Last updated: July 28, 2025

Introduction

JENTADUETO XR is a combination pharmaceutical comprising ertugliflozin and sitagliptin, marketed primarily for managing type 2 diabetes mellitus (T2DM). As a novel agent within the growth segment of SGLT2 inhibitors combined with DPP-4 inhibitors, JENTADUETO XR occupies a distinctive niche in the expanding landscape of diabetes therapeutics. This analysis examines market dynamics, competitive positioning, regulatory factors, and price projections to inform stakeholders and industry participants.

Market Overview and Industry Landscape

Global Diabetes Market Context

The global diabetes management market was valued at approximately $64 billion in 2022, with projections reaching over $90 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 6-7% [1]. The increasing prevalence of T2DM, driven by lifestyle factors and aging populations, underpins sustained demand. The introduction of combination therapies, like JENTADUETO XR, offers enhanced glycemic control with improved patient compliance, favorably impacting market growth.

JENTADUETO XR’s Therapeutic Niche

JENTADUETO XR combines two antidiabetic agents with complementary mechanisms: ertugliflozin (SGLT2 inhibitor) facilitates glycosuria, reducing plasma glucose levels, while sitagliptin (DPP-4 inhibitor) enhances incretin activity, improving insulin secretion. Its once-daily, extended-release formulation enhances adherence, especially in patients requiring multi-mechanistic therapy, positioning it well within chronic disease management paradigms.

Regulatory and Patent Landscape

Regulatory Status

JENTADUETO XR was approved by the U.S. Food and Drug Administration (FDA) in 2019, expanding the line of approved ertugliflozin-containing formulations. Other regulatory agencies, including EMA and Japan’s PMDA, have granted approvals, albeit with regional variations in indication scope.

Patent and Exclusivity Timeline

U.S. patent protections extend into the late 2020s, with exclusivity rights providing a competitive barrier. Patent expiry and potential biosimilar entry could influence future pricing dynamics, although currently, no biosimilars or generics are approved or in advanced development stages for this fixed-dose combination.

Competitive Positioning and Market Share

Key Competitors

JENTADUETO XR faces competition from several classes of antidiabetic agents:

- SGLT2 Inhibitors: Jardiance (empagliflozin), Invokana (canagliflozin), and Farxiga (dapagliflozin).

- DPP-4 Inhibitors: Tradename variants like Januvia (sitagliptin) alone, and other fixed-dose combinations such as Janumet (sitagliptin/metformin).

Market Penetration and Adoption Trends

The drug’s penetration is driven by physician preference for combination therapies with proven cardiovascular and renal benefits, a notable advantage of some competing products. Additionally, increasing adoption hinges on evidence from cardiovascular outcome trials and real-world data favoring safety and tolerability.

Pricing Strategies and Trends

Current Pricing Landscape

As of 2023, JENTADUETO XR’s wholesale acquisition cost (WAC) per month ranges from $500 to $700 in the U.S., aligned with other combination oral antidiabetics [2]. Factors influencing pricing include:

- Formulation advantages: Extended-release tablets reduce pill burden.

- Market exclusivity: Patent protections uphold premium pricing.

- Reimbursement policies: Coverage by Medicare/Medicaid and private insurers impacts net prices.

Cost-Effectiveness and Pricing Initiatives

Value-based pricing is increasingly relevant, emphasizing durability of glycemic control, cardiovascular outcomes, and renal benefits, which could justify premium pricing. Programs offering patient assistance and formulary negotiations also shape net pricing.

Future Price Projections (2023-2030)

Market Dynamics Influencing Price Trends

- Patent Expiry and Biosimilar Entry: Expected between 2026-2028, potentially leading to price erosion.

- Regulatory and Reimbursement Developments: Enhanced coverage might support sustained pricing despite competition.

- Market Penetration of Generics and Biosimilars: Will exert downward pressure, especially in high-volume segments.

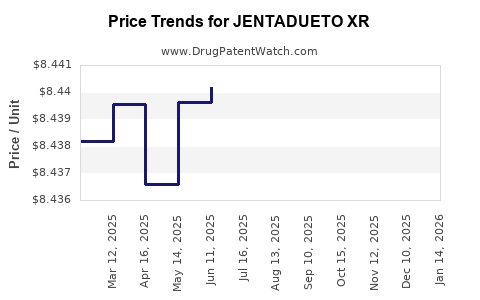

Projected Price Fluctuations

- Short-term (2023-2025): Stable pricing with possible slight increases (~2-4%) driven by inflation, manufacturing cost adjustments, and value-based negotiations.

- Mid-term (2026-2028): Potential decline of 20-30% post-expiry of patent exclusivity, aligning with generic entry.

- Long-term (2029+): Stabilization at a lower price point, possibly 40-50% below current levels, contingent on competition and market uptake.

Factors Potentially Impacting Pricing and Market Share

- Clinical Trial Data: Positive results on cardiovascular and renal benefits can sustain or elevate pricing premium.

- Regulatory Changes: Policy shifts affecting drug pricing and reimbursement could alter market dynamics.

- Market Penetration Strategies: Strategic collaborations, patient assistance programs, and formulary placement will influence volume and revenue.

Conclusion

JENTADUETO XR commands a strong position within the expanding landscape of combination oral therapies for T2DM. Its current premium pricing aligns with its clinical benefits, patent protections, and market exclusivity. However, impending patent expirations and competitive pressures forecast a gradual decline in prices, especially post-2026. Stakeholders should closely monitor regulatory developments, clinical trial outcomes, and biosimilar entry to refine pricing and market strategies.

Key Takeaways

- JENTADUETO XR is positioned as a premium, once-daily combination therapy in the competitive T2DM market, supported by patent exclusivity through the late 2020s.

- Currently priced between $500-$700 monthly in the U.S., with scope for fluctuation based on market and regulatory developments.

- Patent expiration around 2026-2028 is likely to trigger significant price reductions due to biosimilar and generic competition.

- Clinical trial data demonstrating cardiovascular and renal benefits could justify sustained higher pricing levels.

- Strategic engagement with payers, continued clinical validation, and lifecycle management are vital for maximizing revenue in a dynamic market.

FAQs

1. When is JENTADUETO XR expected to lose patent protection?

Patent protections are anticipated to expire around 2026-2028, subject to legal extensions and patent litigations.

2. How does JENTADUETO XR compare cost-wise to other combination therapies?

It is priced similarly to other branded combination antidiabetics; however, its premium positioning reflects clinical benefits and formulation advantages.

3. What factors could influence price adjustments for JENTADUETO XR?

Patent status, clinical trial outcomes, competitive biosimilar availability, payer reimbursement policies, and market penetration strategies.

4. Are biosimilars likely to enter the market for JENTADUETO XR?

While biosimilars are more common in biologics, the oral fixed-dose combination could be challenged by generics of individual components, but a true biosimilar entry is unlikely given the nature of the compound.

5. What is the outlook for JENTADUETO XR in terms of market share?

It is poised to capture a significant segment of the combination therapy market in the short term, with growth plateauing as competition intensifies and generics enter.

References

[1] MarketsandMarkets. Diabetes Drugs Market, 2022.

[2] Drug Price Info. JENTADUETO XR Wholesale Acquisition Cost, 2023.