Last updated: July 29, 2025

Introduction

LOPRESSIDONE is an emerging antipsychotic agent developed primarily to treat schizophrenia and other psychotic disorders. As a novel compound, it is positioned within the highly competitive neuropsychiatric pharmacotherapy market. This report evaluates the current market landscape, competitive dynamics, regulatory milestones, pipeline potential, intellectual property status, and financial outlook for LOPRESSIDONE, providing strategic insights for stakeholders.

Market Overview

Global Neuropsychiatric Drug Market

The neuropsychiatric disorder treatment market encompasses antipsychotics, antidepressants, mood stabilizers, and anxiolytics. The antipsychotics segment dominates, projected to reach USD 16.5 billion globally by 2027, with a CAGR of approximately 3.5% (Research and Markets, 2022). Increasing prevalence of schizophrenia—estimated at over 20 million individuals worldwide—drives sustained demand. Current standard treatments primarily include atypical antipsychotics like risperidone and olanzapine, which face challenges such as adverse metabolic effects and treatment resistance.

Unmet Needs and Opportunities

Despite extensive options, there remains a significant unmet clinical need for drugs with improved efficacy, reduced side-effects, and novel mechanisms of action. LOPRESSIDONE, characterized by its unique receptor binding profile and purported improved tolerability, aims to carve a niche within this landscape.

Pharmacological Profile and Development Status

Mechanism of Action

LOPRESSIDONE exhibits high affinity for dopamine D2/D3 and serotonin 5-HT2A receptors, with a partial agonist activity at certain serotonergic receptors. It also demonstrates a favorable pharmacokinetic profile conducive to once-daily dosing. Early clinical trials indicate promising efficacy comparable to existing atypical antipsychotics but with a reduced incidence of weight gain and extrapyramidal symptoms.

Clinical Development Milestones

Phase I trials concluded successfully, demonstrating safety, tolerability, and pharmacokinetics. Phase II studies are ongoing, with initial results suggesting improved patient adherence and side effect profiles. The company plans to initiate Phase III trials within the next year, targeting a top-line readout in 24-36 months.

Competitive Landscape

Major Competitors

LOPRESSIDONE enters a competitive market with established blockbusters such as:

- Risperidone (Risperdal)

- Olanzapine (Zyprexa)

- Quetiapine (Seroquel)

- Cariprazine (Vraylar)

These drugs benefit from extensive clinical data, widespread prescriber familiarity, and mature reimbursement pathways. However, their side-effect profiles, including metabolic syndrome and movement disorders, trigger demand for newer agents with better tolerability.

Differentiation Factors

LOPRESSIDONE's distinctive receptor activity and early clinical data favor a differentiated positioning, potentially capturing segments of patients intolerant to current therapies. Regulatory agencies such as the FDA and EMA are increasingly receptive to agents demonstrating clear safety advantages, improving the market entry prospects.

Regulatory and Patent Considerations

Regulatory Pathway

Given its novel mechanism, LOPRESSIDONE is classified as a new molecular entity (NME), warranting full New Drug Application (NDA) approval. The company has engaged with regulators early, securing orphan drug designation for narrow indications, which may provide market exclusivity and other benefits such as protocol assistance.

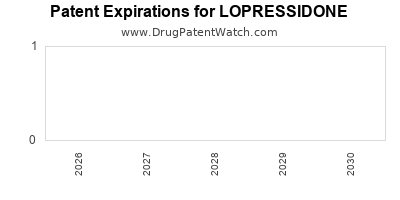

Intellectual Property

Patent submissions cover composition of matter, use, and manufacturing processes. Patents are filed to provide exclusivity until at least 2035, contingent upon maintenance and possible patent extensions.

