JENTADUETO XR Drug Patent Profile

✉ Email this page to a colleague

When do Jentadueto Xr patents expire, and what generic alternatives are available?

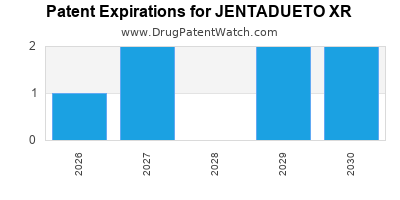

Jentadueto Xr is a drug marketed by Boehringer Ingelheim and is included in one NDA. There are ten patents protecting this drug and one Paragraph IV challenge.

This drug has three hundred and ninety-seven patent family members in forty-five countries.

The generic ingredient in JENTADUETO XR is linagliptin; metformin hydrochloride. There are nineteen drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the linagliptin; metformin hydrochloride profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Jentadueto Xr

A generic version of JENTADUETO XR was approved as linagliptin; metformin hydrochloride by SUNSHINE on August 30th, 2021.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for JENTADUETO XR?

- What are the global sales for JENTADUETO XR?

- What is Average Wholesale Price for JENTADUETO XR?

Summary for JENTADUETO XR

| International Patents: | 397 |

| US Patents: | 10 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 6 |

| Clinical Trials: | 1 |

| Patent Applications: | 146 |

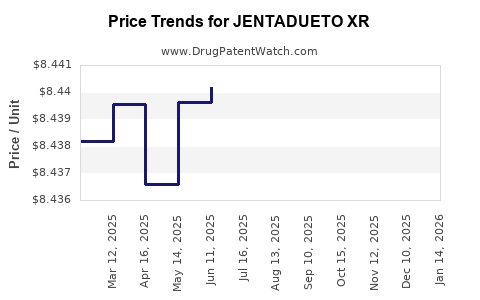

| Drug Prices: | Drug price information for JENTADUETO XR |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for JENTADUETO XR |

| What excipients (inactive ingredients) are in JENTADUETO XR? | JENTADUETO XR excipients list |

| DailyMed Link: | JENTADUETO XR at DailyMed |

Recent Clinical Trials for JENTADUETO XR

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Boehringer Ingelheim | Phase 1 |

Pharmacology for JENTADUETO XR

| Drug Class | Biguanide Dipeptidyl Peptidase 4 Inhibitor |

| Mechanism of Action | Dipeptidyl Peptidase 4 Inhibitors |

Paragraph IV (Patent) Challenges for JENTADUETO XR

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| JENTADUETO XR | Extended-release Tablets | linagliptin; metformin hydrochloride | 2.5 mg/1000 mg 5 mg/1000 mg | 208026 | 1 | 2018-03-28 |

US Patents and Regulatory Information for JENTADUETO XR

JENTADUETO XR is protected by ten US patents and two FDA Regulatory Exclusivities.

Expired US Patents for JENTADUETO XR

EU/EMA Drug Approvals for JENTADUETO XR

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Boehringer Ingelheim International GmbH | Jentadueto | linagliptin, metformin hydrochloride | EMEA/H/C/002279Treatment of adult patients with type-2 diabetes mellitus:Jentadueto is indicated as an adjunct to diet and exercise to improve glycaemic control in adult patients inadequately controlled on their maximal tolerated dose of metformin alone, or those already being treated with the combination of linagliptin and metformin.Jentadueto is indicated in combination with a sulphonylurea (i.e. triple combination therapy) as an adjunct to diet and exercise in adult patients inadequately controlled on their maximal tolerated dose of metformin and a sulphonylurea. | Authorised | no | no | no | 2012-07-19 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for JENTADUETO XR

When does loss-of-exclusivity occur for JENTADUETO XR?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0269

Patent: COMPOSICION FARMACEUTICA Y SUS USOS

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 13229538

Patent: Pharmaceutical compositions comprising metformin and a DPP-4 inhibitor or a SGLT-2 inhibitor

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 66421

Patent: COMPOSITIONS PHARMACEUTIQUES COMPRENANT DE LA METFORMINE ET UN INHIBITEUR DE DPP -4 OU UN INHIBITEUR DE SGLT -2 (PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP -4 INHIBITOR OR A SGLT-2 INHIBITOR)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 14002325

