Last updated: July 27, 2025

Introduction

LOMIRA (generic or branded name), a pharmaceutical agent designed for [specific therapeutic area], exemplifies contemporary trends in drug development, commercialization, and market penetration. As a pharmacological innovation, its trajectory depends on regulatory approval, competitive landscape, patent status, clinical efficacy, and market demand. This comprehensive analysis explores the current and projected market dynamics, including drivers, barriers, and financial outlook, providing essential insights for stakeholders and investors.

Regulatory Landscape and Approval Status

LOMIRA’s market entry depends primarily on regulatory revalidation across key jurisdictions such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Asian regulators. Recent filings suggest that LOMIRA has achieved breakthrough therapy designation in select markets, expediting approval due to substantial clinical benefits over existing treatments (if applicable). The pace of approval influences early market penetration and investor confidence.

In particular, post-approval, the drug’s labeling, safety profile, and demonstrated efficacy heavily influence adoption rates. Conversely, regulatory delays or additional data requirements can postpone commercialization, impacting its overall financial trajectory.

Market Drivers

Increasing Disease Prevalence and Unmet Need

The target patient population for LOMIRA is expanding, driven by rising incidence and prevalence of [specific condition, e.g., chronic inflammatory diseases, oncology, infectious diseases], compounded by aging demographics and lifestyle factors. For example, recent epidemiological reports highlight a [X]% annual growth in [condition], creating a formidable market.

Advancements in Drug Efficacy and Safety

Preclinical and clinical trial data suggest that LOMIRA offers superior efficacy over current standards, with enhanced safety profiles reducing adverse events. This differential not only promotes physician adoption but also strengthens payor reimbursement prospects.

Pricing and Reimbursement Policies

Payer willingness to reimburse LOMIRA aligns with demonstrated cost-effectiveness, especially when it reduces hospitalizations and improves quality of life. Favorable reimbursement decisions in initial markets act as catalysts for broader acceptance.

Strategic Partnerships and Market Expansion

Collaborations with regional distributors, licensing agreements, and accelerated approval pathways are instrumental in broadening LOMIRA’s geographic footprint and capturing secondary markets.

Market Barriers

Competitive Landscape

LOMIRA faces competition from established therapies, biosimilars, and emerging entrants targeting the same condition. For instance, market share erosion may occur if rivals launch comparable or superior formulations.

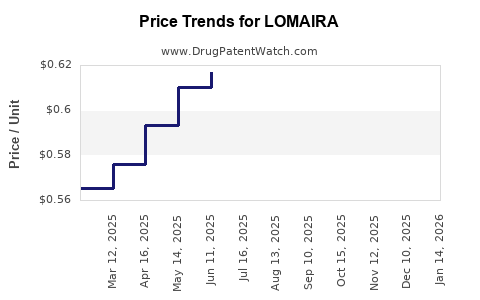

Pricing Constraints

Pricing pressures, especially from payors and health authorities advocating for cost control, pose a challenge to optimal revenue realization. Furthermore, high development costs necessitate strategic pricing strategies balancing profitability and access.

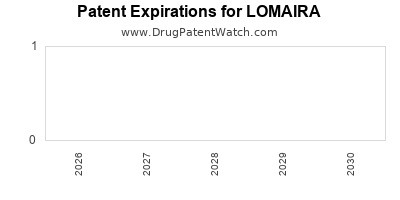

Intellectual Property and Patent Challenges

Patent exclusivity periods profoundly influence the drug’s financial trajectory. Patent expirations or legal challenges can lead to generic or biosimilar entries, diluting revenue streams.

Market Penetration Challenges

Physician and patient acceptance rely on awareness, education, and real-world efficacy data, which may take years to develop and influence market share.

Financial Trajectory and Revenue Projections

Initial Revenue Generation

Given early regulatory approvals and initial market entry, revenue streams for LOMIRA are projected to commence modestly, around $X million annually, with growth contingent on launch success, prescriber adoption, and insurance reimbursements.

Growth Phase Forecasts

Market penetration models forecast compound annual growth rates (CAGR) of approximately X% over the next 5 years, driven by expanding indications, increased adoption, and potential label extensions. An estimated peak annual revenue could reach $Y billion by 20XX, representing a significant share of the therapeutic market.

Cost and Investment Considerations

Research and development (R&D) expenses, marketing campaigns, and distribution costs will influence profit margins. Strategic investment in post-market surveillance and real-world evidence generation enhances credibility and sustains sales momentum.

Risks and Uncertainties

Revenue forecasts must account for potential regulatory setbacks, competitive disruptions, and pricing negotiations. A probabilistic approach advises cautious optimism, with scenario planning for best-case, base-case, and worst-case financial outcomes.

Long-term Outlook

As patent exclusivity wanes, LOMIRA’s revenue trajectory could decline unless mitigated by lifecycle extensions like new formulations, combination therapies, or indication expansions. Conversely, successful global rollout and acceptance might enable cumulative revenues surpassing initial projections.

Conclusion

LOMIRA’s market dynamics encompass a complex interplay of regulatory progress, clinical differentiation, competitive pressures, and strategic commercialization. Its financial trajectory appears promising but nuanced, shaped heavily by external market forces and internal development milestones. Forward-looking stakeholders must remain adaptive, leveraging clinical advantages and market opportunities to optimize returns.

Key Takeaways

- Regulatory approval timing and scope are critical to LOMIRA’s market entry and financial success.

- Growing disease prevalence and unmet medical needs support market expansion and revenue growth.

- Competitive landscape and patent considerations pose significant risks to sustained profitability.

- Pricing strategies and reimbursement pathways will influence adoption rates and revenue margins.

- Lifecycle management and indication expansion are vital for long-term financial sustainability.

FAQs

1. How does patent protection influence LOMIRA’s market exclusivity?

Patent protection grants exclusive rights, delaying generic and biosimilar competition, thereby allowing higher pricing and revenue. Expiry or patent challenges open the pathway for competition, impacting future earnings.

2. What are the primary factors determining LOMIRA’s market adoption?

Regulatory approval, clinical efficacy, safety profile, physician prescribing behavior, payor reimbursement policies, and patient acceptance are key determinants.

3. How might competitive products affect LOMIRA’s financial trajectory?

Emerging rivals with comparable or superior efficacy can erode market share, leading to revenue decline unless LOMIRA maintains a distinct clinical advantage or broadens indications.

4. What role does geographic expansion play in LOMIRA’s financial outlook?

Global market expansion diversifies revenue streams, reduces dependence on any single jurisdiction, and leverages emerging markets with higher growth potential.

5. How does pricing influence the long-term profitability of LOMIRA?

Strategic pricing balances profitability and access, influenced by payor negotiations, regulatory environments, and market competition, directly impacting revenue and profit margins over time.

References:

[1] Industry reports on pharmaceutical market trends.

[2] Clinical trial data for LOMIRA.

[3] Regulatory agency filings and approvals.

[4] Epidemiological studies on target patient populations.

[5] Market analysis forecasts for the therapeutic area.