KOSELUGO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Koselugo, and what generic alternatives are available?

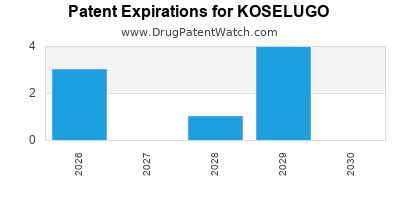

Koselugo is a drug marketed by Astrazeneca and is included in two NDAs. There are eight patents protecting this drug.

This drug has two hundred and one patent family members in forty-five countries.

The generic ingredient in KOSELUGO is selumetinib sulfate. One supplier is listed for this compound. Additional details are available on the selumetinib sulfate profile page.

DrugPatentWatch® Generic Entry Outlook for Koselugo

Koselugo was eligible for patent challenges on April 10, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be September 10, 2028. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for KOSELUGO?

- What are the global sales for KOSELUGO?

- What is Average Wholesale Price for KOSELUGO?

Summary for KOSELUGO

| International Patents: | 201 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 129 |

| Clinical Trials: | 12 |

| Patent Applications: | 4,158 |

| Drug Prices: | Drug price information for KOSELUGO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for KOSELUGO |

| What excipients (inactive ingredients) are in KOSELUGO? | KOSELUGO excipients list |

| DailyMed Link: | KOSELUGO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for KOSELUGO

Generic Entry Dates for KOSELUGO*:

Constraining patent/regulatory exclusivity:

NEW PATIENT POPULATION NDA:

Dosage:

CAPSULE;ORAL |

Generic Entry Dates for KOSELUGO*:

Constraining patent/regulatory exclusivity:

NEW PRODUCT NDA:

Dosage:

GRANULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for KOSELUGO

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Alabama at Birmingham | Phase 2 |

| Congressionally Directed Medical Research Programs | Phase 2 |

| Children's Hospital of Philadelphia | Phase 2 |

Pharmacology for KOSELUGO

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Mitogen-Activated Protein Kinase Kinase 1 Inhibitors Mitogen-Activated Protein Kinase Kinase 2 Inhibitors |

US Patents and Regulatory Information for KOSELUGO

KOSELUGO is protected by eight US patents and five FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of KOSELUGO is ⤷ Get Started Free.

This potential generic entry date is based on NEW PATIENT POPULATION.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Astrazeneca | KOSELUGO | selumetinib sulfate | GRANULE;ORAL | 219943-002 | Sep 10, 2025 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Astrazeneca | KOSELUGO | selumetinib sulfate | GRANULE;ORAL | 219943-001 | Sep 10, 2025 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | KOSELUGO | selumetinib sulfate | GRANULE;ORAL | 219943-002 | Sep 10, 2025 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | KOSELUGO | selumetinib sulfate | GRANULE;ORAL | 219943-002 | Sep 10, 2025 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Astrazeneca | KOSELUGO | selumetinib sulfate | CAPSULE;ORAL | 213756-001 | Apr 10, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for KOSELUGO

When does loss-of-exclusivity occur for KOSELUGO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 8696

Patent: SAL DE SULFATO DE HIDROGENO DEL ACIDO 6-(4-BROMO-2-CLORO-FENILAMINO)-7-FLUOR-3-METIL-3H-BENZOIMIDAZOL-5-CARBOXILICO.

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 06330759

Patent: Novel hydrogen sulfate salt

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0620091

Patent: sal hidrogenossulafato, método para preparo e uso do mesmo

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 34149

Patent: NOUVEAU SEL HYDROGENOSULFATE (NOVEL HYDROGEN SULFATE SALT)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1360718

Patent: Novel hydrogen sulfate salt

Estimated Expiration: ⤷ Get Started Free

Patent: 2329270

Patent: Hydrogen sulfate salt

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0130663

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 14303

Estimated Expiration: ⤷ Get Started Free

Patent: 21030

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 68948

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 088597

Patent: SAL DE SULFATO DE HIDRÓGENO NOVEDOSA

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 68948

Patent: NOUVEAU SEL HYDROGENOSULFATE (NOVEL HYDROGEN SULFATE SALT)

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 0210043

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1051

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 24043

Patent: NOVEL HYDROGEN SULFATE SALT

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 100046

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 2224

Patent: מלח מימן גופרתי של 6-(4-ברומו-2-כלורו-פנילאמינו)-7-פלואורו-3-מתיל-h3-בנזואימידאזול-5-חומצה קרבוקסילית (2-הידרוקסי-אתוקסי)-אמיד לטיפול במחלות המטופלות ע''י עכבה של mek (Hydrogen sulfate salt of 6-(4-bromo-2-chloro-phenylamino)-7-fluoro-3-methyl-3h-benzoimidazole-5-carboxylic acid (2-hydroxy-ethoxy)-amide for treating diseases treated by inhibition of mek)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 27723

Estimated Expiration: ⤷ Get Started Free

Patent: 09521487

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 968948

Estimated Expiration: ⤷ Get Started Free

Patent: 2021530

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0234

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 7733

Patent: NOVEL HYDROGEN SULFATE SALT

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 08008298

Patent: SAL DE SULFATO DE HIDROGENO NOVEDOSA. (NOVEL HYDROGEN SULFATE SALT.)

