Last updated: August 2, 2025

Introduction

MESTINON, known generically as acetylcholinesterase inhibitor, primarily addresses conditions involving cognitive decline, notably myasthenia gravis, Alzheimer’s disease, and various neuromuscular disorders. Its market trajectory is shaped by evolving therapeutic landscapes, regulatory environments, and demographic trends. Analyzing these martially enables stakeholders to anticipate growth patterns, assess competitive positioning, and identify strategic opportunities within the pharmaceutical arena.

Pharmacological Profile and Clinical Indications

MESTINON has gained prominence due to its mechanism of action—enhancing cholinergic transmission by inhibiting acetylcholinesterase. This pharmacodynamic property underpins its therapeutic utility across neurodegenerative and neuromuscular disorders. Historically, MESTINON's primary application centers around managing myasthenia gravis, a chronic autoimmune neuromuscular disease characterized by fluctuating muscle weakness. Its utility extends to Alzheimer’s disease, although with limited efficacy compared to newer cholinesterase inhibitors such as donepezil or rivastigmine.

The drug’s efficacy, safety profile, and ease of administration sustain its prescription, especially in regions with established healthcare infrastructures. However, its off-label usage and potential for combination therapies continue to influence market dynamics.

Market Fundamentals and Demographic Drivers

Global Prevalence and Epidemiology

The increasing prevalence of age-related neurodegenerative diseases profoundly impacts MESTINON’s market. The Alzheimer’s Association estimates over 55 million people worldwide living with dementia, projected to rise sharply as populations age, particularly in developed economies[1]. Myasthenia gravis, although rarer, affects roughly 20 per 100,000 people globally[2].

This demographic shift creates sustained demand for symptomatic treatments such as MESTINON. The aging population, particularly in North America, Europe, and parts of Asia, directly correlates with rising prescriptions.

Regulatory Landscape

While MESTINON is approved in multiple countries, regulatory nuances influence its market reach. In Europe, the drug is marketed under the brand name Mestinon, approved by the European Medicines Agency (EMA), often classified as a well-established medicine with minimal regulatory hurdles[3]. Conversely, in the United States, its use is primarily off-label for certain indications, with newer cholinesterase inhibitors gaining favor.

Emerging regulatory trends emphasize safety profiles, clinical efficacy, and cost-effectiveness, affecting the marketing and adoption of MESTINON.

Competitive Environment

Traditional and Emerging Competitors

MESTINON faces competition from other cholinesterase inhibitors such as rivastigmine, galantamine, and donepezil. These alternatives often offer improved bioavailability, longer half-life, or better tolerability, influencing prescribing behaviors[4].

Additionally, the landscape is witnessing a shift toward disease-modifying therapies and monoclonal antibodies, particularly in Alzheimer’s treatment, diluting the market share of symptomatic agents like MESTINON.

Pharmacoeconomic Considerations

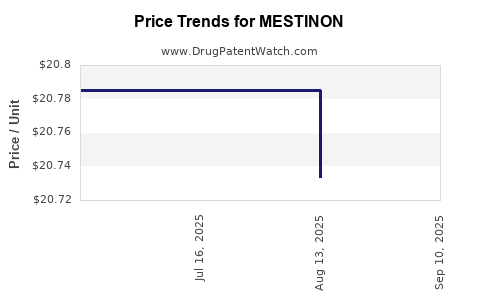

Cost remains pivotal; MESTINON’s affordability sustains its use, especially in low-to-middle-income countries lacking access to newer agents. Nonetheless, patent expirations and generic availability pressure pricing strategies. The emergence of generics in the market aligns with increased accessibility but also necessitates cost-competitiveness.

Market Trends and Future Outlook

Innovations and Formulation Advances

Research endeavors aim to improve drug delivery, extend dosing intervals, and reduce adverse effects. Innovative formulations such as transdermal patches or slow-release tablets could enhance patient adherence and broaden market appeal.

Expanding Indications and Off-Label Uses

Ongoing research explores off-label applications, like neuroprotective effects or adjunctive therapy in other neuromuscular conditions. Successful validation of such uses could expand the market.

