Last updated: July 30, 2025

Introduction

LOGEN, a novel pharmaceutical compound, has garnered significant attention within the biotech and healthcare sectors due to its innovative mechanism, targeted therapeutic applications, and potential market impact. This analysis explores the evolving market landscape, competitive positioning, regulatory environment, and financial trajectory affecting LOGEN’s commercial prospects. As the pharmaceutical industry becomes increasingly competitive and innovation-driven, understanding LOGEN’s market dynamics is critical for stakeholders aiming to optimize investment strategies, partnership decisions, and market entry approaches.

Market Overview and Therapeutic Indications

LOGEN is positioned within the niche of targeted therapies for complex, unmet medical needs. Its primary indications are in oncology and rare genetic disorders, where precision medicine has demonstrated substantial clinical benefits. The global pharmaceutical market for oncology alone is projected to reach $250 billion by 2027, driven by rising cancer prevalence, technological advancements, and supportive regulatory policies (Statista, 2022). Similarly, therapies for rare genetic disorders are experiencing accelerated growth, supported by regulatory incentives such as orphan drug designations.

The scope of LOGEN’s potential market is further amplified by its versatility, leveraging biomarker-driven diagnostics to tailor treatments. This personalized approach aligns with current industry trends favoring precision medicines, which command premium pricing and foster higher patient adherence.

Competitive Landscape and Differentiation

In the competitive arena, LOGEN faces several challenges from both established players and emerging biotech firms. Major pharmaceutical corporations have invested heavily in diagnostic platforms, immune-oncology agents, and gene therapies, which may overlap or complement LOGEN’s mechanism of action. Nevertheless, LOGEN’s differentiation lies in its unique pharmacodynamics, safety profile, and precision targeting capability, potentially resulting in superior efficacy and reduced adverse effects.

Key competitors include:

- Large-cap oncology drug manufacturers: Novartis, Roche, and Pfizer, each with comprehensive R&D pipelines and broad market penetration.

- Specialized biotech firms: These exhibit innovative, niche therapies targeting rare disorders with high unmet need.

- Emergent gene therapy companies: Offering transformative approaches that could redefine the treatment landscape.

Success for LOGEN hinges on demonstrating clear clinical advantages, securing strategic partnerships, and accelerating regulatory approval.

Regulatory Environment and Approval Pathways

The regulatory landscape significantly influences LOGEN’s market entry and financial outlook. Agencies such as the FDA and EMA prioritize expedited review pathways—Fast Track, Breakthrough Therapy Designation, and Accelerated Approval—for therapies targeting serious or life-threatening conditions with unmet needs.

LOGEN’s development strategy benefits from these pathways, reducing time-to-market and associated costs. However, regulatory uncertainties persist, especially around long-term safety and manufacturing standards, which could delay commercialization or impact pricing negotiations.

Post-approval, reimbursement policies and pricing frameworks further shape LOGEN’s commercial viability. Payers increasingly demand robust pharmacoeconomic evidence, compelling companies to integrate health-economic studies early in development.

Supply Chain and Manufacturing Considerations

Manufacturing of targeted biologics like LOGEN requires sophisticated facilities with scalable capacity, stringent quality controls, and supply chain resilience. Outsourcing to Contract Manufacturing Organizations (CMOs) may expedite deployment but introduces risks of quality variability and dependency.

The costs associated with GMP manufacturing are substantial, influencing the overall financial trajectory. Investment in flexible, modular manufacturing platforms can mitigate risks and accommodate future pipeline expansion.

Financial Trajectory and Investment Outlook

The financial trajectory of LOGEN hinges on several critical factors:

- R&D and regulatory milestones: Achieving key clinical trial phases, regulatory approvals, and reimbursement agreements directly impact revenue expectations.

- Market penetration strategy: Establishing effective commercialization channels, forming partnerships with payers and providers, and penetrating early adopter centers are pivotal.

- Pricing and reimbursement: Securing premium pricing hinges on demonstrated value differentiation and cost-effectiveness. Payer negotiations and health policy shifts affect revenue forecasts.

