Last updated: July 27, 2025

Introduction

Lanreotide acetate, a synthetic somatostatin analog, is primarily prescribed for the treatment of neuroendocrine tumors (NETs) and acromegaly. As a long-acting formulation, lanreotide has established itself within niche oncology and endocrinology markets. Understanding its market dynamics and financial trajectory is crucial for industry stakeholders, including pharmaceutical companies, investor analysts, and healthcare strategists aiming to forecast future revenue streams and competitive positioning.

Market Overview

Therapeutic Applications and Adoption

Lanreotide acetate’s primary indications include managing gastrointestinal neuroendocrine tumors (NETs), functioning as a tumor suppressant, and controlling excessive hormone secretion in acromegaly. The drug’s efficacy in reducing tumor size and hormone levels underpins its clinical adoption. The expanding incidence of NETs globally, coupled with increasing diagnosis rates, fuels demand [1].

Additionally, the shift toward targeted therapies and personalized medicine boosts interest in somatostatin analogs, positioning lanreotide favorably against traditional treatment options. The growing awareness among clinicians and expanding reimbursement coverage further accelerate adoption.

Market Dynamics

Drivers

-

Rising Incidence of Neuroendocrine Tumors: The global burden of NETs has climbed over the past decade, with estimates indicating an annual incidence rate of approximately 6 per 100,000 population, which is expected to increase due to improved diagnostics [2].

-

Regulatory Approvals and Expanded Indications: Regulatory approvals in key markets for expanding indications—such as tumor growth control and hormone secretion management—have broadened its use case, fueling market penetration.

-

Novel Formulation Development: The introduction of the long-acting depot formulations enhances patient compliance and reduces healthcare visits, thus favoring market growth.

-

Reimbursement and Healthcare Infrastructure: Favorable insurance reimbursement policies in developed regions such as North America and Europe have facilitated widespread adoption.

Challenges

-

High Cost of Therapy: Lanreotide's high price point constrains accessibility, especially in low- and middle-income countries, limiting its global market reach.

-

Limited Awareness and Diagnosis: Underdiagnosis of NETs restricts potential patient population and revenues, particularly in regions with inadequate healthcare infrastructure.

-

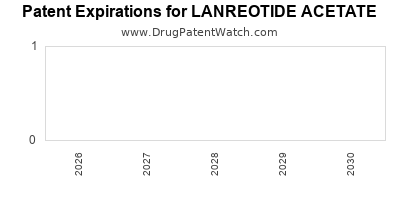

Emergence of Biosimilars and Generics: Patent expirations in certain markets could usher in biosimilar competition, impacting pricing and margins.

Competitive Landscape

Lanreotide contends primarily with octreotide, another somatostatin analog, which enjoys broader awareness and earlier market entry. Recently, platform drugs such as pasireotide complement the landscape. Companies like Ipsen (marketed as Somatuline) and Novartis are major players. Patent expirations and pipeline developments involving alternative analogs could influence the competitive balance.

Financial Trajectory

Revenue Streams and Market Penetration

The financial trajectory of lanreotide acetate hinges upon its sales volume, pricing strategies, and market expansion efforts. The drug's revenue has exhibited steady growth, particularly in high-income markets, averaging annual increases of approximately 5-10%, driven by a combination of increased diagnosis, expanded indications, and geographic expansion.

For example, Ipsen’s reported revenues from Somatuline (lanreotide) reached approximately €755 million in 2022, with notable growth in the U.S. and European markets [3]. The drug’s current market share within gastrointestinal NETs remains significant but faces pressure from emerging therapies and biosimilar competitors.

Pricing and Reimbursement Trends

Pricing for lanreotide remains premium, reflecting its therapeutic efficacy and specialty status. In the U.S., annual treatment costs in excess of $150,000 per patient are common. Reimbursement dynamics are complex, heavily dependent on healthcare policies and negotiation strategies. Favorable reimbursement has historically supported revenue stability but may be challenged by cost-containment measures.

Pipeline and Market Expansion Opportunities

Next-generation formulations, biosimilar introductions, and combination therapies hold potential for revenue diversification. Market penetration into emerging economies and broader indications, such as sporadic NETs or adjunctive therapies, could augment financial outlooks.

Future Outlook

The outlook for lanreotide acetate is cautiously optimistic, influenced by several factors:

-

Growth in NET Diagnoses: As diagnostic techniques improve, early detection will likely expand the treated patient pool, bolstering future revenue.

-

Emerging Competition: Patent cliffs and biosimilar entry may compress margins, necessitating strategic pricing and marketing tactics.

-

Pipeline Innovations: Development of combination therapies and novel delivery mechanisms may stimulate renewed therapeutic interest.

-

Regulatory Evolutions: Faster approvals and expanded indications in emerging markets could accelerate revenue growth.

-

Healthcare Policy Impact: Cost containment policies globally could restrict pricing flexibility, emphasizing cost-effectiveness evaluations.

Conclusion

Lanreotide acetate’s market is characterized by moderate but sustained growth driven by increasing NET prevalence, favorable regulatory environment, and evolving treatment paradigms. Its financial trajectory appears stable but faces challenges from biosimilar competition and healthcare policy constraints. Strategic investments in pipeline development, market expansion, and negotiations on pricing and reimbursement will be pivotal in shaping its future profitability.

Key Takeaways

-

Growing Demand: The increasing global incidence of NETs positions lanreotide as a crucial therapeutic agent, supporting steady revenue growth.

-

Market Competition: The presence of octreotide and potential biosimilars necessitate differentiation through formulation innovation and expanded indications.

-

Pricing Challenges: High therapy costs limit access in developing regions, impacting revenue potential outside high-income markets.

-

Pipeline Opportunities: Next-generation formulations and combination therapies could offset competitive pressures, with positive implications for future sales.

-

Strategic Focus: Stakeholders must prioritize market expansion, reimbursement negotiations, and pipeline innovations to sustain revenue growth.

FAQs

-

What are the main therapeutic uses of lanreotide acetate?

Lanreotide acetate is primarily used to treat neuroendocrine tumors and acromegaly by suppressing hormone secretion and controlling tumor growth [1].

-

How does lanreotide's market share compare to octreotide?

Although octreotide has a broader market presence due to earlier entry and wider awareness, lanreotide has captured significant market share within specialized indications, particularly with its longer-acting formulation [3].

-

What factors are driving future growth for lanreotide?

Increasing NET diagnosis, expansion into new markets, and pipeline development of novel formulations and combinations constitute primary growth drivers.

-

What challenges could impact lanreotide’s financial trajectory?

Patent expirations, biosimilar competition, high treatment costs, and healthcare policy restrictions pose significant challenges.

-

Are biosimilars expected to affect lanreotide’s market?

Yes, biosimilar development could lead to price competition, potentially reducing margins and impacting revenues unless differentiated through indications or formulations.

References

[1] Jensen RT. "Proceedings of the 2009 European Neuroendocrine Tumor Society Congress." Endocrine-Related Cancer, 2009.

[2] Yao JC, et al. "Epidemiology and Clinical Characteristics of Neuroendocrine Tumors." Clin Gastroenterol Hepatol., 2017.

[3] Ipsen. "Annual Report 2022." Ipsen Group.