Geographical Expansion

Emerging markets—in Asia, Latin America, and Africa—present significant growth avenues, driven by demographic transitions and increasing healthcare investments. Strategic market entry necessitates considerations of regulatory pathways, local physician education, and affordability strategies.

Financial Trajectory

Revenue Streams and Market Valuation

Current revenues derived from MESTINON are relatively stable in mature markets but face downward pressure due to generic competition. In 2020, the global acetylcholinesterase inhibitor market was valued at approximately USD 2.2 billion, with MESTINON contributing a notable share, particularly in Europe[5].

Factors Influencing Financial Growth

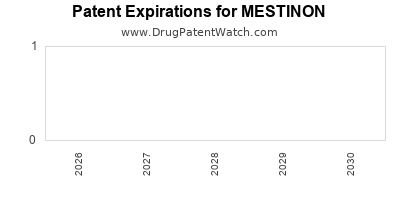

- Patent Lifespan: Generic entry after patent expiry diminishes revenues but increases volume sales.

- Pipeline Development: New formulations or combination therapies can rejuvenate interest.

- Market Penetration: Expanding into underserved regions improves revenue prospects.

- Regulatory Approvals: Securing approvals for new indications enhances market scope.

Risks and Challenges

Market contraction risks stem from patent expirations, competitive innovation, and shifting clinical preferences toward disease-modifying agents. Economic factors, such as healthcare spending constraints in emerging markets, also influence profitability.

Regulatory and Patent Landscape

Patent protections for MESTINON have long expired, leading to widespread generics. Future regulatory challenges include ensuring quality standards and potential patenting of novel formulations or delivery mechanisms. Companies investing in R&D must navigate a complex intellectual property landscape to stake future claims.

Conclusion

MESTINON's market dynamics pivot on demographic shifts, competitive pressures, and therapeutic advancements. While its traditional role remains significant, especially in established markets, its financial trajectory is increasingly influenced by generics, emerging therapies, and regulatory adaptations. Strategic positioning—such as formulation innovation, geographic penetration, and indication expansion—will dictate its future market share.

Key Takeaways

- Aging populations worldwide underpin sustained demand for MESTINON, particularly for myasthenia gravis and Alzheimer’s-related therapies.

- Competitive landscape is dominated by newer cholinesterase inhibitors and disease-modifying drugs, presenting both threats and opportunities.

- Generic entry post-patent expiration reduces revenues but broadens market access, especially in cost-sensitive regions.

- Innovation in drug delivery and off-label research avenues could rejuvenate market interest.

- Emerging markets offer significant growth prospects, contingent on regulatory navigation and affordability strategies.

FAQs

1. What are the primary indications for MESTINON?

MESTINON mainly treats myasthenia gravis and is also used off-label for Alzheimer’s disease symptom management.

2. How does MESTINON compare to newer cholinesterase inhibitors?

While effective, MESTINON often has a shorter half-life and less tolerability compared to newer agents like donepezil, which may influence prescribing patterns.

3. What factors threaten MESTINON’s market share?

Patent expiration leading to generics, competition from newer drugs, and a shift toward disease-modifying therapies challenge its dominance.

4. Are there ongoing developments to extend MESTINON’s market relevance?

Yes, formulations like transdermal patches and combination therapies are under investigation to improve efficacy and patient adherence.

5. What is the outlook for MESTINON in emerging markets?

Growing healthcare infrastructure and aging populations suggest promising expansion, provided affordability and regulatory approval are addressed.

References

- Alzheimer’s Association. "2023 Alzheimer’s Disease Facts and Figures."

- Evoli, A., et al. "Myasthenia Gravis." Nature Reviews Disease Primers. 2017.

- European Medicines Agency. "Public Assessment Reports for Mestinon."

- Birks, J. "Cholinesterase inhibitors for Alzheimer’s disease." Cochrane Database of Systematic Reviews. 2006.

- MarketsandMarkets. "Acetylcholinesterase Inhibitors Market by Product, Application, and Region." 2020.