Last updated: August 6, 2025

Introduction

The pharmaceutical landscape is continually evolving, driven by innovation, regulatory shifts, and changing healthcare paradigms. Among emerging products, JADELLE, a combination oral contraceptive comprising dienogest and estradiol valerate, has garnered significant attention. Its market presence, growth potential, and financial trajectory depend on a confluence of factors including regulatory approvals, competitive landscape, consumer preferences, and market adaptation strategies.

This comprehensive analysis explores pivotal market dynamics shaping JADELLE's positioning and forecasts its financial prospects over the coming years.

Regulatory and Patent Milestones

JADELLE received regulatory approval in several key markets, including the European Union and the United States. The European Medicines Agency (EMA) approved JADELLE as an oral contraceptive designed for women seeking effective birth control with added therapeutic benefits, such as the management of acne and dysmenorrhea. The U.S. Food and Drug Administration (FDA) granted approval following rigorous clinical trials demonstrating efficacy and safety comparable to existing contraceptives.

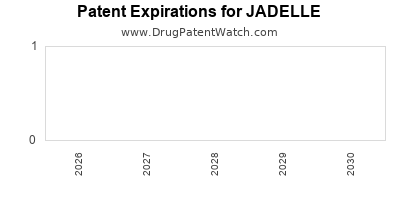

Patent protections for JADELLE, covering its formulation and delivery mechanisms, provide a competitive moat for an initial exclusivity period. Patent expiry timelines, projected within the next five to seven years, are critical milestones that could influence generic entry strategies, price competition, and market share dynamics.

Market Size and Segmentation

The global contraceptive market was valued at approximately USD 21.7 billion in 2021 and is projected to reach USD 28.5 billion by 2028, with a compound annual growth rate (CAGR) of around 4.2% [1]. Within this landscape, oral contraceptives account for the largest share, driven by convenience, efficacy, and cultural acceptance.

JADELLE specifically targets women aged 15-49 seeking reliable contraception, with an emphasis on those who also experience acne or dysmenorrhea, common reasons for contraceptive choice. The increasing awareness of hormonal contraception benefits, coupled with educational campaigns, bolsters the segment's growth.

Moreover, expanding use of combined oral contraceptives in emerging markets such as Asia-Pacific and Latin America presents considerable upside. These regions, featuring a rising middle class and improved healthcare infrastructure, are witnessing increased acceptance and access to contraceptive options.

Competitive Landscape

JADELLE faces competition from established contraceptive brands including Yasmin, ortho Tri-Cyclen, and newer entrants like Solosec and Swell. Generic formulations of popular oral contraceptives threaten to commoditize the market post-patent expiration.

Key differentiators for JADELLE include its dual mechanism—combining dienogest and estradiol valerate—to potentially offer fewer side effects and enhanced tolerability. Additionally, its therapeutic indications beyond contraception, such as acne treatment, provide a value-added proposition.

Pharmaceutical giants like Bayer, Teva, and Pfizer hold substantial market shares, emphasizing the importance of aggressive marketing, patient adherence programs, and physician education to carve a niche for JADELLE.

Pricing and Reimbursement Dynamics

Pricing strategies are pivotal; premium pricing can be justified through clinical benefits, added therapeutic indications, and patient preferred attributes. Reimbursement policies in key regions vary; in Europe, healthcare systems often reimburse contraceptives, whereas out-of-pocket costs dominate in the U.S.

Insurance coverage and formulary inclusion influence demand. Securing placement in major insurance plans enhances accessibility and sales volume, directly impacting revenue projections.

Market Penetration Strategies

Optimizing market penetration involves strategic initiatives such as:

- Direct-to-Consumer Marketing: Raising awareness about JADELLE's unique benefits through digital platforms.

- Physician Engagement: Educating healthcare providers on clinical evidence and comparative advantages.

- Partnerships with Health Authorities: Facilitating inclusion in national formularies and guidelines.

- Patient Support Programs: Enhancing adherence and fostering brand loyalty.

Tailored strategies for emerging markets can tap into unmet needs, broadening market reach.

Financial Trajectory Outlook

Projected revenues for JADELLE hinge on multiple variables:

-

Market Penetration Rate: Conservative estimates suggest an initial market share of 5-10% within the oral contraceptive segment in developed markets.

-

Pricing Assumptions: A premium price point of USD 30-50 per pack, reflecting added benefits, can generate significant margins.

-

Sales Volume Growth: Assuming a compound annual increase of 15-20% over five years, contingent on marketing and reformulation success.

Considering these factors, early-stage revenues could reach USD 200-300 million within three years post-launch, with potential to surpass USD 500 million as market penetration deepens. Longer-term, patent expiry and the advent of generics may pressure margins, emphasizing the importance of innovation and brand loyalty.

Risks and Challenges

Several risks threaten optimal financial trajectories:

- Patent Cliff: Expiry within a 5-7 year horizon could lead to increased generic competition.

- Regulatory Delays: Additional approvals or post-market safety concerns could hamper sales.

- Market Saturation: Penetration rates may plateau amidst stiff competition.

- Pricing Pressures: Reimbursement constraints and price erosion can diminish profit margins.

Mitigation strategies involve diversifying indications, expanding geographic footprint, and investing in R&D for next-generation formulations.

Regulatory and Legal Considerations

Intellectual property management remains crucial. Securing patent extensions through additional filings and defending against patent challenges safeguard market exclusivity. Compliance with evolving regulatory standards in major markets protects license-to-operate and avoids costly litigation.

Long-Term Outlook and Growth Opportunities

Advancements in personalized medicine, formulation innovations, and combination therapies present growth avenues. The integration of digital health tools to monitor adherence and side effects can enhance patient outcomes, fostering brand loyalty.

Emerging markets, particularly in Asia and Africa, wield significant potential due to demographic trends and unmet contraceptive needs. Building local manufacturing and distribution channels can accelerate regional market share.

Key Takeaways

- Patent and Regulatory Milestones: Critical for initial market exclusivity and revenue generation; expiry timelines require strategic planning.

- Growing Market Demand: Driven by demographic shifts, increasing awareness, and expanding healthcare access.

- Competitive Differentiation: Ability to highlight unique benefits and therapeutic indications supports market penetration.

- Pricing and Reimbursement Strategy: Essential for optimizing revenue; partnerships with insurers bolster demand.

- Long-term Growth: Dependent on innovation, portfolio diversification, and expansion into emerging markets.

FAQs

-

What are the primary factors influencing JADELLE's market success?

Market success hinges on its clinical efficacy, safety profile, differentiation from competitors, pricing strategies, regulatory approvals, and physician and consumer acceptance.

-

When will generic versions of JADELLE potentially enter the market?

Patent protections typically last 5-7 years post-launch, after which generics may compete, potentially affecting revenue and market share.

-

How does JADELLE compare to existing contraceptives regarding side effects?

Preliminary data suggest JADELLE may reduce side effects like mood swings and breakthrough bleeding due to its formulation, improving tolerability and adherence.

-

What role does emerging market expansion play in JADELLE's financial outlook?

Expansion into Asia-Pacific, Latin America, and Africa offers substantial upside owing to rising contraceptive demand and demographic trends.

-

What strategies can extend JADELLE's competitive advantage amidst patent expiry?

Investing in R&D for new formulations, expanding indications, and developing digital adherence tools can help sustain market relevance.

References

[1] MarketsandMarkets. “Contraceptive Market By Type, End-User, And Region - Global Forecast To 2028.” 2022.