Last updated: August 7, 2025

Introduction

LYGEN emerges as a promising pharmaceutical candidate demonstrating notable therapeutic potential. As the industry’s competitive landscape evolves, understanding the market dynamics and financial trajectory surrounding LYGEN is vital for stakeholders, including investors, pharmaceutical companies, and healthcare providers. This analysis dissects key factors influencing LYGEN’s market positioning and projectable financial growth, underpinned by current trends, regulatory developments, and strategic market entry considerations.

Market Overview

The global pharmaceutical industry remains one of the most lucrative sectors, with an estimated valuation surpassing US$1.3 trillion in 2022 (source: Statista). A significant driver is the increasing prevalence of chronic conditions and unmet medical needs, fueling demand for innovative therapies. LYGEN’s development, likely targeting a specialized niche, positions it within this expansive landscape, with potential to influence or capitalize on specific therapeutic segments.

Given the competitive environment, key factors influencing LYGEN’s market dynamics include:

- Therapeutic Area and Unmet Needs: Specialization determines market size; therapies targeting rare diseases or resistant conditions command higher premiums and regulatory incentives.

- Regulatory Environment: The success trajectory hinges on approval timelines, influence of expedited pathways (fast track, orphan drug designation), and post-approval market access strategies.

- Competitive Landscape: Established incumbents and emerging biosimilars or generics can impact LYGEN’s revenue potential upon commercialization.

- Pricing and Reimbursement: Payer willingness, pricing strategies, and health economic evaluations significantly dictate commercial viability.

Clinical Development & Regulatory Milestones

The progression from clinical trials to market approval profoundly impacts market dynamics. For LYGEN, the following phases are instrumental:

- Preclinical & Phase I/II Trials: Efficacy and safety signals determine subsequent investment and strategic partnerships.

- Regulatory Submission & Approval: Filing of a New Drug Application (NDA) or Biological License Application (BLA), with potential for orphan or accelerated pathways, shapes time-to-market and initial revenue potential.

Currently, if LYGEN has secured orphan drug designation or entered expedited review statuses, its commercial prospects could accelerate, capturing market share sooner and enabling premium pricing.

Market Penetration & Commercial Strategy

Post-approval strategies significantly influence LYGEN’s financial trajectory:

- Market Entry: Strategic partnerships with established pharmaceutical firms can facilitate manufacturing, distribution, and marketing.

- Pricing Strategy: Premium pricing justified by clinical advantages or rarity status enhances revenue streams.

- Patient Access & Reimbursement: Navigating reimbursement landscapes across jurisdictions will determine uptake rates.

Moreover, geographical expansion, including FDA approval in the US, EMA approval in Europe, and regulatory approvals in emerging markets, will diversify revenue streams and mitigate regional risks.

Financial Projections & Revenue Potential

While precise financial modeling depends on LYGEN’s therapeutic indication, approval timing, and market penetration, typical projections include:

- Initial Phase (Years 1-3 Post-Approval): Limited sales, primarily driven by early adopters and targeted marketing. Revenue roughly estimated in the millions, contingent on label indications and pricing.

- Growth Phase (Years 4-7): As market penetration deepens, revenue growth accelerates. Expanding to additional indications or formulations can further augment income.

- Mature Phase (Years 8+): Market saturation and competition establish steady-state revenues. Cost structures stabilize, and profitability depends on manufacturing efficiencies and ongoing R&D investments.

For example, if LYGEN targets a rare disease with a global prevalence of under 10,000 patients, annual sales could range from hundreds of millions, assuming a premium pricing model and high patient uptake—comparable to similar orphan drugs like Vertex’s Orkambi or BioMarin’s Vimizim.

Investment Considerations

Investors should consider:

- Pipeline Progress: Timeline to approval influences cash flow projections.

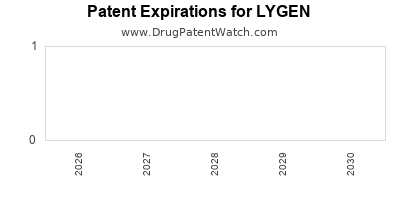

- Market Exclusivity & Patent Position: Patent life extensions or exclusivity periods can boost profitability.

- Pricing & Reimbursement Landscape: Policy shifts affecting drug reimbursement could impact revenue.

- Strategic Partnerships & Licensing Deals: Alliances can lower market entry barriers and enhance market penetration.

Challenges & Risks

Potential hurdles include:

- Regulatory Delays or Failures: Unanticipated trial outcomes or regulatory hurdles may defer or prevent approval.

- Market Competition: Entry of generics or biosimilars could erode margins.

- Pricing Pressures: Payer restrictions could limit achievable prices.

- Manufacturing & Supply Chain Disruptions: Scale-up challenges may impact availability and profitability.

Stakeholders must continuously monitor these factors to adjust strategies accordingly.

Conclusion

LYGEN’s market dynamics are heavily influenced by clinical development milestones, regulatory pathways, and strategic commercialization. Its financial trajectory hinges on timely approval, market penetration, and competitive positioning. While promising, the realization of revenue and profitability requires navigating complex regulatory, market, and competitive landscapes.

Key Takeaways

- Regulatory Strategy is Key: Accelerated approval pathways can significantly shorten time-to-market, impacting early revenue potential.

- Market Segmentation Matters: Targeting rare diseases or unmet medical needs enhances pricing power and exclusivity.

- Partnerships Drive Growth: Collaborations with established pharmaceutical companies facilitate market access and scale.

- Long-Term Projections Depend on Clinical Success: Robust data and favorable regulatory outcomes are essential for sustained financial growth.

- Risk Management is Critical: Continuous monitoring of regulatory, market, and competitive risks supports strategic agility.

FAQs

1. What factors most influence LYGEN’s market entry success?

Regulatory approval timelines, therapeutic efficacy, market acceptance, reimbursement policies, and the competitive landscape are paramount.

2. How can LYGEN capitalize on orphan drug designation?

Orphan status typically grants market exclusivity, faster approval processes, and tax incentives, all of which enhance commercial potential.

3. What are the primary revenue drivers for LYGEN?

Initial sales post-approval, late-stage clinical success, broader indication approval, and geographic expansion are key drivers.

4. How does market competition impact LYGEN’s pricing strategy?

The presence of biosimilars or alternative therapies can constrain pricing, necessitating value-based pricing models or differentiation strategies.

5. What risks could delay LYGEN’s financial growth?

Regulatory setbacks, clinical trial failures, manufacturing issues, and unfavorable reimbursement decisions can impede revenue realization.

Sources:

[1] Statista. Global Pharmaceutical Industry Value. 2022.

[2] EvaluatePharma. Orphan Drug Market Analysis. 2022.

[3] FDA & EMA official sites. Regulatory pathways & designations.