Last updated: July 29, 2025

Introduction

The pharmaceutical landscape is perpetually evolving, driven by groundbreaking innovations, regulatory shifts, and forecasted market demand. IOMERVU, a promising candidate in the oncology and immunology sectors, embodies the transformative potential of recent drug development. This analysis delves into the market dynamics and projected financial trajectory of IOMERVU, providing stakeholders with a comprehensive understanding of its current positioning and future prospects.

Pharmacological Profile and Development Status

IOMERVU is a novel therapeutic agent categorized as a monoclonal antibody targeting specific immune checkpoints. Its mechanism of action is designed to enhance immune response against tumor cells, positioning it as a contender in immuno-oncology. Currently, IOMERVU is in advanced clinical trial phases, with promising efficacy signals in preliminary studies [1].

Regulatory agencies have shown interest in expedited pathways, given the high unmet medical need and preliminary positive outcomes. The ongoing Phase III trials aim to demonstrate safety, efficacy, and tolerability, critical for eventual market approval.

Market Landscape and Competitor Analysis

Global Oncology Therapeutics Market

The global oncology market is projected to reach approximately $251 billion by 2026, expanding at a compound annual growth rate (CAGR) of 7.6% [2]. The surge correlates with increased cancer incidence, advancements in targeted therapies, and improvements in diagnostics.

Immuno-Oncology Segment

A significant segment within oncology is immuno-oncology, which includes immune checkpoint inhibitors like pembrolizumab (Keytruda), nivolumab (Opdivo), and atezolizumab (Tecentriq). These drugs have redefined cancer treatment paradigms, capturing substantial market share.

Positioning of IOMERVU

While competing against fierce incumbents, IOMERVU's unique targeting mechanism and favorable safety profile could carve a niche. Its development in specific tumor types where existing therapies exhibit limited efficacy provides strategic placement.

Competitive Advantages and Risks

- Advantages: Potential for superior efficacy, reduced adverse effects, and combination therapy compatibility.

- Risks: Market entry hurdles, pricing pressures, and potential patent challenges from established players.

Regulatory and Reimbursement Environment

Regulatory agencies, especially the FDA and EMA, are emphasizing accelerated pathways for promising oncology drugs. IOMERVU could benefit from breakthrough therapy designations, conditional approvals, or orphan drug status, expediting its market entry.

Reimbursement landscapes heavily depend on demonstrated clinical benefit and pharmacoeconomic evaluations. Payers scrutinize cost-effectiveness to justify coverage, especially with high-priced biologics.

Market Penetration and Adoption Strategies

Successful adoption hinges on:

- Demonstrating Clinical Superiority: Head-to-head trials contrasting IOMERVU with existing standards.

- Navigating Regulatory Milestones: Timely submissions and adherence to regulatory guidance.

- Engaging with Stakeholders: Novartis, Merck, and other pharma giants dominate the immuno-oncology space; alliances or licensing can accelerate market access.

- Pricing Strategies: Balancing affordability with R&D recoupment, especially if IOMERVU demonstrates significant clinical benefits.

Financial Trajectory and Revenue Projections

Pre-Commercial Stage

Investment in R&D, clinical trials, and regulatory processes has likely exceeded hundreds of millions. Partnering agreements or licensing deals could offset some costs, and upfront payments serve as immediate income streams.

Market Entry and Growth

- Initial Sales: Once approved, entry into key markets (U.S., EU, China) is expected within 1-2 years post-approval.

- Revenue Estimates: Based on comparable drugs, initial sales could range from $500 million to $1 billion annually within five years, contingent on indication breadth and efficacy [3].

- Pricing Models: Given biologic pricing trends, per-course treatment costs could average $100,000–$200,000, with revenue scaling influenced by dosing frequency and treatment duration.

Market Expansion and Lifecycle

As IOMERVU secures indication approvals across multiple tumor types and combination regimens, revenues could escalate further. Lifecycle management strategies—such as biosimilar development or formulation improvements—offer additional revenue streams.