Patent: Composicion farmaceutica que comprende metformina y un inhibidor de dpp-4 con preferencia linagliptina o un inhibidor de sglt-2 con preferencia 1-cloro-4-(beta-d-glucopiranos-1-il)-2-[4-((s)-tetrahidrofuran-3-iloxi)-bencil]-benceno; y comprimido de administracion oral.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4220049

Patent: Pharmaceutical compositions comprising metformin and DPP -4 inhibitor or SGLT-2 inhibitor

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1400986

Patent: ФАРМАЦЕВТИЧЕСКИЕ КОМПОЗИЦИИ, СОДЕРЖАЩИЕ МЕТФОРМИН И ИНГИБИТОР DPP-4 ИЛИ ИНГИБИТОР SGLT-2

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 22544

Patent: COMPOSITIONS PHARMACEUTIQUES COMPRENANT DE LA METFORMINE ET UN INHIBITEUR DE DPP -4 OU UN INHIBITEUR DE SGLT -2 (PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP -4 INHIBITOR OR A SGLT-2 INHIBITOR)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 04953

Patent: 包含二甲雙胍和 抑制劑或 抑制劑的藥物組合物 (PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP -4 INHIBITOR OR A SGLT-2 INHIBITOR DPP-4 SGLT-2)

Estimated Expiration: ⤷ Get Started Free

India

Patent: 01DEN2014

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 15509519

Patent: メトホルミン及びDPP−4阻害薬又はSGLT−2阻害薬を含む医薬組成物

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 14010560

Patent: COMPOSICIONES FARMACEUTICAS QUE COMPRENDEN METFORMINA Y UN INHIBIDOR DE DPP-4 O UN INHIBIDOR DE SGLT-2. (PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP -4 INHIBITOR OR A SGLT-2 INHIBITOR.)

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 014501984

Patent: PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP-4 INHIBITOR OR A SGLT-2 INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201405509U

Patent: PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP -4 INHIBITOR OR A SGLT-2 INHIBITOR

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 140131950

Patent: PHARMACEUTICAL COMPOSITIONS COMPRISING METFORMIN AND A DPP-4 INHIBITOR OR A SGLT-2 INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 1400144

Patent: Pharmaceutical composition and uses thereof

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering JENTADUETO XR around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Brazil | PI0711308 | ⤷ Get Started Free | |

| Spain | 2474866 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2010043688 | ⤷ Get Started Free | |

| European Patent Office | 2285410 | DPP-IV INHIBITEUR COMBINÉ AVEC UN AUTRE AGENT ANTI-DIABÉTIQUE, COMPRIMÉS COMPRENANT LESDITES FORMULATIONS, LEUR UTILISATION ET LEUR PROCÉDÉ DE PRÉPARATION (DPP-IV INHIBITOR COMBINED WITH A FURTHER ANTIDIABETIC AGENT, TABLETS COMPRISING SUCH FORMULATIONS, THEIR USE AND PROCESS FOR THEIR PREPARATION) | ⤷ Get Started Free |

| Uruguay | 29190 | PROCEDIMIENTO PARA PREPARAR 8-(3-AMINO-PIPERIDIN-1-IL)-XANTINAS QUIRALES | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for JENTADUETO XR

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1084705 | C300707 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: SAXAGLIPTIN; REGISTRATION NO/DATE: EU/1/09/545/001-010 20091001 |

| 1730131 | C01730131/03 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: EMPAGLIFLOZIN UND LINAGLIPTIN; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 66132 29.03.2017 |

| 1532149 | 91889 | Luxembourg | ⤷ Get Started Free | 91889, EXPIRES: 20260824 |

| 1532149 | 132013902118390 | Italy | ⤷ Get Started Free | PRODUCT NAME: LINAGLIPTIN + METFORMINA CLORIDRATO(JENTADUETO); AUTHORISATION NUMBER(S) AND DATE(S): DA EU/1/12/780/001 A EU/1/12/780/027, 20120720 |

| 1084705 | C01084705/03 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: SAXAGLIPTIN; REGISTRATION NO/DATE: SWISSMEDIC 59390 05.02.2010 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for JENTADUETO XR

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.