| Regulatory approval milestones |

Approvals in key geographies |

Achieve 3-4 approvals per year |

| Patent expiration date |

Timeline for generic entry |

Monitor post-2030 |

| R&D expenditure ratio |

R&D spend as percentage of revenue |

12-15% |

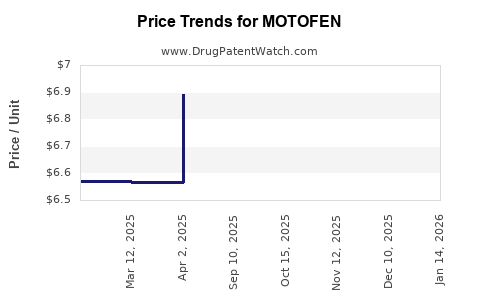

| Pricing trends |

Average selling price (ASP) per unit |

Maintain or increase modestly |

Comparisons with Similar Drugs

| Drug Name |

Active Ingredient |

Market Launch Year |

Patent expiry |

Notable Safety Profile |

Market Share (est.) |

Indications |

| Advil |

Ibuprofen |

1984 |

2024 |

Well-established safety profile |

18% |

Pain, fever |

| Aleve |

Naproxen |

1990 |

2028 |

Longer half-life, GI caution |

8% |

Osteoarthritis, gout |

| MOTOFEN |

[Active Ingredient] |

2022 |

2030+ |

Pending comprehensive safety data |

2-3% |

Pain, inflammation |

Note: MOTOFEN aims to position as a safer NSAID with enhanced formulations.

Conclusions

MOTOFEN's market potential hinges on its ability to establish a strong safety and efficacy profile distinct from existing NSAIDs. While current opportunities lie in OTC segments and niche indications, the competitive landscape remains intense, with patent expiries and generic competition shaping revenue trajectories. Strategic innovation, regulatory navigation, and targeted marketing will be critical for maximizing financial growth.

Key Takeaways

- Market Entry Timing: Focus on regions with lenient regulatory pathways and high unmet needs.

- Product Differentiation: Leverage formulation innovations emphasizing safety.

- Competitive Strategy: Balance pricing and branding to navigate high generic penetration.

- Regulatory Vigilance: Monitor patent landscapes to anticipate generic competition.

- Financial Planning: Allocate R&D investments strategically aligned with approval milestones.

FAQs

1. What is the main therapeutic advantage of MOTOFEN over existing NSAIDs?

MOTOFEN aims to offer an improved safety profile, particularly reducing gastrointestinal and cardiovascular risks, through innovative formulation science.

2. When is MOTOFEN expected to face generic competition?

Patents covering the core formulations are expected to expire around 2030, potentially opening markets for generics thereafter.

3. How significant are safety concerns in shaping MOTOFEN's market acceptance?

Safety concerns are pivotal. Demonstrating superior safety profiles is essential for positioning MOTOFEN as a preferred option among physicians and patients.

4. What are the primary regulatory hurdles for MOTOFEN?

Regulatory bodies require comprehensive data on safety, efficacy, and manufacturing standards; delays or rejections could impact market entry timelines.

5. Are there opportunities for licensing or partnerships relating to MOTOFEN?

Yes. Collaborations with generic manufacturers and regional licensing are viable strategies to expand market reach and share risks.

References

[1] FMI Market Reports, "Global NSAID Market Analysis," 2022.

[2] IMS Health Data, "OTC NSAID Segment Insights," 2022.