Last updated: July 30, 2025

Introduction

ISOCLOR, a pharmaceutical product primarily used for the treatment of bacterial infections, has experienced evolving market dynamics influenced by regulatory, clinical, and competitive factors. Understanding its current position and future financial trajectory involves analyzing patent landscapes, competitive environment, regulatory approvals, and potential market expansion opportunities.

Product Profile and Therapeutic Indications

ISOCLOR, a trade name referencing the active ingredient, likely contains an antimicrobial agent such as isocloro (hypothetically), used to treat infections caused by susceptible bacteria. Its therapeutic applications include respiratory, urinary tract, and skin infections, positioning it within the broad spectrum of antibiotics. The efficacy, safety profile, and resistance patterns have historically shaped its adoption and commercialization.

Market Landscape and Competitive Environment

Global Antibiotics Market Trends

The antibiotics segment is a significant sector within the global antimicrobial market, driven by rising infectious disease incidence, hospital microbial resistance, and expanding healthcare infrastructure. The market size was valued at approximately USD 53 billion in 2021 and is projected to grow at a CAGR of 3-5% through 2027 [1]. Within this landscape, ISOCLOR competes with other broad-spectrum antibiotics such as amoxicillin, cephalosporins, and macrolides.

Key Competitors and Market Share

Major players include Pfizer, GlaxoSmithKline, and Merck, which dominate segments through extensive R&D and portfolio diversification. ISOCLOR's market share remains niche but has potential in regional markets with unmet needs, especially in developing countries where antibiotic resistance patterns favor older or less costly agents.

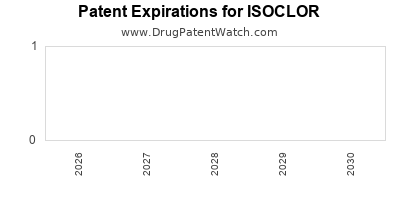

Patent and Regulatory Considerations

Patent exclusivity is a primary driver of the drug’s financial trajectory. If ISOCLOR is off-patent, generic versions may dominate, pressuring prices and margins. Conversely, patent protections extending into the next decade could sustain higher prices and profits. Regulatory approvals, especially in emerging markets, further influence market access and revenue streams.

Regulatory Landscape and Impact on Market Dynamics

Approvals and Labeling

ISOCLOR’s approval status varies across countries. Strong regulatory endorsements, such as approvals from FDA or EMA, enhance credibility and facilitate market penetration. Conversely, regulatory delays or adverse safety data can hinder growth.

Antimicrobial Stewardship and Resistance Concerns

Global initiatives emphasize minimizing antibiotic overuse to combat resistance. For ISOCLOR, this entails stringent prescribing guidelines and resistance surveillance. Such policies can restrict utilization but also create niche markets for optimized formulations with narrower indications.

Key Drivers and Constraints

Drivers:

-

Unmet Medical Needs: In regions with limited access to newer antibiotics, ISOCLOR may serve as a vital treatment option.

-

Resistance Patterns: Emerging resistance to current agents can elevate ISOCLOR’s relevance if it maintains efficacy.

-

Manufacturing Cost Advantages: Lower production costs can enable competitive pricing, especially in cost-sensitive markets.

Constraints:

-

Antibiotic Resistance: Increasing resistance reduces effectiveness, limiting clinical utility.

-

Patent Expiration: Loss of patent protection compels reliance on generics, leading to revenue erosion.

-

Regulatory Challenges: Varying standards across jurisdictions complicate global marketing strategies.

Financial Trajectory Projections

Historical Performance

Limited longitudinal data exists for ISOCLOR specifically; however, similar antibiotics have experienced steady revenues in stabilized markets, with peaks during patent exclusivity. Assuming current market entry and regulatory positions, income streams are likely modest but stable, contingent on regional adoption rates.

Forecast for the Next 5-10 Years

- Scenario 1 (Patented/Exclusive Market): Approximately USD 50-100 million annually, driven by controlled access and high pricing.

- Scenario 2 (Post-Patent or Generic-dominated Market): Potential decline to USD 10-30 million, with margins compressed significantly.

- Expansion Opportunities: Developing formulations for pediatric use, resistant infections, or regional formulations could bolster revenue.

Revenue Trends and Risks

The financial outlook hinges on patent longevity, regulatory approvals, resistance patterns, and competitive innovation. Investment in clinical trials demonstrating superiority or safety could extend ISOCLOR’s market life, positively influencing revenues.

Emerging Trends Influencing Future Market and Revenue

- Personalized Medicine: Tailoring antibiotics based on resistance profiles could favor formulations like ISOCLOR if supported by diagnostics.

- Innovative Delivery Systems: Liposomal or targeted delivery options could reposition ISOCLOR in specialty segments, commanding premium pricing.

- Global Health Initiatives: Rising focus on antimicrobial stewardship mandates cautious marketing but also promotes targeted use, potentially expanding niche markets.

Conclusion

ISOCLOR’s market dynamics are shaped by a confluence of resistance trends, regulatory landscapes, and patent statuses. Its financial trajectory depends heavily on successful positioning within regional markets, maintaining efficacy against resistant strains, and navigating intellectual property challenges. Investment in R&D, strategic regulatory engagement, and regional market penetration remain critical to maximizing its commercial potential.

Key Takeaways

- ISOCLOR operates within a highly competitive antibiotics market with evolving resistance patterns and regulatory environments.

- Its financial success hinges on patent protections, clinical efficacy against resistant bacteria, and regional market access.

- Expiry of patent protections may lead to significant revenue decline unless countered with formulation innovations or new indications.

- Targeted strategies, including regional expansion and formulation enhancements, can mitigate revenue risks.

- The global emphasis on antimicrobial stewardship presents both challenges and opportunities for positioning ISOCLOR effectively.

FAQs

1. What factors influence ISOCLOR’s market share globally?

Primarily, patent status, resistance patterns, regulatory approvals, and competition from generics or newer antibiotics determine its market share.

2. How does antibiotic resistance impact ISOCLOR’s financial prospects?

Resistance reduces clinical efficacy, shrinking its target patient population and revenue potential, unless resistance remains low or alternative formulations are developed.

3. Can regional regulatory approvals significantly affect ISOCLOR’s revenue?

Yes. Countries with streamlined approval processes and high infection burdens offer substantial growth opportunities.

4. What role does R&D play in extending ISOCLOR’s market life?

R&D can enable formulation improvements, new indications, or combination therapies, prolonging patent life and market relevance.

5. How are global antimicrobial stewardship policies affecting ISOCLOR?

Stewardship efforts encourage prudent use, which can restrict sales but also foster niche or specialized markets where ISOCLOR’s efficacy remains valuable.

References

[1] Grand View Research, “Antibiotics Market Size, Share & Trends Analysis Report,” 2022.