Last updated: September 23, 2025

Introduction

Mirabegron, marketed primarily under the brand name Myrbetriq, is a groundbreaking pharmacological agent developed for the treatment of overactive bladder (OAB). As a selective beta-3 adrenergic receptor agonist, mirabegron offers a novel mechanism compared to traditional antimuscarinics, and its market trajectory reflects evolving therapeutic preferences, regulatory landscapes, and competitive pressures. This article examines the current market dynamics and forecasts the financial trajectory of mirabegron, providing stakeholders with insights into its commercial potential and strategic positioning.

Therapeutic Profile and Market Positioning

Introduced in 2012 by Astellas Pharma, mirabegron emerged as an alternative to antimuscarinic agents, targeting OAB symptoms such as urgency, frequency, and incontinence [1]. Its mechanism of action—stimulating beta-3 adrenergic receptors in the detrusor muscle—relaxes bladder smooth muscle without anticholinergic side effects such as dry mouth and cognitive impairment. This safety profile has catalyzed its acceptance among patients intolerant to traditional therapies, expanding its target population.

The drug's unique therapeutic profile positions it as a premium treatment option, often priced higher than generic antimuscarinics. Its efficacy and tolerability have garnered endorsements from clinical guidelines, thereby cementing its role within the OAB therapeutic landscape.

Market Dynamics

Market Penetration and Adoption Trends

Since its launch, mirabegron has achieved steady adoption across global markets. In the United States, it secured FDA approval in 2012, followed by rapid commercialization [2]. By 2021, its market share among prescription medications for OAB increased gradually, reaching approximately 24% of total OAB drug prescriptions [3].

Key factors driving adoption include:

- Safety and Tolerability: Patients with contraindications to antimuscarinics, such as elderly populations or those with cognitive impairment, favor mirabegron due to its minimal anticholinergic burden.

- Differences in formulary access: Payers increasingly favor drugs with better safety profiles and patient adherence potential, benefiting mirabegron’s positioning.

- Expanding indications: Clinical research suggests potential benefits in conditions like neurogenic detrusor overactivity, supporting broader use.

Competitive Landscape

Mirabegron operates in a competitive environment primarily against antimuscarinics like oxybutynin, tolterodine, and solifenacin, which dominate due to lower costs and established efficacy. Generic formulations of these drugs have exerted downward pressure on market prices.

Despite these challenges, mirabegron's growth is bolstered by its differentiators:

- Reduced side effects: Particularly dry mouth and cognitive impairment.

- Combination therapy potential: Emerging evidence suggests efficacy when combined with other OAB treatments.

- Cost-effectiveness: Long-term adherence and improved quality of life translate into economic benefits, influencing prescribing patterns.

Regulatory Considerations and Approvals

Mirabegron’s approval in various regions, including the European Union in 2013 [4], expanded its market reach. Regulatory agencies' endorsement of its safety profile has promoted clinician confidence and facilitated inclusion in treatment algorithms, further fueling market expansion.

Market Challenges

While promising, several challenges hinder market growth:

- Pricing and reimbursement hurdles: High acquisition costs and inconsistent insurance coverage impact patient access.

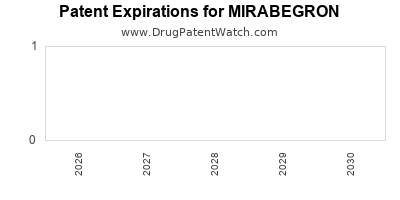

- Patent expirations: Loss of exclusivity in some markets leads to erosion of revenues due to generic competition.

- Limited awareness: Especially in low-income regions, awareness and education about its benefits lag, limiting adoption.

Financial Trajectory

Revenue Trends

Astellas Pharma reported net sales of approximately $500 million globally for mirabegron in 2021, representing a compound annual growth rate (CAGR) of roughly 8% since its launch [5]. The U.S. market remains the largest contributor, accounting for nearly 60% of global sales.

Revenue growth is projected to continue modestly, driven by:

- Increased prescriptions in mature markets due to clinician familiarity.

- Expansion into emerging markets, leveraging local partnerships.

- Development of new formulations (e.g., extended-release doses) to improve compliance.

Market Forecasts

Industry analysts forecast the global mirabegron market will reach approximately $1.2 billion by 2027, with a CAGR of around 9%, driven by:

- Growing prevalence of OAB: Aging populations in developed countries heighten demand.

