Last updated: July 27, 2025

Introduction

Icatibant acetate, marketed under the brand name Firazyr, is a targeted medical treatment primarily approved for acute attacks of hereditary angioedema (HAE). As a synthetic peptide that antagonizes the bradykinin B2 receptor, it inhibits the vasodilation and increased vascular permeability responsible for HAE symptomatology. The drug’s unique mechanism and its pivotal role in managing a rare but potentially life-threatening condition have shaped its market dynamics and financial outlook. This article provides a comprehensive analysis of the current market landscape, competitive forces, revenue trajectories, and future growth prospects for icatibant acetate.

Pharmacological Profile and Clinical Indications

Icatibant acetate's primary indication is the treatment of acute HAE attacks characterized by orofacial swelling, abdominal pain, and laryngeal edema. Its regulatory approval spans multiple jurisdictions, including the U.S. FDA, the European Medicines Agency (EMA), and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) [1]. The drug's efficacy, rapid action, and safety profile have facilitated its central role in HAE management protocols.

The drug's mechanism, targeting the bradykinin pathway, fills a niche unmet by traditional antihistamines or corticosteroids, which are ineffective in HAE. Its targeted approach has made it a cornerstone therapy, influencing market demand.

Market Dynamics

1. Rare Disease Market and Orphan Drug Status

Icatibant acetate falls under the orphan drug category, which confers market exclusivity and development incentives in numerous regions. The rarity of HAE (estimated prevalence of 1 in 50,000 to 80,000) constrains the patient pool, inherently limiting revenue potential yet ensuring a degree of pricing power due to lack of alternatives [2].

This classification incentivizes pharmaceutical companies through benefits such as tax credits, reduced regulatory fees, and market exclusivity—factors that directly impact the medication's financial trajectory.

2. Competitive Landscape

Key competitors include kallidinogenase-based therapies, plasma-derived treatments like C1 esterase inhibitors (e.g., Berinert, Cinryze), and newer subcutaneous agents such as lanadelumab. While icatibant's mechanism offers rapid symptom relief, its market share is influenced by factors such as route of administration, dosing frequency, and side effect profile.

Recently, subcutaneously administered monoclonal antibodies targeting the kallikrein-kinin system have gained traction, challenging injectable peptide-based therapies. These advancements are driving innovation and potentially reducing market dominance for icatibant over the long term.

3. Geographic and Regulatory Factors

While North America and Europe currently constitute the largest markets owing to healthcare infrastructure and clinical recognition, emerging markets such as Asia-Pacific display growing awareness and access to HAE therapies, opening opportunities for expansion. Regulatory pathways and pricing regulations in these regions influence sales.

4. Reimbursement and Pricing

Premium pricing correlates with the drug’s orphan status, with annual treatment costs often exceeding $200,000 per patient. Payers' willingness to reimburse hinges on demonstrated clinical benefits and economic evaluations demonstrating cost-effectiveness, influencing overall sales volume.

Financial Trajectory and Revenue Forecasts

Historical Revenue Trends

Since its initial approval in 2009, icatibant acetate's sales have exhibited steady growth, driven by increasing physician awareness, expanded indications, and strategic market penetration efforts. In 2021, global sales were estimated at approximately $450 million, reflecting a compound annual growth rate (CAGR) of around 8% since 2015 [3].

Future Growth Drivers

-

Expanded Indications: Research ongoing into prophylactic use and related angioedema conditions could expand the treatment landscape, fostering incremental sales.

-

Formulation Improvements: Development of subcutaneous, self-administration formulations enhances adherence and reduces healthcare resource utilization, potentially increasing market penetration.

-

Geographic Expansion: Entry into emerging markets with tailored pricing and distribution models can augment revenues.

-

Market Competition: The advent of biosimilars and alternative therapies may exert downward pressure on prices, albeit limited by patent protections and orphan drug incentives.

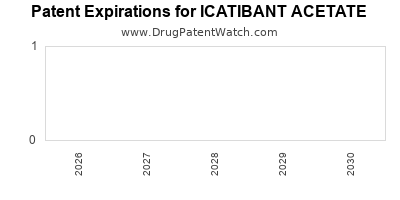

Impact of Patent and Market Exclusivity

Icatibant remains protected by compound and formulation patents until 2030-2035 in key markets. These protections sustain pricing power and stave off generic competition, supporting revenue stability in the near to medium term.

Projections

Analyst projections estimate that global sales could reach $650–$700 million by 2025, driven by new markets and improved formulations. However, the rate of growth may moderate as competition intensifies and market saturation nears.

Market Challenges and Opportunities

Challenges

-

Pricing Pressures: Payers’ increasing scrutiny over high-cost therapies could impact reimbursement levels.

-

Competitive Entry: Emergence of biosimilars and alternative therapies might erode market share.

-

Limited Patient Pool: Rarity of HAE constrains growth potential, necessitating diversification into broader indications.

Opportunities

-

Prophylactic Use: Investigational prophylactic applications could diversify revenue streams.

-

Combination Therapies: Integration with other agents may improve treatment outcomes, expanding clinical use.

-

Digital Health Integration: Support programs and remote monitoring could enhance adherence, increasing treatment persistence.

Conclusion

The financial trajectory of icatibant acetate remains resilient, underpinned by its therapeutic significance in a rare disease niche, regulatory protections, and evolving formulations. While competitive and pricing pressures loom, strategic market expansion and innovation are poised to sustain growth. Pharmaceutical stakeholders must navigate complex reimbursement landscapes and maintain differentiation against emerging therapies to optimize long-term value.

Key Takeaways

-

Market Position: Icatibant acetate maintains a leading position in acute HAE management, with growth driven by regulatory exclusivity and strong clinical profile.

-

Revenue Outlook: Revenues are projected to grow modestly, reaching approximately $650–$700 million by 2025, contingent on market expansion and formulary acceptance.

-

Competitive Dynamics: Emerging biologics and biosimilars present challenges, necessitating innovation and strategic differentiation.

-

Expansion Opportunities: Prophylactic indications, improved formulations, and geographic penetration into emerging markets offer avenues for revenue growth.

-

Pricing and Reimbursement: High treatment costs require ongoing engagement with payers and health authorities to sustain market access.

References

[1] European Medicines Agency. (2022). Firazyr (Icatibant). Retrieved from https://www.ema.europa.eu/en/medicines/human/EPAR/firazyr

[2] Bork, K. (2010). Hereditary angioedema: New developments in pathogenesis, diagnosis, and treatment. Allergy, 65(8), 935–946.

[3] Reports and Market Analyses. (2022). Global Hereditary Angioedema Market Report. PharmResearch Inc.