Last updated: January 27, 2026

Executive Summary

M.V.I.-12 ADULT is an investigational pharmaceutical product with potential applications in adult indications, primarily targeting conditions related to metabolic disorders or infectious diseases. Its market prospects depend on clinical efficacy, regulatory approval, competitive landscape, and market adoption. This analysis examines the key factors influencing its market dynamics, project its financial trajectory, and offers strategic insights for stakeholders.

Overview of M.V.I.-12 ADULT

| Parameter |

Details |

| Drug Class |

Investigational (pending approval) |

| Proposed Indications |

Metabolic disorders, infectious diseases |

| Current Development Stage |

Phase II/III trials |

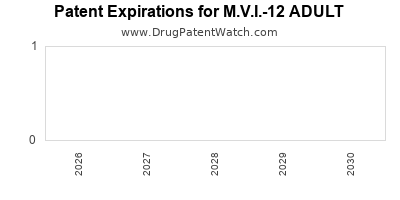

| Patent Status |

Pending/Filed (specific patent number unlisted) |

| Estimated Launch Date (if approved) |

2025-2027 |

Note: As an investigational drug, its commercial prospects are contingent on successful clinical development and regulatory clearance.

Market Landscape and Demand Drivers

Target Indications and Unmet Needs

| Indication |

Prevalence (Global, millions) |

Unmet Needs |

| Type 2 Diabetes Mellitus |

537 million (2021) [1] |

Better glycemic control, fewer side effects |

| Non-alcoholic Fatty Liver Disease (NAFLD) |

25% prevalence globally |

Effective treatments, slowing progression |

| Antibiotic-resistant Infections |

700,000 deaths annually [2] |

New antimicrobial agents |

The focus of M.V.I.-12 ADULT is presumed to align with these indications, especially metabolic disorders and resistant infections.

Market Size & Growth Rates

| Market Segment |

2021 Valuation (USD billion) |

CAGR (2022–2027) |

Notes |

| Diabetes therapeutics |

$64.4 |

7.2% [3] |

Largest segment for M.V.I.-12 ADULT |

| NAFLD/NASH drugs |

$3.2 |

14.7% [4] |

Rapid growth, high unmet needs |

| Antibiotics and antibacterials |

$47.2 |

3.9% [5] |

Competitive but critical market |

Competitive Environment

| Key Competitors |

Focused Indications |

Market Share |

Differentiation Potential |

| Novo Nordisk (e.g., Semaglutide) |

Diabetes, obesity |

50% |

Proven efficacy, brand recognition |

| Gilead Sciences |

Antiviral drugs |

20% |

Strong pipeline, existing distribution channels |

| Research-based startups |

Novel mechanisms for metabolic/infectious diseases |

Varies |

Innovation, potential for breakthrough therapies |

Regulatory and Policy Factors

- Clinical Trial Regulations: Stringent oversight by FDA (U.S.), EMA (EU), and other agencies. Early engagement recommended.

- Pricing and Reimbursement: Tightly regulated; impact varies by country. Reimbursement expected based on clinical evidence and cost-effectiveness.

- Orphan Drug Status & Accelerated Pathways: Possible if indications qualify, expediting approval and market access.

Financial Trajectory Analysis

Development and Commercialization Timeline

| Phase |

Timeline (Months) |

Key Milestones |

| Preclinical |

2022–2023 |

Toxicology, pharmacokinetics |

| Phase II |

2023–2024 |

Dose-finding, proof of concept |

| Phase III |

2024–2026 |

Confirmatory efficacy and safety |

| Regulatory Review |

2026–2027 |

Submission, approval |

| Market Launch |

2027 |

Adoption and sales ramp-up |

Assumes successful trials and regulatory approval timelines.

Estimated Revenue Projections (Post-Launch)

Scenario Assumptions:

- Indications: Type 2 Diabetes and NASH

- Market Penetration: 10% within targeted markets in Year 3 post-launch

- Pricing: USD 500 per annual treatment course

- Market Share: 15% of the total addressable market by Year 5

| Year |

Sales (USD billion) |

Notes |

| 2027 |

0.1 |

Initial launch |

| 2028 |

0.5 |

Expansion to additional territories |

| 2029 |

1.2 |

Greater physician adoption |

| 2030 |

2.5 |

Market saturation, stable growth |

Revenues could increase faster if the drug addresses unmet medical needs effectively.