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1139

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 9792

Patent: Novel hydrogen sulphate benzimidazole salt

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 68948

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 68948

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 18790

Patent: НОВАЯ ГИДРОСУЛЬФАТНАЯ СОЛЬ (NOVEL HYDROSULPHATE SALT)

Estimated Expiration: ⤷ Get Started Free

Patent: 08129199

Patent: НОВАЯ ГИДРОСУЛЬФАТНАЯ СОЛЬ

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 843

Patent: NOVA SO VODONIK SULFATA (NOVEL HYDROGEN SULFATE SALT)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 68948

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0805705

Patent: NOVEL HYDROGEN SULFATE SALT

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1361460

Estimated Expiration: ⤷ Get Started Free

Patent: 080080200

Patent: NOVEL HYDROGEN SULFATE SALT

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 21746

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 05756

Estimated Expiration: ⤷ Get Started Free

Patent: 0800915

Patent: Novel hydrogen sulfate salt

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 531

Patent: НОВИЙ ГІДРОСУЛЬФАТ[НОВЫЙ ГИДРОСУЛЬФАТ (NOVEL HYDROGEN SULFATE SALT)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering KOSELUGO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Ukraine | 101654 | МАТРИКСНАЯ ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ НА ОСНОВЕ ГИДРОСУЛЬФАТА ( 2-ГИДРОКСИЭТОКСИ)АМИДА 6-( 4-БРОМ-2-ХЛОРФЕНИЛАМИНО)-7-ФТОР-3-МЕТИЛ-3Н-БЕНЗОИМИДАЗОЛ-5-КАРБОНОВОЙ КИСЛОТЫ;МАТРИКСНА ФАРМАЦЕВТИЧНА КОМПОЗИЦІЯ НА ОСНОВІ ГІДРОСУЛЬФАТУ (2-ГІДРОКСІЕТОКСІ)АМІДУ 6-(4-БРОМ-2-ХЛОРФЕНІЛАМІНО)-7-ФТОР-3-МЕТИЛ-3Н-БЕНЗОІМІДАЗОЛ-5-КАРБОНОВОЇ КИСЛОТИ (MATRIX PHARMACEUTICAL COMPOSITION BASED ON HYDROGEN SULPHATE SALT OF 6-(4-BROMO-2-CHLORO-PHENYLAMINO)-7-FLUORO-3-METHYL-3H-BENZOIMIDAZOLE-5-CARBOXYLIC ACID(2-HYDROXY-ETHOXY)-AMIDE) | ⤷ Get Started Free |

| Peru | 20091755 | COMPOSICION FARMACEUTICA QUE COMPRENDE UNA SAL DE SULFATO DE HIDROGENO DE 6-(4-BROMO-2-CLORO-FENILAMINO)-7-FLUORO-3-METIL-3H-BENZOIMIDAZOL-5-ACIDO CARBOXILICO (2-HIDROXI-ETOXI)-AMIDA | ⤷ Get Started Free |

| Russian Federation | 2491920 | ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ 271 (PHARMACEUTICAL COMPOSITION 271) | ⤷ Get Started Free |

| Lithuania | PA2021530 | ⤷ Get Started Free | |

| Japan | 2008019277 | N3 ALKYLATED BENZIMIDAZOLE AS MEK INHIBITOR | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for KOSELUGO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1968948 | C20210036 00434 | Estonia | ⤷ Get Started Free | PRODUCT NAME: SELUMETINIIB;REG NO/DATE: EU/1/21/1552 19.06.2021 |

| 1482932 | 648 | Finland | ⤷ Get Started Free | |

| 1968948 | 301139 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: SELUMETINIBWATERSTOFSULFAAT, DESGEWENST IN WATERVRIJE VORM OF IN DE VORM VAN EEN SOLVAAT; REGISTRATION NO/DATE: EU/1/21/1552 20210619 |

| 1968948 | 2190048-5 | Sweden | ⤷ Get Started Free | PRODUCT NAME: SELUMETINIB HYDROGEN SULFATE, INCLUDING ANY SOLVATES AND ANHYDROUS FORMS THEREOF; REG. NO/DATE: EU/1/21/1552 20210619 |

| 1482932 | C201930018 | Spain | ⤷ Get Started Free | PRODUCT NAME: BINIMETINIB O UNA SAL O UN SOLVATO FARMACEUTICAMENTE ACEPTABLE DEL MISMO.; NATIONAL AUTHORISATION NUMBER: EU/1/18/1315; DATE OF AUTHORISATION: 20180920; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/18/1315; DATE OF FIRST AUTHORISATION IN EEA: 20180920 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for KOSELUGO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.