KERENDIA Drug Patent Profile

✉ Email this page to a colleague

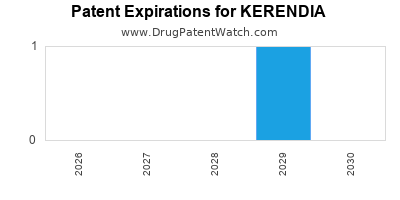

When do Kerendia patents expire, and when can generic versions of Kerendia launch?

Kerendia is a drug marketed by Bayer Hlthcare and is included in one NDA. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has ninety-six patent family members in forty-nine countries.

The generic ingredient in KERENDIA is finerenone. One supplier is listed for this compound. Additional details are available on the finerenone profile page.

DrugPatentWatch® Generic Entry Outlook for Kerendia

Kerendia was eligible for patent challenges on July 9, 2025.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be April 12, 2029. This may change due to patent challenges or generic licensing.

There have been three patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for KERENDIA?

- What are the global sales for KERENDIA?

- What is Average Wholesale Price for KERENDIA?

Summary for KERENDIA

| International Patents: | 96 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 33 |

| Clinical Trials: | 6 |

| Patent Applications: | 325 |

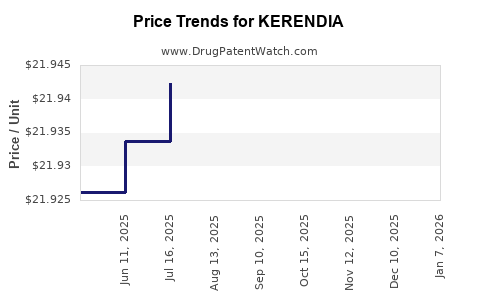

| Drug Prices: | Drug price information for KERENDIA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for KERENDIA |

| What excipients (inactive ingredients) are in KERENDIA? | KERENDIA excipients list |

| DailyMed Link: | KERENDIA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for KERENDIA

Generic Entry Date for KERENDIA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for KERENDIA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Boehringer Ingelheim | Phase 4 |

| University Medical Center Groningen | Phase 4 |

| University of North Carolina, Chapel Hill | Phase 2 |

Pharmacology for KERENDIA

| Drug Class | Nonsteroidal Mineralocorticoid-Receptor Antagonist |

| Mechanism of Action | Mineralocorticoid Receptor Antagonists |

Paragraph IV (Patent) Challenges for KERENDIA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| KERENDIA | Tablets | finerenone | 10 mg and 20 mg | 215341 | 9 | 2025-07-09 |

US Patents and Regulatory Information for KERENDIA

KERENDIA is protected by two US patents and four FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of KERENDIA is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,436,180.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bayer Hlthcare | KERENDIA | finerenone | TABLET;ORAL | 215341-001 | Jul 9, 2021 | RX | Yes | No | 8,436,180 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Bayer Hlthcare | KERENDIA | finerenone | TABLET;ORAL | 215341-002 | Jul 9, 2021 | RX | Yes | Yes | 8,436,180 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Bayer Hlthcare | KERENDIA | finerenone | TABLET;ORAL | 215341-001 | Jul 9, 2021 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bayer Hlthcare | KERENDIA | finerenone | TABLET;ORAL | 215341-003 | Jul 11, 2025 | RX | Yes | No | 8,436,180 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Bayer Hlthcare | KERENDIA | finerenone | TABLET;ORAL | 215341-002 | Jul 9, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for KERENDIA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Bayer AG | Kerendia | finerenone | EMEA/H/C/005200Kerendia is indicated for the treatment of chronic kidney disease (stage 3 and 4 with albuminuria) associated with type 2 diabetes in adults. | Authorised | no | no | no | 2022-02-16 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for KERENDIA

When does loss-of-exclusivity occur for KERENDIA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 5463

