Last updated: September 15, 2025

Introduction

KAPVAY, a brand name for extended-release clonidine, has established itself within the pharmaceutical landscape as a crucial therapeutic option primarily indicated for ADHD management in pediatric populations. As a central nervous system agent, its market performance hinges on patient demand, regulatory shifts, competitive dynamics, and evolving clinical guidelines. This analysis delineates the factors shaping KAPVAY’s market trajectory and forecasts its financial outlook.

Pharmacological Profile and Indications

KAPVAY (clonidine extended-release) operates as an alpha-2 adrenergic agonist, reducing sympathetic outflow from the central nervous system. Its primary indication is attention deficit hyperactivity disorder (ADHD) in children aged six years and older, often prescribed as a monotherapy or adjunct to stimulants for managing hyperactivity, impulsivity, and in some cases, sleep disturbances. The drug’s unique extended-release formulation enhances compliance and minimizes dosing frequency, providing a competitive advantage over immediate-release formulations.

Market Dynamics

1. Growing Prevalence of ADHD and Market Demand

The rising prevalence of ADHD globally acts as a primary driver for KAPVAY's market. According to the CDC, approximately 9.4% of children in the U.S. are diagnosed with ADHD[1], a statistic reflected in increasing healthcare utilization and medication prescriptions. The surge in diagnosis rates, combined with the preference for long-acting formulations in pediatric care, bolsters demand for drugs like KAPVAY.

2. Operational and Regulatory Factors

The U.S. Food and Drug Administration (FDA) approved KAPVAY in 2007[2], with subsequent EMA approvals expanding its reach. Regulations mandating rigorous clinical trials for pediatric medications influence the pace of new entries and modifications. Recently, heightened scrutiny over sedative and alpha-2 agonist agents, associated safety concerns such as hypotension and bradycardia, necessitate vigilant post-marketing surveillance, impacting sales trajectories.

3. Competitive Landscape and Market Share

KAPVAY operates within a competitive environment comprising stimulant medications (e.g., methylphenidate and amphetamines), other non-stimulant agents such as atomoxetine, and newer extended-release formulations. Notably, newer non-stimulant drugs with improved tolerability profiles have gained adoption, diminishing KAPVAY's market share. Nevertheless, its niche role, especially in patients intolerant to stimulants, sustains steady demand.

4. Prescriber and Patient Preferences

Clinician comfort with KAPVAY, driven by its efficacy and side effect profile, influences prescribing patterns. Parent and caregiver preferences for non-stimulant therapies, especially amid concerns over abuse potential related to stimulants, favor continued utilization. However, concerns over side effects like dry mouth, fatigue, and hypotension can limit broader adoption.

5. Emerging Therapeutic Alternatives and Innovation

The pipeline of ADHD pharmacotherapeutics includes novel non-stimulant agents and behavioral interventions, potentially impacting KAPVAY's market. Additionally, digital therapeutics and behavioral strategies increasingly complement pharmacotherapy, shifting demand dynamics.

Financial Trajectory

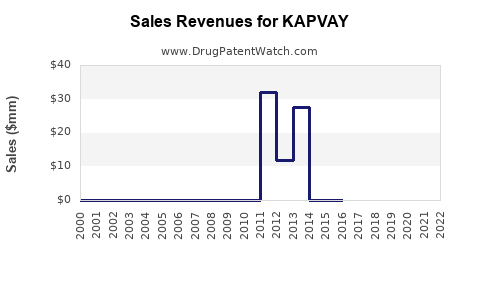

1. Revenue Trends and Historical Performance

KAPVAY's initial launch in 2007 facilitated a modest but consistent revenue stream. Post-2010, sales growth corresponded with rising ADHD prevalence and expanded approvals. However, in recent years, sales plateaued owing to competitive pressures and the genericization of clonidine formulations.

2. Patent and Market Access

While KAPVAY’s patent life concluded prior to 2010, exclusivity was maintained through formulation patents and pediatric exclusivity periods, temporarily shielding it from generics[3]. The introduction of generic clonidine extended allusions to cost-effectiveness, compelling pricing to decline and squeezing profit margins for branded versions.

3. Market Penetration and Geographic Factors

The drug remains predominantly a U.S.-market leader owing to early approval and established guidelines. In emerging markets, regulatory enzymes and healthcare infrastructure limitations restrict access, although growth prospects exist due to rising ADHD awareness.