- Increasing acceptance among clinicians and patients: Ongoing education campaigns bolster confidence.

- Product pipeline developments: Fixed-dose combinations and novel delivery systems promise enhanced adherence and efficacy.

Emerging markets in Asia-Pacific and Latin America are expected to account for a significant portion of this growth, given increasing healthcare expenditure and population aging.

Impact of Generic Competition

Patent expirations, notably in the U.S. expected in 2026, will introduce generic mirabegron formulations, exerting downward pricing pressure and affecting revenue streams. The transition period necessitates strategic repositioning, such as product line extensions or combination therapies to sustain profitability.

Research & Development Investment

Continued R&D investments aim to expand therapeutic indications and improve formulations. Companies exploring analogous beta-3 receptor agonists or combination agents could redefine the competitive landscape and open new revenue streams.

Market Drivers and Barriers

Drivers

- Demographic shifts: Aging populations globally increase OAB prevalence.

- Preference shift: Patients and clinicians favor drugs with better tolerability profiles.

- Guideline endorsements: Formal recommending of mirabegron supports market expansion.

- Innovation in drug delivery: New formulations enhance adherence.

Barriers

- Pricing pressures and reimbursement constraints reduce profit margins.

- Generic entry may diminish premium pricing.

- Limited awareness in developing regions hampers access.

- Alternative therapies: Emerging treatments could challenge mirabegron’s market share.

Strategic Opportunities

- Combination therapies: Investigating fixed-dose combinations with other OAB agents or antimuscarinics.

- Market expansion: Targeting underpenetrated regions like Southeast Asia and Africa.

- Patient adherence programs: Leveraging digital health tools to improve compliance.

- Biomarker research: Personalizing therapy to enhance efficacy.

Conclusion

Mirabegron’s market trajectory highlights its evolution from a novel option to an established, preferred therapy in specific patient cohorts. While competitive pressures and upcoming patent expirations pose challenges, strategic innovation, market expansion, and clinical advocacy will be vital to sustain its growth. The ongoing integration of mirabegron into comprehensive OAB management contributes to a compound annual growth rate aligning with industry projections—affirming its role in the future of bladder disorder therapeutics.

Key Takeaways

- Mirabegron’s unique mechanism provides a differentiated position in the OAB market, emphasizing safety and tolerability.

- Its current global revenue approximates $500 million, with forecasts projecting growth to over $1.2 billion by 2027.

- Market expansion hinges on demographic trends, clinician acceptance, and strategic entry into emerging markets.

- Patent expirations and generic competition will challenge profitability, requiring innovation and pipeline diversification.

- Strategic initiatives include combination therapies, targeted marketing, and awareness campaigns to sustain momentum.

FAQs

1. What distinguishes mirabegron from traditional OAB treatments?

Mirabegron offers a selective beta-3 adrenergic receptor agonist mechanism, reducing common antimuscarinic side effects like dry mouth and cognitive impairment. Its tolerability profile makes it suitable for elderly and sensitive populations.

2. How does the patent landscape impact mirabegron’s market potential?

Patent protections currently sustain premium pricing; however, patent expiration (~2026 in the U.S.) will lead to generic competition, pressuring prices and revenues.

3. What are the primary markets driving mirabegron sales?

The United States remains the largest market, followed by Europe and Japan. Emerging markets in Asia-Pacific and Latin America are expected to offer significant growth opportunities.

4. Are there new formulations or indications for mirabegron?

Research centers on combination therapies and extended-release formulations to improve adherence and efficacy. New indications like neurogenic detrusor overactivity are under clinical investigation.

5. What strategic moves can pharmaceutical companies employ to maximize mirabegron’s market value?

Investing in pipeline innovations, expanding indications, entering new geographic markets, and enhancing patient adherence strategies will be critical for optimizing long-term revenue.

References

[1] Astellas Pharma. (2012). FDA approval of Myrbetriq.

[2] U.S. Food and Drug Administration. (2012). Mirabegron approval document.

[3] IQVIA. (2021). Market Share Reports for OAB therapeutics.

[4] European Medicines Agency. (2013). Approval of Mirabegron in the EU.

[5] Astellas Pharma. (2022). Annual Report: Financial Review.