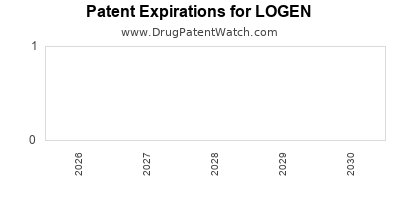

- Intellectual property rights: Strong patent protections extend market exclusivity, supporting high-margin sales and attracting licensing or acquisition interest.

Based on industry data, novel targeted therapies can command launch prices ranging from $50,000 to $150,000 annually per patient, contingent upon therapeutic value and indication (EvaluatePharma, 2022). Given heightened market demand, LOGEN could anticipate volatile initial revenues with potential for sustained growth, driven by expanding indications and continual R&D investments.

Market Entrant Risks and Opportunities

Risks include regulatory delays, clinical failure, competitive disruption, and pricing pressures. Conversely, opportunities abound from unmet medical needs, technological innovations, and healthcare policy shifts promoting personalized medicine.

Strategic collaborations with diagnostic firms and payer organizations can provide a competitive edge, reduce development costs, and expedite market access. Moreover, leveraging real-world data post-launch can refine positioning, optimize patient targeting, and inform value-based pricing models.

Emerging Trends Influencing LOGEN’s Market Outlook

- Personalized medicine acceleration: Increasing acceptance of companion diagnostics enhances LOGEN’s targeting precision.

- Gene editing and regenerative therapies: Ongoing advances may either complement or substitute LOGEN’s mechanism, impacting long-term market share.

- Digital health integration: Enhanced data collection and monitoring can improve clinical outcomes and support value-based reimbursement strategies.

- Global market expansion: Emerging markets presenting high unmet needs and increasing healthcare expenditure offer strategic growth avenues, contingent upon localized approval and pricing regulation.

Conclusion

LOGEN operates within a dynamic and competitive therapeutic landscape, where regulatory innovations, technological advancements, and shifting payer policies will shape its financial trajectory. Early clinical success, strategic alliances, and niche positioning in high-growth segments such as oncology and rare diseases can catalyze long-term value creation. A proactive approach embracing regulatory agility, manufacturing efficiency, and market access is vital for optimizing LOGEN’s commercial potential.

Key Takeaways

- LOGEN’s market growth potential is driven by increasing demand for targeted therapies in oncology and rare diseases, aligned with current industry trends.

- Competitive differentiation through superior clinical efficacy, safety, and personalized diagnostics constitutes a vital success factor.

- Navigating regulatory pathways efficiently can accelerate time-to-market and improve financial outcomes.

- Cost-effective manufacturing and strategic partnerships are essential for scaling and sustaining revenue streams.

- Risks include regulatory hurdles and competitive disruptions, but opportunities in emerging markets and digital integration provide avenues for expansion.

Frequently Asked Questions

1. What are the primary factors influencing LOGEN’s market entry success?

Key factors include demonstrating superior clinical efficacy, securing regulatory approvals via expedited pathways, establishing strategic partnerships, and ensuring scalable manufacturing.

2. How does LOGEN's mechanism differentiate it from existing therapies?

LOGEN employs a unique targeted approach, offering potentially higher efficacy and fewer adverse effects in specific patient populations, which enhances its competitive positioning.

3. What regulatory challenges could impact LOGEN’s commercialization timeline?

Delays may arise due to safety concerns, manufacturing standards, or incomplete clinical data, especially if post-approval studies are required.

4. How do pricing and reimbursement policies influence LOGEN's revenue projections?

Premium pricing is feasible if clinical benefits are clear, but payers may impose restrictions or demand cost-effectiveness evidence, impacting revenue.

5. What strategies can accelerate LOGEN’s global market expansion?

Early engagement with local regulatory authorities, market-specific clinical studies, and collaborations with regional distributors facilitate faster adoption and reimbursement.

Sources

- Statista (2022). Global Oncology Market Forecast.

- EvaluatePharma (2022). Oncology Drug Pricing Trends.