Last updated: July 30, 2025

Introduction

LOTRIMIN ULTRA, a topical antifungal medication, is a leading product in the treatment of dermatophyte infections such as athlete’s foot, jock itch, and ringworm. Its active ingredient, butenafine hydrochloride, offers rapid efficacy and sustained relief, positioning it favorably within the over-the-counter (OTC) antifungal segment. As an established brand, LOTRIMIN ULTRA's market dynamics and projected financial trajectory depend on multifaceted factors including consumer demand, regulatory landscape, competitive environment, and evolving healthcare trends.

Market Overview

The global antifungal market, estimated valued at approximately USD 13 billion in 2022, is anticipated to grow at a CAGR of around 4% through 2028[1]. The segment for topical antifungals like LOTRIMIN ULTRA constitutes a significant subset, driven by increasing prevalence of fungal infections worldwide. Rising awareness, improved hygiene practices, and the accessibility of OTC formulations bolster demand.

LOTRIMIN ULTRA commands a mature market position, particularly in North America and Europe where dermatophytic infections are widespread. The product’s reputation for fast action and minimal side effects sustains its market share amid fierce competition from generic brands and other formulations containing different active ingredients like terbinafine, clotrimazole, and miconazole.

Key Market Drivers

- Prevalence of Fungal Infections: Increased incidence in both developed and developing nations, influenced by hot climates, athletic lifestyles, and comorbidities such as diabetes, fuels demand[2].

- Consumer Shift to OTC Medications: The rising preference for self-medication and OTC substitutes reduces reliance on prescription drugs, expanding the market for products like LOTRIMIN ULTRA.

- Product Efficacy and Brand Loyalty: Proven rapid relief and persistent antifungal activity sustain customer loyalty, especially when coupled with aggressive marketing.

- Growing Urbanization and Lifestyle Factors: Increased participation in sports, fitness activities, and occupational exposure contribute significantly to fungal infections, further benefitting OTC antifungal sales.

Competitive Landscape

LOTRIMIN ULTRA faces competition from both brand-name and generic products. Generic versions of butenafine, along with other classes like azoles, intensify price competition and erode margins. Key competitors include:

- Lamisil (terbinafine): Known for broad spectrum and efficacy.

- Clotrimacel (clotrimazole): Economical and widely available.

- Miconazole: Frequently used alternative.

Innovation corridors focus on extended-release formulations, combination therapies, and novel delivery systems to enhance therapeutic outcomes and market share.

Regulatory and Economic Challenges

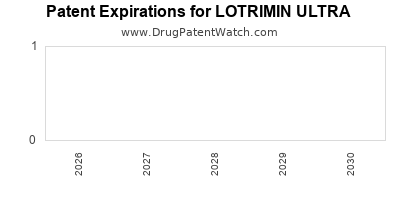

Regulatory changes—such as stricter over-the-counter label standards and patent expirations—affect market dynamics. The expiration of key patents allows generics to enter the market, pressuring pricing and brand loyalty. Additionally, market access limitations in emerging markets due to supply chain constraints and regulatory barriers temper growth potential.

Financial Trajectory Outlook

Revenue Projection

The financial outlook for LOTRIMIN ULTRA hinges on several factors:

- Market Penetration and Share: Sustained advertising, educational campaigns, and consumer trust underpin ongoing sales growth.

- Pricing Strategies: Premium positioning compared to generics can preserve margins; aggressive pricing may expand market share but at reduced profitability.

- Product Line Expansion: Introducing formulations with enhanced benefits (e.g., longer duration, better patient compliance) can bolster revenues.

- Geographic Expansion: Entry into emerging markets—particularly Asia-Pacific and Latin America—could markedly increase revenues, given increasing fungal infection rates and rising OTC consumption.

A conservative CAGR estimate of 3-5% over the next five years aligns with the maturation of the antifungal OTC market, with potential for acceleration due to innovative product launches and emerging markets.

Profitability Trends

Gross margins for LOTRIMIN ULTRA are expected to stabilize between 60-70%, supported by brand recognition and probability of premium pricing. However, patent expirations and rising competition could diminish margins unless offset by cost efficiencies and product differentiation.

Investment and Development Outlook

Manufacturers are directed to invest in R&D to develop next-generation formulations with enhanced efficacy, minimal resistance, and competitive advantages. Strategic alliances and licensing deals could facilitate market expansion and revenue diversification, influencing overall financial trajectory positively.

Market Challenges and Risks

- Generic Competition: Widespread patent expirations threaten market share and pricing power.

- Regulatory Hurdles: Approval delays or stricter safety standards could curtail new product launches.

- Consumer Behavior Fluctuations: A shift towards natural or alternative remedies might impact OTC antifungal sales.

- Global Economic Conditions: Economic downturns could suppress discretionary spending on OTC medications.

Market Opportunities

- Digital and E-commerce Growth: Online sales platforms have gained prominence, especially during pandemic disruptions, providing avenues for direct-to-consumer marketing.

- Emerging Markets Expansion: Large underserved populations can be tapped through localized marketing and affordable formulations.

- Product Innovation: Combining antifungal agents with moisturizers or anti-inflammatory compounds can differentiate offerings and command higher price points.

Key Takeaways

- The OTC antifungal market, including LOTRIMIN ULTRA, is poised for moderate growth driven by rising fungal infection prevalence and consumer preference for self-medication.

- Competitive intensity necessitates innovation, brand loyalty, and strategic pricing to sustain financial performance.

- Patent expirations and regulatory landscapes will shape future market share dynamics, emphasizing the importance of R&D and geographic expansion.

- Potential for revenue growth exists through emerging markets and product line extensions; however, profitability margins may face pressure from intensified generic competition.

- Market success hinges on leveraging digital platforms, differentiating formulations, and adapting to evolving consumer behaviors.

FAQs

1. What distinguishes LOTRIMIN ULTRA from other topical antifungal treatments?

LOTRIMIN ULTRA contains butenafine hydrochloride, known for rapid symptom relief and prolonged antifungal activity. Its formulation provides superior efficacy in treating dermatophyte infections, with a favorable safety profile compared to some alternatives.

2. How does patent expiration impact LOTRIMIN ULTRA’s market share?

Patent expiration allows generic competitors to enter the market, leading to price competition and potential erosion of LOTRIMIN ULTRA’s market share unless the brand maintains a competitive advantage through formulation, brand loyalty, or expanded indications.

3. What growth opportunities exist for LOTRIMIN ULTRA in emerging markets?

Emerging markets present sizable demand due to high prevalence of fungal infections, increasing healthcare awareness, and expanding OTC drug consumption. Tailored marketing and affordable pricing are essential for successful penetration.

4. How might regulatory changes influence the product’s financial trajectory?

Stricter safety and efficacy standards could delay new product introductions or require reformulations, impacting revenue growth. Conversely, favorable regulatory environments may facilitate faster approvals and market expansion.

5. Can innovation sustain LOTRIMIN ULTRA’s market position amid rising competition?

Yes. Formulation improvements, combination therapies, or novel delivery systems can differentiate LOTRIMIN ULTRA, sustain consumer interest, and potentially command premium pricing, reinforcing market share and financial stability.

References

[1] MarketWatch. (2022). Antifungal Drugs Market Size, Share & Trends Analysis Report.

[2] Global Data. (2023). Fungal Infection Incidence and Impact Report.