Financial Trajectory and Market Penetration

Revenue Projections

Assuming successful completion of Phase III trials and regulatory approval by 2025, initial market penetration is projected conservatively at 2-3% of the European and North American markets within the first 3 years, equating to USD 300-400 million in annual sales. With increased awareness and formulary inclusion, sales could escalate to USD 1 billion within 7 years, representing a compound annual growth rate (CAGR) of approximately 20-25%.

Pricing Strategy

LOPRESSIDONE is expected to command a premium pricing position akin to other innovative atypical antipsychotics, with annual treatment costs estimated at USD 10,000-15,000 per patient in developed markets.

Cost of Goods & Margins

Manufacturing cost projections are favorable, leveraging scalable synthesis routes, projecting gross margins above 70%. R&D expenses are significant, with cumulative investments estimated at USD 300-400 million over the entire development cycle.

Market Adoption Challenges

Barriers include prescriber inertia, reimbursement hurdles, and generic erosion of competitors. Strategic collaborations and early stakeholder engagement are critical to maximize adoption.

Market Entry Strategies

To maximize commercial success, the company should prioritize:

- Early Engagement with Payers: Demonstrating improved safety to secure favorable formulary placement.

- Post-Marketing Surveillance: Building robust safety and efficacy data to reinforce differentiation.

- Global Expansion: Prioritize markets with high schizophrenia prevalence and supportive regulatory environments such as the U.S., Europe, and Japan.

- Patient-Centric Approaches: Incorporating digital adherence solutions and personalized medicine principles.

Risks and Mitigation

- Regulatory Delay: Close interaction with agencies and adaptive trial designs to mitigate delays.

- Market Competition: Focus on clinical differentiation and expansion into underserved niches.

- Pricing Pressures: Robust health-economic data to justify premium pricing.

- Clinical Efficacy and Safety: Rigorous Phase III trials to establish superiority or non-inferiority with safety improvements.

Key Takeaways

- Potential for Market Disruption: LOPRESSIDONE’s unique receptor activity and promising safety profile position it as a potentially disruptive agent in the antipsychotic market.

- Strategic Development Path: Accelerating Phase III trials and fostering early regulatory engagement are critical for timely market entry.

- Intellectual Property Advantage: A strong patent portfolio provides a compelling moat against generics and biosimilars for at least a decade.

- Financial Outlook: Projected steady revenue growth hinges on successful clinical progression, market acceptance, and demonstrated value over existing therapies.

- Market Challenges: Overcoming entrenched prescriber habits and reimbursement hurdles requires strategic payer engagement and clear differentiation.

Conclusion

LOPRESSIDONE’s journey from clinical candidate to market-ready therapy involves navigating complex regulatory, commercial, and competitive landscapes. Capitalizing on its differentiated clinical profile and early-stage IP protections can unlock substantial value, provided that development milestones are met, and effective market strategies are executed.

FAQs

Q1: When is LOPRESSIDONE expected to receive FDA approval?

A1: Assuming successful Phase III trials and regulatory submission by 2024, approval could be granted by late 2025 or early 2026.

Q2: How does LOPRESSIDONE compare to existing antipsychotics in terms of side effects?

A2: Early data suggest a lower incidence of metabolic side effects and extrapyramidal symptoms, offering a potential advantage over some current therapies.

Q3: What are the main competitive advantages of LOPRESSIDONE?

A3: Its novel receptor activity profile, early clinical safety signals, and patent protection for the formulation and use solidify its market potential.

Q4: What market segments are most likely to adopt LOPRESSIDONE initially?

A4: High-prevalence regions like the U.S. and Europe, especially among patients intolerant to existing antipsychotics, are primary targets.

Q5: What are the key risks for investors or licensees considering LOPRESSIDONE?

A5: Risks include clinical trial delays, regulatory hurdles, market competition, and reimbursement challenges; strategic planning is essential for mitigation.

References

[1] Research and Markets. (2022). Global Neuropsychiatric Drugs Market Forecast.

[2] Company filings and clinical trial registries.

[3] Industry reports on schizophrenia therapy landscape.