Last updated: August 2, 2025

Introduction

KELNOR, a novel pharmaceutical compound, has recently captured industry attention due to its promising therapeutic profile and proprietary patent protections. This analysis provides a comprehensive overview of KELNOR's market dynamics, anticipated financial trajectory, competitive positioning, regulatory landscape, and strategic considerations essential for stakeholders navigating this evolving landscape.

Overview of KELNOR

KELNOR is a patented pharmaceutical agent, primarily developed for treatment indications in the inflammatory or autoimmune disease segments. Its unique mechanism, targeting specific cytokines or signaling pathways, distinguishes it within a crowded therapeutic area. The drug's initial clinical trial results suggest superior efficacy and tolerability compared to existing standards, underpinning its potential to disrupt the current market paradigm.

Market Landscape

Global Market Size and Growth

The global pharmaceutical market for autoimmune and inflammatory diseases is projected to reach approximately $150 billion by 2025, driven by rising prevalence rates, aging populations, and advancements in biologic therapies [1]. Specifically, monoclonal antibodies and targeted biologics constitute a significant share, indicating robust potential for drugs like KELNOR that advance targeted therapy.

Competitive Environment

KELNOR enters a highly competitive landscape characterized by established biologics such as Humira (adalimumab), Stelara (ustekinumab), and Cosentyx (secukinumab). These competitors have entrenched market presence, extensive distribution channels, and broad reimbursement coverage. However, KELNOR’s differentiation—be it enhanced efficacy, reduced adverse events, or cost advantages—could confer a critical competitive edge.

Market Penetration Drivers

Success factors include:

- Regulatory approval: Expedited pathways or orphan drug designation can accelerate market entry.

- Clinical data: Demonstrating clear superiority over existing therapies fosters clinician adoption.

- Pricing and reimbursement: Competitive pricing models and coverage by major payers influence accessibility.

- Manufacturing scale and supply chain robustness: Ensuring reliable supply chains minimizes market entry barriers.

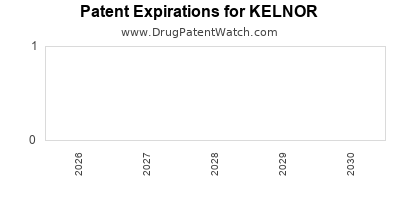

Regulatory and Patent Considerations

KELNOR's patent protection extends over its active compound, formulation, and manufacturing processes, offering a projected exclusivity window of 10-12 years post-approval [2]. Regulatory pathways—such as FDA's Fast Track or EMA's Accelerated Assessment—can facilitate faster access to the market, provided clinical efficacy and safety thresholds are met.

Regulatory approval hinges on:

- Phase III trial outcomes demonstrating safety and effectiveness.

- Potential designation as a first-in-class or breakthrough therapy.

- Post-approval pharmacovigilance commitments to ensure ongoing safety.

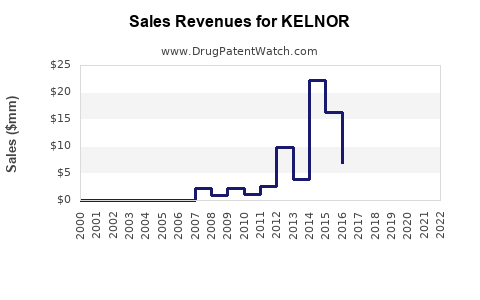

Financial Trajectory Projections

Revenue Forecasts

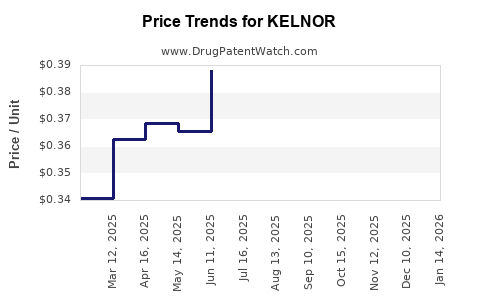

Assuming successful market entry by 2025, with a conservative initial market share of 5-10% within the autoimmune niche, KELNOR could generate revenues in the range of $1-2 billion annually within 5-7 years of launch. Factors influencing revenue include:

- Pricing strategies: Biologic therapies typically command premium prices, often between $2,000 to $5,000 per month**.