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 08221071

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0808098

Estimated Expiration: ⤷ Get Started Free

Patent: 2020008544

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 79232

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 08000502

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1641352

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 20951

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 976

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0150702

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 874

Estimated Expiration: ⤷ Get Started Free

Patent: 090148

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 16455

Estimated Expiration: ⤷ Get Started Free

Patent: 22022

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 32206

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 009000205

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 099581

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 32206

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1017

Estimated Expiration: ⤷ Get Started Free

Germany

Patent: 2007009494

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 0900230

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 09001597

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 40194

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 26441

Estimated Expiration: ⤷ Get Started Free

Patent: 200015

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 0060

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 67586

Estimated Expiration: ⤷ Get Started Free

Patent: 52754

Estimated Expiration: ⤷ Get Started Free

Patent: 10519232

Estimated Expiration: ⤷ Get Started Free

Patent: 14012678

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 18

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 2022512

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0260

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 0748

Estimated Expiration: ⤷ Get Started Free

Patent: 6873

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09008701

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 245

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1192

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 9230

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 22013

Estimated Expiration: ⤷ Get Started Free

Panama

Patent: 70101

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 090724

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 32206

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 32206

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 70932

Estimated Expiration: ⤷ Get Started Free

Patent: 09135659

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 290071

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 32206

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0905730

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1614164

Estimated Expiration: ⤷ Get Started Free

Patent: 090129992

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 40803

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 15608

Estimated Expiration: ⤷ Get Started Free

Patent: 74821

Estimated Expiration: ⤷ Get Started Free

Patent: 0843755

Estimated Expiration: ⤷ Get Started Free

Patent: 1340968

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 09000318

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 2065

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 931

Estimated Expiration: ⤷ Get Started Free

Patent: 952

Estimated Expiration: ⤷ Get Started Free

Patent: 953

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering KERENDIA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Brazil | PI0808098 | ⤷ Get Started Free | |

| South Korea | 20180041138 | (4S)-4--5-에톡시-2,8-디메틸-1,4-디히드로-1,6-나프티리딘-3-카르복스아미드의 제조 방법 및 활성 제약 성분으로서 사용하기 위한 그의 정제 | ⤷ Get Started Free |

| Hungary | E026441 | ⤷ Get Started Free | |

| Portugal | 2132206 | ⤷ Get Started Free | |

| Mexico | 367960 | PROCEDIMIENTO PARA LA PREPARACION DE (4S)-4-(4-CIANO-2-METOXIFENIL O)-5-ETOXI-2,8-DIMETILO-1,4-DIHIDRO-1,6-NAFTIRIDINA-3-CARBOXAMIDA Y SU PURIFICACION PARA SU USO COMO PRINCIPIO ACTIVO FARMACEUTICO. (METHOD FOR THE PREPARATION OF (4S)-4-(4-CYANO-2-METHOXYPHENYL)-5- ETHOXY-2,8-DIMETHYL-1,4-DIHYDRO-1-6-NAPHTHYRIDINE-3-CARBOXAMIDE AND THE PURIFICATION THEREOF FOR USE AS AN ACTIVE PHARMACEUTICAL INGREDIENT.) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for KERENDIA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2132206 | 15/2022 | Austria | ⤷ Get Started Free | PRODUCT NAME: FINERENON UND SALZE, SOLVATE UND SOLVATE DER SALZE DAVON; REGISTRATION NO/DATE: EU/1/21/1616 (MITTEILUNG) 20220217 |

| 2132206 | LUC00260 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: FINERENONE, SES SELS ET SOLVATES AINSI QUE LES SOLVATES DES SELS DE FINERENONE; AUTHORISATION NUMBER AND DATE: EU/1/21/1616 20220217 |

| 2132206 | PA2022512,C2132206 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: FINERENONAS; REGISTRATION NO/DATE: EU/1/21/1616 20220216 |

| 2132206 | PA2022512 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: FINERENONAS; REGISTRATION NO/DATE: EU/1/21/1616 20220216 |

| 2132206 | C202230028 | Spain | ⤷ Get Started Free | PRODUCT NAME: FINERENONA Y SUS SALES, SOLVATOS Y SOLVATOS DE LAS SALES; NATIONAL AUTHORISATION NUMBER: EU/1/21/1616; DATE OF AUTHORISATION: 20220216; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/21/1616; DATE OF FIRST AUTHORISATION IN EEA: 20220216 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.