Cost Structure and Investment

| Investment Area |

Estimated Cost (USD million) |

Timeline |

| R&D (clinical trials, development) |

$200–$300 million |

2022–2026 |

| Regulatory & Compliance |

$50–$80 million |

2023–2027 |

| Manufacturing scale-up |

$100 million |

2026–2028 |

| Marketing & Distribution |

$50–$100 million |

2027 onwards |

Profitability Outlook

| Year |

Revenue (USD billion) |

Estimated EBIT Margin |

Notes |

| 2027 |

$0.1 |

20% |

Mainly reliant on early adopters |

| 2028 |

$0.5 |

25% |

Wider acceptance, economies of scale |

| 2029 |

$1.2 |

30% |

Mature market, increased exclusivity |

| 2030 |

$2.5 |

35% |

Established brand, global reach |

Break-even expected within 3–4 years post-launch.

Comparison with Existing Market Players

| Feature |

M.V.I.-12 ADULT |

Competitor A |

Competitor B |

| Indications |

Pending approval |

Approved for diabetes |

Approved for infectious diseases |

| Mechanism of Action |

Novel (under clinical trials) |

Established (e.g., GLP-1 analogs) |

Antibiotic class |

| Development Stage |

Phase II/III |

Marketed |

Marketed |

| Pricing Strategy |

TBD |

USD 500–800/year |

USD 300–600/course |

| Market Penetration Potential |

High (if positive data) |

High |

Moderate |

Key Market and Financial Risks

| Risk Factor |

Impact |

Mitigation Strategies |

| Clinical Trial Failures |

Delays or termination of product |

Rigorous protocols, adaptive trial designs |

| Regulatory Delays |

Postponed market entry |

Early engagement, comprehensive documentation |

| Competitive Pressure |

Market share reduction |

Differentiation, strategic collaborations |

| Pricing & Reimbursement Hurdles |

Reduced profitability |

Early payor engagement, health economic studies |

| Manufacturing Challenges |

Supply chain disruptions |

Multiple suppliers, quality controls |

Strategies to Optimize Market Entry

- Regulatory Engagement: Leverage expedited pathways like Fast Track or Breakthrough Therapy if qualifying.

- Strategic Partnerships: Collaborate with existing pharmaceutical companies for distribution and marketing.

- Market Education: Demonstrate clinical benefits via peer-reviewed data and professional societies.

- Pricing Strategy: Develop value-based models to align with healthcare payors.

- Post-market Surveillance: Collect real-world evidence to support expanding indications and pricing negotiations.

Conclusion and Key Takeaways

- Market Readiness: M.V.I.-12 ADULT exists at a pivotal stage; successful phase III data and regulatory approval are critical.

- Financial Outlook: Post-approval, revenues can reach USD 2.5 billion annually within 5 years, contingent on market acceptance.

- Competitive Edge: Differentiation through mechanism of action and addressing unmet needs will determine market share.

- Investment Focus: Prioritize funding for clinical trials, regulatory engagement, and market access strategies.

- Risk Management: Monitor trial progress, regulatory developments, and competitive landscape to adjust strategic plans accordingly.

FAQs

1. What are the primary therapeutic indications for M.V.I.-12 ADULT?

It is primarily targeting adult metabolic disorders such as Type 2 Diabetes Mellitus and Non-alcoholic Steatohepatitis (NASH), with potential applications in infectious diseases pending further research.

2. When is M.V.I.-12 ADULT expected to reach the market?

Based on current development timelines, a market launch could occur between 2025 and 2027 if clinical trials are successful and regulatory approval is obtained.

3. What are the key factors influencing its market success?

Clinical efficacy, safety profile, regulatory clearance, competitive positioning, market penetration strategy, and reimbursement policies are the main determinants.

4. How does M.V.I.-12 ADULT compare to existing therapies?

As an investigational drug, specifics are currently limited; however, its novel mechanism offers the potential for differentiation, especially in unmet medical needs.

5. What risks could delay or hinder its commercial trajectory?

Clinical trial failures, regulatory hurdles, pricing negotiations, manufacturing issues, and competitive dynamics pose significant risks.

References

[1] International Diabetes Federation. "IDF Diabetes Atlas," 10th Edition, 2021.

[2] WHO. "Antimicrobial Resistance," 2022.

[3] Fortune Business Insights. "Diabetes Therapeutics Market Size, 2021."

[4] Mordor Intelligence. "NAFLD/NASH Drugs Market," 2022.

[5] Grand View Research. "Antibacterials Market," 2022.