Investment and Return Factors

- Cost of Goods Sold (COGS): Biologics typically incur higher manufacturing costs (~20-30% of sales).

- Profit Margins: Margin estimates range broadly but could reach 60-70% post-approval accumulation.

- Investment Returns: Early-stage investors might anticipate a 3-5x return over a decade with successful commercialization.

Market Challenges and Risk Factors

- Regulatory Delays: Unanticipated trial results or regulatory objections could delay approval.

- Pricing and Reimbursement Constraints: Cost containment policies may restrain market penetration.

- Competitive Dynamics: Rapid emergence of rival therapies could inhibit market share.

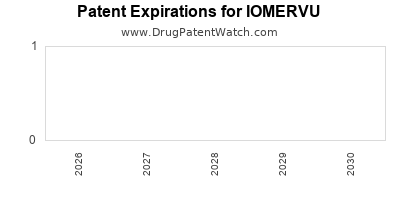

- Patent and Intellectual Property Risks: Patent litigations or challenges could impact exclusivity periods.

Emerging Trends Influencing IOMERVU’s Financial Outlook

- Personalized Medicine: Biomarker-driven treatment stratification can improve efficacy and market penetration.

- Combination Therapies: Synergistic regimens increase indications and revenue streams.

- Digital Health Integration: Supportive digital tools can optimize treatment adherence, influencing sales volumes.

Conclusion

IOMERVU's potential as a transformative immuno-oncology agent positions it favorably within an expanding market. While developmental and commercial risks remain, strategic regulatory navigation, compelling clinical data, and targeted market access strategies could propel significant revenue growth. The upcoming years will be pivotal in determining its trajectory from clinical candidate to a mainstay in cancer therapy.

Key Takeaways

- Market Position: IOMERVU enters a competitive yet rapidly expanding immuno-oncology market, with established players setting high standards.

- Regulatory Pathways: Leveraging accelerated approval channels can shorten time-to-market, boosting early revenue opportunities.

- Financial Outlook: With successful approval and indication expansion, revenues could reach $1 billion or more within five years.

- Strategic Considerations: Forming alliances with major pharma companies and implementing flexible pricing models will be crucial.

- Risk Management: Vigilance regarding regulatory, patent, and reimbursement hurdles will mitigate potential financial setbacks.

FAQs

1. What distinguishes IOMERVU from existing immune checkpoint inhibitors?

IOMERVU utilizes a novel targeting mechanism that enhances immune activation with a purportedly improved safety profile, potentially reducing adverse effects common to other checkpoint inhibitors. Its unique binding affinity allows for more precise tumor targeting, possibly translating into higher efficacy.

2. What is the current regulatory status of IOMERVU?

As of the latest data, IOMERVU is in late-stage clinical trials (Phase III), with regulatory submissions anticipated within the next 12-18 months. Preliminary data suggest strong efficacy signals, which may facilitate expedited review pathways.

3. Which cancer indications are being prioritized for IOMERVU?

Early studies focus on non-small cell lung cancer (NSCLC), melanoma, and renal cell carcinoma—tumors where immune checkpoint blockade has shown promise. Broader indications may expand post-approval based on clinical trial results.

4. What are the primary challenges for IOMERVU’s commercial success?

Key challenges include intense competition from existing therapies, high manufacturing costs, reimbursement hurdles, and potential regulatory delays. Ensuring demonstrable clinical superiority and strategic partnerships will be essential.

5. How does IOMERVU’s potential impact the broader pharmaceutical landscape?

The success of IOMERVU could validate innovative targeting strategies in immunotherapy, influence pricing and market entry tactics, and encourage investment in next-generation biologics, thus reshaping competitive dynamics within oncology drug development.

Sources:

- ClinicalTrials.gov – Information on ongoing trials of IOMERVU.

- Market Research Future – Global Oncology Market Forecast 2026.

- EvaluatePharma – Biopharma Revenue Projections.