4. Pricing Strategies and Reimbursement Policies

Pricing transparency and reimbursement policies influence revenues. Managed care organizations often favor generics to control costs, pressuring branded KAPVAY sales. Strategic discounting and rebate arrangements remain pivotal to maintain market presence.

5. Forecasting and Growth Opportunities

The overall market for ADHD medications is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4-6% over the next five years[4]. KAPVAY’s growth will depend on its ability to differentiate through clinical outcomes, safety profile, and patient adherence programs. The aging pediatric population, along with increasing diagnosis rates, suggests a cautiously optimistic revenue trend.

6. Impact of COVID-19 Pandemic

The pandemic resulted in disrupted healthcare delivery, delayed diagnoses, and prescription adjustments. As healthcare settings normalize, a resurgence in ADHD diagnoses has been observed, potentially reinvigorating demand. Conversely, transient economic downturns may influence healthcare expenditure and drug utilization behaviors.

Key Challenges and Risks

- Generic Competition: Patent expiration and the proliferation of generic clonidine formulations threaten branded product revenues.

- Safety Concerns: Adverse events may lead to prescribing hesitancy or regulatory warnings, impacting demand.

- Market Penetration: Limited awareness in non-U.S. markets reduces global revenue potential.

- Development of Novel Therapies: Advances in digital and behavioral interventions could substitute pharmacotherapy.

Opportunities for Growth

- Expanded Indications: Investigating KAPVAY’s efficacy in off-label indications such as hypertension in adults or post-traumatic stress disorder (PTSD) can diversify revenue streams.

- Formulation Innovations: Developing combination formulations or improving delivery methods could enhance patient compliance.

- Market Expansion: Tailored strategies targeting emerging markets, augmented by local regulatory engagement, can unlock new growth avenues.

- Strategic Collaborations: Partnerships and licensing agreements may facilitate broader distribution and formulary inclusion.

Conclusion

KAPVAY’s market and financial prospects are intricately tied to the dynamics of ADHD diagnosis trends, competitive pressures, regulatory landscapes, and innovation in treatment modalities. While facing commoditization challenges driven by generic entry, strategic focus on niche indications, differentiated clinical data, and geographic expansion can sustain its relevance. The future trajectory remains cautiously optimistic, contingent on effective market positioning and responding proactively to evolving therapeutic landscapes.

Key Takeaways

- Demand Drivers: Rising ADHD diagnosis rates and increased preference for non-stimulant therapies underpin steady demand for KAPVAY.

- Competitive Pressures: Patent expiry and generic clonidine formulations exert downward price pressures on branded revenues.

- Market Growth: The broader pediatric ADHD market is projected to grow at 4-6% CAGR, offering growth opportunities despite challenges.

- Innovation and Expansion: Diversifying indications and expanding into emerging markets can bolster long-term financial performance.

- Regulatory and Safety Dynamics: Vigilant compliance and safety profile management are critical to maintaining prescriber confidence and market share.

FAQs

1. How does KAPVAY compare with other ADHD treatments?

KAPVAY offers a non-stimulant alternative with a favorable dosing schedule. Its efficacy is comparable in certain patient populations, but it faces competition from other non-stimulants and stimulants with higher market share.

2. What is the impact of patent expiration on KAPVAY’s market?

Patent expiration has allowed generic clonidine formulations to enter the market, intensifying price competition and reducing branded sales margins.

3. Are there specific safety concerns associated with KAPVAY?

Yes, adverse effects such as hypotension, bradycardia, and sedation warrant monitoring. These safety considerations influence prescribing decisions and post-market surveillance.

4. What are the growth prospects of KAPVAY in emerging markets?

Emerging markets provide growth potential due to increasing recognition of ADHD and expanding healthcare infrastructure, although regulatory hurdles and cost considerations pose challenges.

5. Could new therapies threaten KAPVAY’s market share?

Yes, innovations such as digital therapeutics and novel pharmacological agents are potential disruptors. However, KAPVAY’s niche positioning and clinical profile can sustain its relevance with appropriate strategic adjustments.

References

[1] Centers for Disease Control and Prevention (CDC). (2022). Data & Statistics on ADHD.

[2] FDA. (2007). Approval Letter for KAPVAY.

[3] U.S. Patent and Trademark Office. (2010). Patent timeline for clonidine formulations.

[4] MarketWatch. (2023). ADHD therapeutics market outlook and growth prospects.