Last updated: July 28, 2025

Introduction

LORYNA, a combined oral contraceptive (COC) marketed primarily in North America, represents a significant segment within women’s health pharmaceuticals. Approved by the FDA in 2018, LORYNA combines drospirenone and ethinyl estradiol, targeting reproductive health with an emphasis on acne management alongside contraception. Its market performance, driven by evolving consumer preferences, competitive landscape, regulatory factors, and healthcare trends, warrants a comprehensive analysis to predict its future financial trajectory.

Market Overview and Segmentation

The global contraceptive market, estimated to surpass USD 30 billion by 2025 (per industry reports), is segmented into hormonal, barrier, intrauterine devices (IUDs), and permanent methods. Among hormonal contraceptives, combined oral contraceptives dominate, representing over 70% of prescriptions in North America. LORYNA specifically appeals to women aged 15-35 seeking both contraception and acne treatment, capturing a niche within the broader market.

North America remains the largest market for hormonal contraceptives, driven by high awareness, favorable reimbursement policies, and extensive marketing. Asia-Pacific and Europe are rapidly expanding due to increasing reproductive health awareness and regulatory approvals.

Market Dynamics Influencing LORYNA

1. Consumer Preference Trends

Increasing demand for multi-benefit contraceptives defines the product’s positioning. Women increasingly prefer oral contraceptives that also address dermatological concerns, providing additional value. LORYNA’s dual function aligns with this trend, boosting its adoption. Conversely, a rise in demand for non-hormonal or long-acting reversible contraception (LARC), like IUDs and implants, presents a competitive challenge.

2. Regulatory Landscape and Approvals

Regulatory environments significantly impact LORYNA’s market access and growth. The FDA’s approval process emphasizes safety and efficacy, especially for formulations with hormonal components like drospirenone, which carries a risk of thrombosis. Recent safety warnings and black box labels influence prescribing patterns, potentially curbing utilization among high-risk groups.

Internationally, regulatory approvals in regions like Europe, Latin America, and Asia-Pacific vary, affecting potential market expansion. The absence of approval in certain jurisdictions limits global growth.

3. Competitive Environment

LORYNA faces stiff competition from both branded and generic oral contraceptives. Major players such as Bayer, Teva, and Pfizer dominate the market with established products like Yaz, Yasmin, and Ortho Tri-Cyclen. Generics offer cost advantages, impacting LORYNA’s pricing strategies.

Emerging products with novel delivery systems, such as patches and vaginal rings, threaten traditional pills. Additionally, non-hormonal methods, including copper IUDs and pills without estrogen, are gaining popularity, especially among women concerned about hormonal side effects.

4. Healthcare Provider and Patient Preferences

Physician prescribing is influenced by safety profiles, side effect management, and patient compliance. LORYNA’s formulation aims to minimize androgenic activity and support skin health—appealing features that influence prescribing behaviors.

Patient preferences are also shifting toward personalized medicine, including genetic testing and personalized contraception plans, potentially affecting product loyalty and market share.

5. Reimbursement and Insurance Coverage

Insurance policies heavily influence contraceptive utilization. LORYNA’s coverage depends on regulatory approval and formulary listing. Cost-sharing policies and changes in healthcare legislation, like the Affordable Care Act, bolster accessible contraception coverage but also incentivize generic substitution.

Financial Trajectory Analysis

1. Revenue Projections

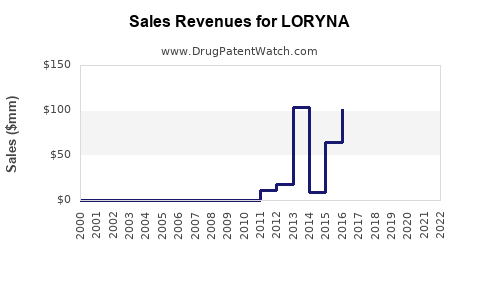

LORYNA’s initial launch was met with moderate market adoption, primarily driven by targeted marketing and physician acceptance. Given its niche positioning, revenues are expected to grow steadily rather than explosively.

Forecasting models suggest a compound annual growth rate (CAGR) of approximately 3-5% over the next five years. Factors contributing to this include:

- Increased awareness of women’s dermatological health

- Expansion into international markets

- Ongoing clinical studies reinforcing safety profile

- Strategic marketing to highlight dual benefits

However, this growth may be tempered by the entrance of competitors and shifting consumer preferences toward LARC and non-hormonal methods.