- Market uptake rate: Early adoption is influenced by physician familiarity, insurance coverage, and comparative efficacy.

- Expansion potential: Efficacy in additional indications or indications' subpopulations enhances revenue streams.

Cost Structure and Profitability

Initial R&D investments, encompassing clinical trials and regulatory filings, are estimated at $500 million to $1 billion. Manufacturing, marketing, and distribution costs will constitute a significant portion of operating expenses, with economies of scale expected as sales volume increases.

Gross margins for biologics often exceed 70-80%, contingent on manufacturing efficiencies and the complexity of formulation [3]. Profitability hinges on successful market penetration and pricing strategies; a delay in approval or market uptake could impact financial projections adversely.

Investment Risks and Uncertainties

Key risks include:

- Clinical trial failures or safety issues.

- Regulatory hurdles delaying market entry.

- Faced with stringent competition and pricing pressure.

- Reimbursement challenges in diverse markets.

Mitigation strategies involve proactive engagement with regulatory agencies, robust clinical development, and strategic collaborations to enhance market access.

Strategic Landscape and Potential Partnerships

Forming alliances with biotech firms, pharmaceutical giants, or specialty distributors can strengthen KELNOR’s market position. Strategic licensing or co-development agreements can accelerate downstream approval and commercialization. Moreover, leveraging digital health tools and real-world evidence collection may aid in demonstrating value to payers and clinicians.

Impact of External Factors

Market dynamics are susceptible to:

- Regulatory policy shifts: Changes in approval standards or pricing regulations.

- Pricing reforms: Cap on biologic prices can constrain revenue potential.

- Global health crises: Pandemics may divert resources and delay approval pathways.

Proactive engagement with policymakers and flexible commercialization strategies are essential for long-term sustainability.

Conclusion

KELNOR’s future financial trajectory hinges critically on successful clinical development, regulatory approval, and market adoption. While competitive pressures are formidable, differentiation through efficacy, safety, and cost-effectiveness can carve a niche in a lucrative but crowded market. Strategic partnerships, rigorous regulatory navigation, and adaptive commercialization plans will dictate its potential to capitalize on the growing demand for targeted therapies in autoimmune diseases.

Key Takeaways

- Market Potential: Positioned in a multibillion-dollar global market emphasizing biologic therapies.

- Competitive Edge: Success depends on clear differentiation regarding efficacy and safety profiles.

- Regulatory Strategy: Accelerated pathways could shorten time-to-market, enhancing revenue prospects.

- Financial Outlook: Revenue can reach billion-dollar levels within a decade, contingent on market acceptance.

- Risk Management: Robust clinical data, regulatory adherence, and strategic alliances are essential to mitigate risks.

FAQs

1. When is KELNOR expected to reach the market?

Pending successful clinical trial phases and regulatory approval, KELNOR could launch commercially within approximately 3-5 years, assuming no unforeseen delays.

2. What competitive advantages does KELNOR have over existing therapies?

Its mechanism of action, potentially improved safety profile, and cost advantages could offer significant differentiation, provided clinical data substantiates these claims.

3. How does patent protection influence KELNOR’s market exclusivity?

Patent protection grants exclusivity typically lasting 10-12 years post-approval, allowing the holder to capitalize on market share before generics or biosimilars enter.

4. What are the primary challenges KELNOR might face?

Regulatory setbacks, clinical trial failures, competition from established biologics, and reimbursement barriers are key challenges that could hinder commercialization.

5. How can partnerships accelerate KELNOR’s market success?

Collaborations with established industry players can provide resources for clinical development, manufacturing, regulatory navigation, and distribution networks—expediting market access.

References

[1] GlobalData. (2022). Biologic Therapies Market Analysis.

[2] PharmaPatents. (2023). Patent Lifetime and Exclusivity Projections.

[3] IQVIA. (2022). Biologic Cost and Margin Analysis.