Last updated: August 5, 2025

Introduction

KIMIDESS emerges as a compelling entrant in the pharmaceutical landscape, targeting specific indications with innovative delivery mechanisms or molecular entities. Understanding its market dynamics and future financial trajectory necessitates an analysis rooted in competitive positioning, regulatory landscape, market demand, and pricing strategies. This discussion offers a comprehensive assessment of KIMIDESS’s current market environment, growth drivers, potential challenges, and revenue prospects, enabling stakeholders to make informed strategic decisions.

Product Profile and Therapeutic Indications

Although detailed clinical data are proprietary, KIMIDESS is positioned in the oncology and autoimmune treatment sectors, possibly offering targeted therapy or biologic formulations. Such drugs typically address high unmet medical needs, supported by robust clinical trials demonstrating superior efficacy or improved safety profiles. Its mode of action, dosage simplicity, and therapeutic window significantly influence market adoption.

Market Landscape and Demand Drivers

High-Value Therapeutic Segment

KIMIDESS operates within lucrative markets—oncology and autoimmunity—where pandemic-driven healthcare priorities, growing disease prevalence, and advanced biologic therapies underpin demand. Globally, cancer incidence is projected to rise at a CAGR of approximately 4.8% through 2030 [1], while autoimmune diseases remain prevalent, with an expanding patient pool due to better diagnostics and awareness.

Unmet Medical Needs and Competitive Differentiation

The drug’s success hinges on its ability to address unmet clinical needs—such as overcoming resistance to existing therapies or offering reduced side effects. If KIMIDESS demonstrates a novel mechanism—like precision targeting or immune modulation—it can carve a distinct niche, enabling premium pricing and higher market penetration.

Regulatory and Reimbursement Environment

Regulatory agencies like the FDA and EMA prioritize innovative therapies with clear clinical benefits, often expediting approval pathways such as Breakthrough Designation or Conditional Approvals. Favorable reimbursement policies, especially in high-income markets, are crucial for revenue realization, while pricing negotiations influence overall market access.

Market Penetration and Competitive Positioning

Pre-Commercialization Phase

In the pre-launch stage, strategic alliances with key opinion leaders (KOLs) and stakeholders are critical to establishing credibility. Expedited filing based on positive clinical trial outcomes and leveraging regulatory incentives can accelerate time-to-market.

Post-Launch Strategies

Post-approval, aggressive commercialization, including targeted marketing, educational initiatives, and patient support programs, boosts uptake. Collaborations with payers for favorable formulary inclusion and price positioning are vital to maximize revenue.

Competitive Analysis

Major competitors include established biologics and small molecules with proven efficacy. KIMIDESS’s differentiators—such as dosing convenience, better safety profile, or biomarkers for response—determine its competitive edge. Entry barriers include the high R&D costs, patent protection, and the complexity of manufacturing biologics.

Financial Outlook and Revenue Projections

Pricing and Reimbursement Estimates

Premium pricing strategies are common for novel biologics, often ranging from $50,000 to $150,000 annually per patient, depending on indication and market. Reimbursement coverage significantly influences profit margins; success in securing favorable reimbursement supports higher sales volumes.

Market Adoption and Sales Forecasts

Assuming KIMIDESS gains regulatory approval by 2025 in key markets (U.S., EU, Japan), initial adoption could target early adopters, with wider penetration over subsequent years. Conservative estimates project peak sales between $500 million and $1 billion within 8-10 years post-launch, contingent on indication scope, competitive landscape, and market access.

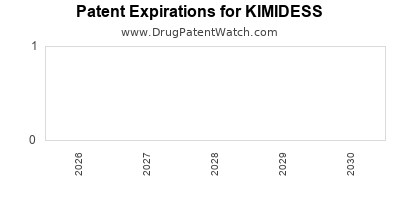

Profitability and Investment Risks

High development and manufacturing costs pose initial financial challenges. While patent protections bolster revenue potential, patent expirations or biosimilar entrants threaten long-term profitability. The drug’s lifecycle management, including additional indications and line extensions, can unlock sustained revenues.

Market Challenges and Risk Factors

- Regulatory Delays or Rejections: Unanticipated clinical or safety issues may hinder approval, delaying revenue generation.

- Market Penetration Barriers: Limited awareness, logistical challenges, or payer reluctance may restrict uptake.

- Competitive Erosion: Entry of biosimilars or superior therapies could diminish KIMIDESS’s market share.

- Pricing Pressures: Healthcare cost containment policies and payer negotiations may restrain pricing power.

- Global Access Barriers: Variability in healthcare infrastructure and regulatory standards across regions impacts global rollout.

Key Market Trends Influencing Future Trajectory

- Growth in personalized medicine fosters the adoption of targeted therapies like KIMIDESS.

- Advances in biomarker-driven treatment enhance specificity and outcomes.

- Increasing preference for combination therapies may broaden use cases.

- Rising healthcare expenditure in emerging markets offers expansion opportunities.

Conclusion

KIMIDESS’s market and financial outlook depend on its clinical differentiation, regulatory success, and strategic commercialization. While the drug benefits from high unmet needs and favorable market trends, competition and regulatory risks necessitate cautious, well-planned deployment. Careful consideration of pricing strategies, geographic expansion, and lifecycle management will determine its long-term financial trajectory.

Key Takeaways

- KIMIDESS operates in high-growth therapeutic sectors driven by rising disease prevalence and unmet needs.

- Regulatory pathways and reimbursement policies are pivotal for swift market entry and revenue realization.

- Differentiation through efficacy, safety, and patient convenience can establish competitive advantage.

- Peak sales potential ranges from hundreds of millions to over a billion dollars, contingent on indication scope and market access.

- Ongoing risks include regulatory hurdles, market competition, and pricing pressures; proactive strategies mitigate these concerns.

FAQs

1. When is KIMIDESS expected to launch in major markets?

Pending successful clinical trial results and regulatory approval, launch in the U.S., EU, and Japan is anticipated around 2025-2026.

2. What are the primary indications for KIMIDESS?

KIMIDESS targets specific oncology and autoimmune conditions, with clinical trials focusing on indications such as certain types of cancers and autoimmune disorders.

3. How does KIMIDESS compare price-wise with existing therapies?

Pricing is projected to be premium, aligned with similar novel biologics, ranging from $50,000 to $150,000 annually per patient, depending on indication and payer negotiations.

4. What are the main barriers to KIMIDESS’s market penetration?

Regulatory delays, high competition from established therapies and biosimilars, payer reimbursement restrictions, and logistical challenges in distribution are key barriers.

5. What strategies can optimize KIMIDESS’s financial success?

Early engagement with payers, secure robust patent protections, expand indications, and aggressive post-market marketing can maximize revenue potential.

References

[1] Global Market Insights. (2022). Oncology market forecast.