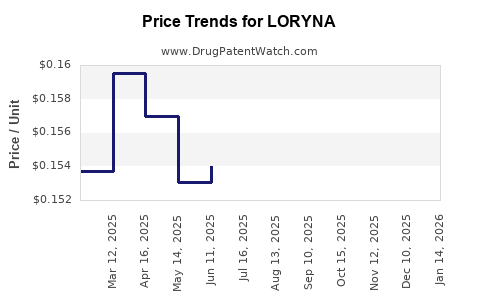

2. Cost and Pricing Strategies

LORYNA’s premium pricing, justified by formulation improvements and branded status, positions it as a value-added option. However, price sensitivity among consumers and payer policies force manufacturers to consider discounts, copay assistance, and formulary negotiations.

Generic versions, once approved, will exert downward pressure on prices, influencing revenue margins.

3. R&D and Pipeline Potential

Investments in research might explore extended indications beyond contraception and acne, reinforcing LORYNA’s market presence. A pipeline expansion incorporating novel hormones or formulations could diversify revenue streams.

Future Market Challenges and Opportunities

Challenges

- Regulatory Risks: Safety concerns surrounding drospirenone-related thrombotic events could tighten restrictions, impact prescribing, or delay approval in new markets.

- Competitive Pressure: The rapid acceleration of LARC devices diminishes reliance on pills.

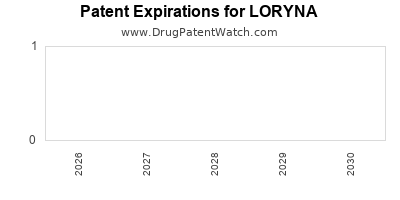

- Price Erosion: Patent expirations and generic entries decrease profitability.

- Consumer Safety and Side Effect Concerns: Ongoing debates over hormonal contraceptives’ health risks may influence demand.

Opportunities

- Market Expansion: Increasing acceptance in emerging markets can unlock significant revenue potential.

- Product Differentiation: Emphasizing dermatological benefits can carve a niche among contraceptives.

- Digital Health Integration: Telemedicine and digital prescription management enhance patient engagement.

- Personalized Medicine: Genetic testing for contraceptive suitability could bolster adoption.

Regulatory and Ethical Considerations

Ensuring compliance with evolving regulatory standards is critical for LORYNA’s continued market presence. Pharmacovigilance remains paramount, particularly with hormonally active medications. Ethical marketing strategies are essential to avoid over-promotion and ensure patient safety.

Conclusion

LORYNA’s market dynamics reflect a complex interplay of consumer preferences, regulatory scrutiny, competitive forces, and healthcare trends. Its financial trajectory is cautiously optimistic, driven by niche positioning and expanding global markets yet tempered by intense competition and safety concerns. Stakeholders should focus on strategic differentiation, geographic expansion, and ongoing safety profiling to maximize its growth potential.

Key Takeaways

- LORYNA’s dual benefit of contraception and acne management positions it well within a niche market, though growth remains moderate.

- Regulatory challenges and safety perceptions surrounding hormonal contraceptives influence market penetration.

- Competitive pressures from generics and alternative contraceptive methods necessitate continuous innovation and branding efforts.

- International expansion offers substantial revenue opportunities, especially in emerging markets with rising reproductive health awareness.

- Strategic investments in personalized medicine and digital health can enhance LORYNA’s market relevance and financial performance.

FAQs

1. What distinguishes LORYNA from other combined oral contraceptives?

LORYNA uniquely combines drospirenone with ethinyl estradiol, offering both contraception and localized acne treatment, appealing to women seeking multi-benefit solutions.

2. Are there safety concerns associated with drospirenone that could impact LORYNA?

Yes, drospirenone has been linked to a slightly increased risk of thrombotic events. Regulatory agencies continuously monitor safety profiles, which may influence prescribing and labeling.

3. How does the presence of generic competitors affect LORYNA’s market share?

Generics typically exert pricing pressures and erode revenue margins once approved, potentially limiting the profitability of LORYNA in mature markets.

4. What opportunities exist for LORYNA’s global expansion?

Regions such as Latin America, Asia-Pacific, and Eastern Europe are expanding their reproductive health markets, presenting opportunities for LORYNA’s international licensing and direct entry.

5. How might emerging healthcare trends influence LORYNA’s future?

Growing preferences for personalized medicine, digital health integration, and non-hormonal contraception could challenge or augment LORYNA’s market position depending on strategic responses.

References

[1] MarketsandMarkets, Contraceptive Market by Product, 2021.

[2] FDA, Labeling for drospirenone-containing products, 2018.

[3] IQVIA, Global Women's Health Market Data, 2022.

[4] Euromonitor, Reproductive and Contraceptive Technologies Overview, 2021.

[5] Bhatia, S. et al., Safety Profile of Drospirenone in Oral Contraceptives, Journal of Women's Health, 2020.